Table of Contents

The biggest problem that Financial Planning and Analysis faces with SaaS is an increase in spending – and not having line of sight into what’s being purchased.

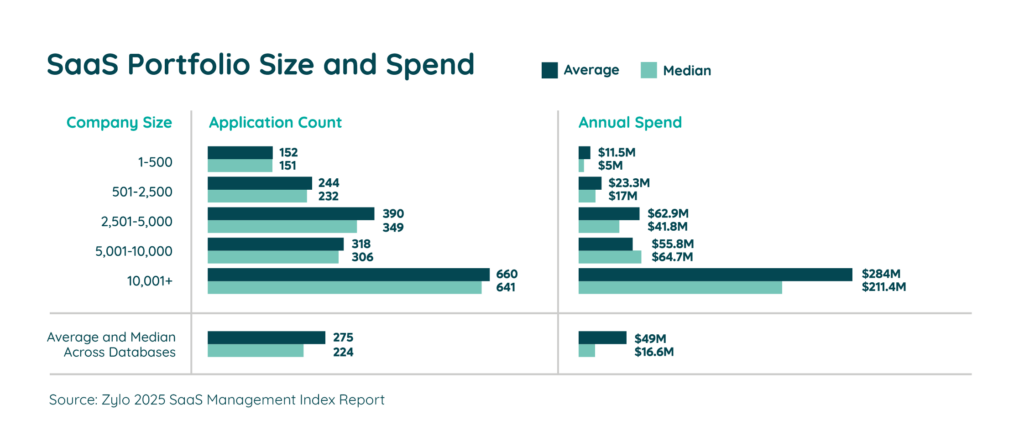

According to Zylo’s SaaS Management Index, the average organization spends $49M annually on SaaS. This makes SaaS spending the biggest line item right behind headcount. What’s more, experts expect this to grow exponentially in the coming years.

In 2021, SaaS reached $152.2 billion in end-user spending. Gartner projects this number to reach $299B in 2025. That is approximately a 96.5% increase in only four years.

Without a proper SaaS Management practice, this issue will continue to be a financial challenge to organizations. Here’s why.

How SaaS Creates Challenges for Financial Planning and Analysis

SaaS Decentralization

Tracking down all of the SaaS applications utilized across an organization is a daunting task.

With the accessibility of new SaaS applications a few clicks away, SaaS can proliferate across the business at all levels. This disjointed spending and acquisition create uncontrolled costs and risks to the organization.

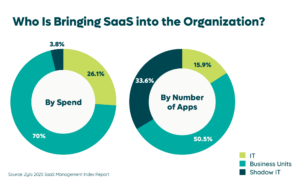

In fact, one in fifteen employees expense SaaS without the knowledge of IT or finance. This trend has led to IT only owning 26% of software spending for the average organization.

Additionally, companies often don’t capture the full picture of their SaaS costs. Sure, you can sift through expense reports or your ERP system. However, SaaS is often miscategorized on expense reports.

All this translates to a lack of visibility, which makes it difficult for FP&A to manage the budget and bottom line.

Forecasting and Budgeting

Without a complete system record, it is impossible to forecast and budget SaaS spend.

A unified, cross-organization view of SaaS spending and usage is necessary to make informed budgeting decisions. Otherwise, the costs of shadow IT and inefficient license renewal policies make future budgets unreliable.

Manual Processes

Tracking SaaS manually in a spreadsheet is resource and time-intensive. The absence of automation forces Financial Planning and Analysis to manually track down SaaS spend across business stacks. And then they’d have to spend additional time cataloging applications, how much they’re spending, renewal dates, and more.

By the time a list is put together, it’s out of date. The dynamic nature of SaaS means it’s always changing, making it impossible to keep up. In fact, our SaaS Management Index found that the average organization has six new applications entering their environment every 30 days.

With manual processes, you never truly get the full picture.

Managing Policy Conformance and Alerting

Before the popularization of SaaS, companies could manage policy and compliance with ease. Software was all on-premise – easily found in one place. IT had complete oversight into all software as it entered the environment, and policies were clear.

However, SaaS disrupted this by offering users quick and easy access to new applications. It tipped the scale in software ownership, with IT owning less than before.

It’s necessary to know when SaaS and other assets are not operating within policy to minimize risk. An unintentional breach of policy could result in loss of license or contract with necessary assets.

Why SaaS Management Is Important to Financial Planning and Analysis

SaaS Management is essential for financial planning and analysis to maximize their SaaS investments.

However, proper management requires cooperation across business units. This is because application acquisition is occurring at all levels of the organization.

C-suite is purchasing the big-ticket items while lines of business and individuals are buying smaller items to sharpen their tech stacks. Without proper controls to manage and optimize SaaS costs at a cross-organizational level, it is impossible to budget.

Everyone needs to be in sync, and Zylo is here to help with just that. Let’s look at what a unified SaaS management system offers:

Full Visibility

How can you budget if you don’t even know about your full expenses and where they’re coming from? Full visibility throughout the organization through SaaS discovery is essential for SaaS management.

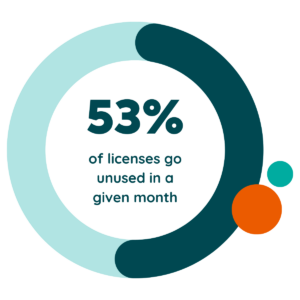

The average organization only utilizes 47% of its SaaS licenses. They lose the other 53% as waste, in need of optimization. Furthermore, Zylo customer data has shown that companies are overpaying for SaaS licenses by approximately 15%.

The average organization only utilizes 47% of its SaaS licenses. They lose the other 53% as waste, in need of optimization. Furthermore, Zylo customer data has shown that companies are overpaying for SaaS licenses by approximately 15%.

When you have visibility into all your SaaS you can:

- Find all of your organization’s shadow IT, applications purchased by employees unbeknownst to finance and IT. Shadow IT carries certain risks and hidden sources of expense.

- Gain a faster understanding of your SaaS usage and spending.

- Solve for overpriced licenses, giving you an edge over your competitors using the same SaaS.

- Master renewal negotiations with the confidence that comes from data and insight.

Zylo’s Discovery Engine powers comprehensive discovery, continued monitoring, and complete optimization of SaaS applications. Businesses can create an accurate view of all SaaS applications with a patent-pending machine learning model. Unlike fallible humans, our AI has nearly 100% accuracy in finding your applications.

How the Zylo Discovery Engine Powers the Most Comprehensive SaaS Management Platform

Learn MoreThe Ability to Budget and Forecast Spending with Accuracy

After identifying SaaS, you can pinpoint who purchased it, and where and when the spending occurs. This becomes vital for accurate spending forecasting in the coming years. Especially as projections show SaaS spending growing by 19% year over year.

And although it’s tempting to project costs based on this rate, FP&A must consider cost-inflating factors that affect forecasting.

These include:

- Increased need for new applications due to increased headcount or initiatives

- Sunsetting and offboarding of existing tools

- Renewals of mission-critical applications

- Price increases for surpassing per-license/per-seat price brackets

- Mergers and acquisitions

Being able to track and account for these factors ensures FP&A creates an accurate and optimized SaaS budget. SaaS spending management software makes this possible.

The data-driven insights give you the power to negotiate new purchases and contracts with SaaS benchmarking. Additionally, a SaaS managemen tool like Zylo will give you actionable insights and recommendations to rightsize, rationalize, and optimize your SaaS, leading to cost savings.

Ensure Compliance and Eliminate Risk with SaaS Governance

SaaS governance is the policies businesses put in place to identify, control, manage, and mitigate the use of SaaS. When done effectively, SaaS governance is key to reducing SaaS costs and security risks.

To start, it’s important to establish a cloud governance framework for how you plan to govern your SaaS environment.

Tools such as Zylo empower companies to launch and maintain effective governance policies. They tools track SaaS across the organization, including decentralized purchases, to support governance policies seeking to reduce shadow IT and reign in sprawl.

Additionally, these tools help reduce risks as headcount fluctuates. This emphasizes the need for effective SaaS governance that includes proper SaaS offboarding policies as any amount of company data is dangerous in the wrong hands.

Effective SaaS offboarding prevents:

- Compliance violations – Former employees with access to sensitive data present a serious risk of violating regulations.

- Loss of Data – Without proper SaaS offboarding, organizations risk losing intellectual properties such as source code and trade secrets.

- Data Breaches – The cost of data breaches reached a new high last year with an average of $4.45M in damages.

- Wasted IT spending – Without SaaS management and governance policies, organizations may well be paying for licenses for employees that no longer work there. These licenses go unutilized and cut into the bottom line.

Evolving Your SaaS Governance Framework for the Digital Workplace

Learn MoreReduce Spend and Risk with SaaS Management

The proliferation of apps has created the need for consistent and effective SaaS management. Financial Planning and Analysis suffers without it and faces a budget ridden with hidden costs and inefficient spending.

Leveraging a SaaS management platform allows FP&A to harness the power of SaaS optimization. No other option can equip your business to locate your applications as quickly and thoroughly as Zylo.

Schedule a demo with us today and take a peek at the ways we can optimize your SaaS stack while reducing costs and enabling you to budget with confidence.