11 Best Practices for Accurate Cloud Cost Forecasting

Table of Contents ToggleWhy DocuSign License Management Matters for EnterprisesUnderstanding DocuSign’s...

Back

Back

Search for Keywords...

Blog

Table of Contents

Updated October, 31, 2025 – This article has been revised to include guidance on tracking envelope usage and Zylo’s real-time consumption insights for DocuSign eSignature.

DocuSign is a foundational SaaS tool, used far beyond signatures. It powers revenue workflows, hiring, compliance, vendor management, and more. But as adoption grows across departments, so does the challenge of managing it effectively.

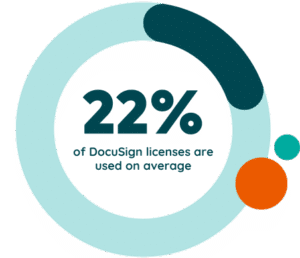

Why it matters: DocuSign often comes with consumption-based licensing, envelope limits, and bundled add-ons that can quietly drive up costs. It’s not always the most expensive tool in your stack—but it’s one of the easiest to overspend on. In fact, our data shows average utilization is just 21.6%, meaning nearly 80% of DocuSign licenses are ripe for optimization.

In this blog, I’ll walk through what DocuSign license management so tricky—and how IT, SAM, and procurement teams can take back control. You’ll learn how to:

In this blog, I’ll walk through what DocuSign license management so tricky—and how IT, SAM, and procurement teams can take back control. You’ll learn how to:

Managing DocuSign doesn’t have to be a black box. With the right strategy and tooling, it becomes another category you can optimize with confidence.

DocuSign is deeply embedded in your business. From offer letters to NDAs to vendor contracts, it runs through high-value, high-volume processes across the org. But most enterprises manage it reactively, leading to overspend, shelfware, and renewal surprises.

Here’s what I see most often:

Without active license management, you lose visibility, waste budget, and open yourself up to unnecessary risk. And because DocuSign often sits outside of IT’s direct control—owned by legal, HR, or Procurement—it’s especially vulnerable to sprawl and inefficiency.

But there’s good news: this is a high-impact opportunity. By treating DocuSign like a strategic software category, you can:

DocuSign isn’t going anywhere. But how you manage it can—and should—change.

DocuSign offers multiple licensing models, each with distinct pricing mechanics and risks. Two primary contract structures—per-user and per-envelope—require different strategies to manage cost and usage. Choosing the right one depends on how your teams use the tool.

DocuSign contracts are typically structured in one of two ways: by user (seat-based) or by envelope volume (consumption-based).

Which to choose?

Enterprise contracts introduce added complexity. Common characteristics include:

These minimums can drive up shelfware quickly if adoption stalls or departments overestimate usage.

DocuSign’s standard enterprise-facing plans include Standard, Business Pro, and Enhanced Enterprise. Here’s the breakdown:

The cost of DocuSign depends on whether you choose a per-user or per-envelope pricing structure. Here’s the breakdown by plan tier:

Note: All pricing is directional and based on industry benchmarks and public estimates. Actual costs vary by contract and volume.

DocuSign’s Intelligent Agreement Management (IAM) package bundles CLM and AI features like clause detection and agreement summaries. These plans:

If your org isn’t fully ready to roll out AI-driven CLM, these seats may go unused, adding shelfware without delivering ROI.

The biggest cost drivers for DocuSign are buried in contract terms or hidden usage patterns, such as:

Even with tight budgets, most enterprises still overspend on DocuSign. If you’re not proactively managing them, they’ll quietly inflate your renewal year after year.

If you exceed your envelope allotment, DocuSign charges ~$4.80 per additional envelope. These overages are triggered quietly and compound quickly—especially in departments like HR or legal with burst-heavy usage.

Many “unlimited” plans are governed by a “reasonable use” clause, which is not defined upfront. If your usage exceeds what DocuSign deems reasonable, you’ll be asked to true-up or face throttling and penalties.

Departments often overestimate user counts, especially when bundled packages require 5-seat increments. Without license reclamation in place, these unused seats sit idle but still renew at full cost.

Enterprise plans frequently bundle advanced features whether you use them or not. Add-ons like CLM or IAM may be sold as must-haves but go under-adopted, leaving thousands in value untapped.

If your workflows are integrated with other platforms or automated via API, exceeding your API call limits can trigger usage-based overage charges not visible in the standard dashboard.

Many DocuSign agreements include auto-renewals with a 10-15% annual increase, unless negotiated out. These can’t be removed after the fact, and are often missed without a proactive renewal calendar.

Renewals are your best opportunity to cut costs and fix what’s not working in your DocuSign agreement. But most teams go in without the right data or strategy and end up locked into inflexible terms and inflated costs.

To avoid that, here’s what actually works:

Each of these moves gives you more leverage and helps align your contract with how your organization really uses DocuSign.

I recommend giving yourself 90+ days before your renewal to gather data and build a position. At a minimum, come prepared with:

Zylo customers use automated workflows and usage insights to generate this view in minutes—not weeks.

Enterprise discounts aren’t published, but they’re expected. Based on benchmarks:

Ask for renewal price caps or multi-year pricing to contain costs.

Your current model might not match your current usage. Use renewal as your chance to realign:

The renewal is often your only window to make this change without penalty.

If you’re negotiating an enterprise agreement—whether for the first time or at renewal—ask for:

The more flexibility you build in now, the more control you’ll have later.

The Ultimate Guide for Wildly Effective SaaS Renewals

Learn MoreDocuSign license management in the enterprise requires more than seat counts and invoice data. License optimization at scale requires real-time visibility, automation, and usage alignment across departments. Without that foundation, waste compounds quickly—especially in large or decentralized orgs.

Here’s how to optimize your DocuSign environment with measurable results:

Optimizing DocuSign starts with understanding who’s actually using it. Just because a user has a license doesn’t mean they’re active, and most admin dashboards won’t tell you the difference.

I recommend looking for users who:

These users are ideal candidates for deprovisioning or license reassignment. Zylo surfaces this data automatically, so you can find underutilized seats across departments and take action before renewal.

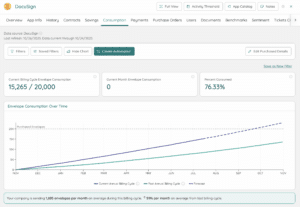

Envelope overages are rarely intentional. Often, they’re the result of delayed visibility. Most teams only look at usage quarterly (or worse, annually), making it impossible to intervene in time.

Instead:

Zylo’s DocuSign eSignature integration gives you this visibility out of the box so you can act before the overages hit.

Just because someone has an active DocuSign account doesn’t mean they’re actually using it. Admin panels, SSO, or HRIS systems may show the user is active—but without envelope activity, that license is effectively wasted.

To solve this, you need user-based reclamation:

This approach helps you cut waste, reduce risk, and ensure licenses stay aligned with actual demand, not just perceived user access.

It’s easy to overbuy advanced features that look good in the demo but never get deployed. If you’ve purchased IAM or CLM add-ons, validate their actual adoption.

Ask:

If usage is low, push to defer expansion until there’s a plan—and budget—for full adoption.

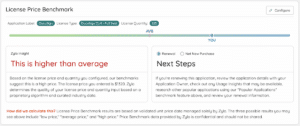

Price benchmarks help you understand whether your per-license cost is fair and are a critical lever to rightsizing licensing and realizing cost savings.

Follow these steps:

Zylo customers benchmark DocuSign usage against peers by company size, turning renewal conversations into data-backed negotiations.

Adobe Drives Innovation and Massive Savings with Zylo

In the past 4 years, Adobe has rapidly scaled from $9B to $18B. This growth has made an already complex environment even more complex. Learn how they leveraged Zylo to get complete visibility into their SaaS portfolio, unlock millions in cost savings and avoidance and improve the employee experience.

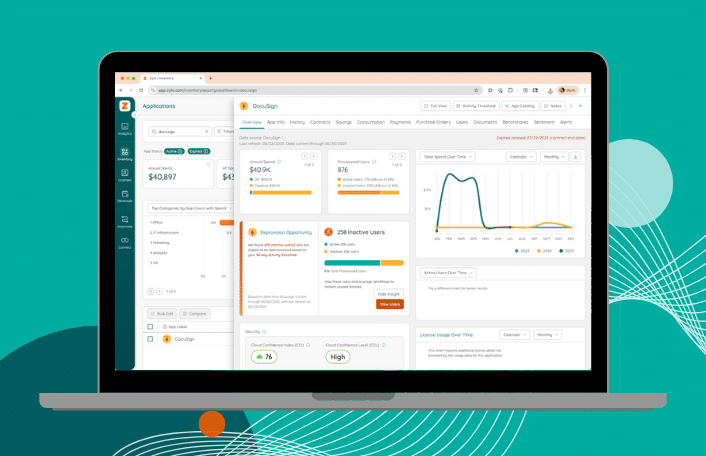

Leading IT, SAM, and procurement teams use Zylo to manage DocuSign proactively with automation, visibility, and benchmarks purpose-built for SaaS optimization.

Zylo aggregates DocuSign data across all departments, instances, and spend sources so you see:

No more surprises at renewal or chasing down spreadsheets across teams.

Zylo’s DocuSign integration pulls in actual usage data, not just license assignments. You don’t have to guess who’s using what and data stays accurate without manual exports or uploads.

This means you can:

Manual license reviews don’t scale, especially if you have 50+ DocuSign users. Zylo helps automate critical actions like:

The result: fewer wasted licenses, fewer overages, and tighter governance.

When it’s time to renegotiate, Zylo gives you the data to push back. Go into renewal armed with facts so you can drive real savings. You get:

Shelfware, bundled add-ons, and envelope overages don’t have to ber the cost of doing business with DocuSign. With the right visibility, automation, and workflows, IT and SAM teams can cut waste, improve governance, and take back control.

I’ve seen it firsthand: organizations that treat DocuSign license management as an ongoing process save more, negotiate smarter, and lead stronger SaaS governance across the business.

Ready to find your DocuSign waste and reclaim it? Book a demo to see how Zylo makes it possible. Or explore our SaaS License Management solution.

DocuSign’s per-user pricing typically ranges from $25 to $40 per user per month, with enterprise pricing negotiated based on volume. Plans often include 100 envelopes per user annually. Additional features like CLM or IAM increase costs significantly.

If you exceed your envelope allotment, DocuSign charges ~$4.80 per additional envelope. These overages often go unnoticed until after they’ve accumulated, making real-time usage monitoring critical.

Licenses are assigned to individual users and tied to a company account. In envelope-based contracts, usage can be pooled, but the license itself is still provisioned to a specific user.

Use activity metrics—such as login history, envelope activity, and last send date—to identify users with no recent activity. Zylo makes it easy to surface inactive users and take action with automated deprovisioning workflows.

Yes. Renewal is typically your only opportunity to switch between per-user, per-envelope, or “unlimited” models without penalty. Use actual usage data to determine which structure best fits your organization.

Track DocuSign envelope usage in the admin panel or with a SaaS Management Platform like Zylo. Review usage on a monthly and yearly basis to ensure you have the correct number of envelopes for your organization’s needs. Use this data to forecast usage, rightsize envelope counts, and negotiate renewals more effectively.

ABOUT THE AUTHOR

Ben Pippenger

Ben Pippenger is Staff Product Manager and Co-Founder of Zylo, where he helps enterprises maximize the value of their SaaS investments. With more than 20 years of experience in B2B software, Ben is a recognized thought leader in SaaS Management, license optimization, and IT strategy. Before founding Zylo, he held product and account leadership roles at Salesforce and ExactTarget. A self-proclaimed SaaS geek, Ben regularly speaks on topics like shadow IT, SaaS ROI, and software lifecycle management.

Table of Contents ToggleWhy DocuSign License Management Matters for EnterprisesUnderstanding DocuSign’s...

Table of Contents ToggleWhy DocuSign License Management Matters for EnterprisesUnderstanding DocuSign’s...

Table of Contents ToggleWhy DocuSign License Management Matters for EnterprisesUnderstanding DocuSign’s...

Table of Contents ToggleWhy DocuSign License Management Matters for EnterprisesUnderstanding DocuSign’s...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |