FinOps SaaS Myths Busted: SaaS vs Cloud (and Why It Matters for…

Table of Contents ToggleHow FinOps Teams Commonly Understand SaaS—and What’s MissingSaaS...

Back

Back

Search for Keywords...

Blog

Table of Contents

In the evolving world of software, there has been a seismic shift away from software ownership. With moves to subscription-based software and the decentralization of IT, many organizations are questioning how to manage software assets effectively in the age of SaaS.

To help answer these questions, Zylo invited leading independent software asset management experts to discuss the organizational impact and strategies for adapting to the unique challenges of managing SaaS.

Zylo co-founder and VP of Product Ben Pippegner joined hosted a panel that included John Tomeny, CEO of ITAM Partners, Rory Canavan, founder of SAM Charter, and David Foxen, principal of SAM Beast. All three provide independent consulting and services for businesses and organizations seeking to manage IT and software assets.

Zylo co-founder Ben Pippenger hosted three independent SAM experts to discuss the evolving role of software asset management in organizations experiencing significant growth in the use of SaaS and other subscription software

RELATED: Read the post that inspired the webinar: How SAM Pros Can Manage SaaS

More than three decades ago, the enterprise software lifecycle was purely IT’s operation. Software required on-premises hardware for hosting and managing. IT selected and sourced software purchases, provisioned and supported the on-premise systems, including deployment to users and ongoing license management, which, if available, fell squarely on the shoulders of software asset management (SAM) teams.

In the late 1990s early 2000s, the ownership of software purchasing shifted as new software publishers took advantage of specialized categories such as Marketing, Finances, and Human Resources. In these scenarios, the principal buyer became the leader within respective departments, not IT.

Today, that ownership model has shifted again with the advent of the end-user era. With low-cost and freemium subscription software and few requirements for deployment other than an Internet connection, individual employee users now contribute significantly to software acquisition.

This shift displaced the buying power from IT and put it into the hands of individual users. With the swipe of a credit card, individuals suddenly had the option to purchase software tools for business purposes. The transference of purchasing power is creating a whole new challenge in the world of software asset management.

“On average, organizations have 300 to 400 software titles within their organizations,” Pippenger says. And, according to Zylo data, this number is greatly underestimated. Before completing an accurate inventory of their software environment, most businesses underestimate their application quantity by two to three times.

These shifts in software ownership and the resulting blind spots for managing these assets have created the need for a corollary shift in software asset management best practices.

The unique profile of SaaS creates new challenges for software asset managers. And according to the panel’s participants, SAM professionals need to evolve their approach accordingly to keep costs and risk in check.

“One of the most critical differences is that everything in SaaS has an expiration date,” Tomeny says. “You’re purchasing—instead of a permanent license to use software—you’re purchasing a subscription – like a magazine – so you have to predict ahead of time what you’re going to need.”

The move to SaaS products was intended to provide organizations with greater control and flexibility while also avoiding the inherent costs from supporting on-premise data centers. Organizations can acquire new software as needed, with few prerequisites. Businesses and their employees can quickly deploy new and innovative tools and quickly eliminate unnecessary or outdated ones.

However, this high degree of flexibility and turnover – along with the fact more employees purchase SaaS outside IT’s awareness (shadow IT) – means traditional SAM oversight processes can prove ineffective. This lack of oversight for SaaS quickly translates to increased costs as purchases are duplicated, various tools compete for similar functions, and software choices become siloed amongst teams or departments, creating friction due to lack of standardization.

Foxen simplifies this condition: “[Organizations] lose track of what SaaS applications they’ve got, who’s got it, and how much it costs them because it’s just so accessible and easy,” he says.

Before the current era of subscription-based software, most business software was acquired, installed, and managed by centralized, internal IT and SAM teams. With SaaS, organizations no longer buy software that resides within hardware systems but instead renting an access period of time with that software.

“You’ve got an opportunity once a year or once every couple of years to rightsize and adjust your licensing levels,” Foxen says. But, “it’s a lot more difficult to look out into the future and see what your needs are going to be.”

The factors that drive planning are posing a particular challenge in the software asset management world. Without proper controls and visibility, companies are incurring more wasted spending. To anticipate how long software will remain useful, you have to be able to engage in multi-year planning and understand how long a subscription will remain viable for your needs.

“The difference between SaaS and SAM is it’s a lot easier to go down a rabbit hole and lose control of your SaaS environment, particularly around assigning licenses, and not recouping them when someone leaves or doesn’t need them anymore,” Foxen says. “It’s so easy to consume, it’s easy to get lost and have so many different SaaS applications… The controls and the parameters around it need to be a lot tighter than the old perpetual model because costs can spiral out of control.”

To correctly manage your software assets, organizations need a clear picture of their environment; this is where auditing comes into play. As Tomeny notes, when businesses look to create scale in anticipation of growth, it’s of vital importance that they can assess their current software usage and predict their future needs.

With permanent licenses and centralized software management – the hallmarks of software asset management, an audit simply involves pulling data from internal dashboards. But with SaaS and the cloud era, businesses have limited oversight because they no longer directly control all instances of the technology.

“The whole model of discovery changes,” Tomeny says. “What’s more effective is examining our purchase strings, account payable, and learning what is being purchased by various lines of business and further on, monitoring expense accounts for employees to see what’s being purchased outside of accounts payable. There are ways of keeping all of this visible.”

Tracking down what an organization is using becomes far more complicated with SaaS. Instead of following technology assets themselves, organizations are now in a situation where they have to follow the money.

Without transparency and a successful SaaS-management strategy, costs can quickly spiral out of control. Tomeny discovered just how quickly costs could become inflated during a SaaS-optimization audit he performed in Q1 of 2020.

His analysis uncovered $4 million is SaaS assets, with more than $1.5 million wasted spend occurring in only the top five subscriptions. “When we looked at it a little closer, we found that close to 30 percent was coming from employee expense accounts,” he says.

If the purpose is to save money and drive efficiency, why are companies experiencing this kind of wasted spend?

“If you’ve got people who are heading out and buying retail instances of software, they’re not getting the commercial benefits of buying under a contract,” Canavan says. “They’re not getting any favorable terms and conditions that come from operating under that contract too, so it’s almost like people are undermining procurement,” Canavan says.

The challenge of SaaS extends beyond the level of transparency to inform enterprise purchasing practices. With subscriptions, software costs are now incurred as OpEx, rather than CapEx. “The way that SaaS is licensed—since it’s a subscription—most organizations are going to default toward operating expense,” Tomeny says.

How a software purchase is expensed can have a significant impact on the bottom line and hence, how SaaS is managed.

“OpEx is on your profit-loss sheet, so it gets listed with utilities, with gas, with electricity, with wages,” Canavan says. “That reinforces the need to persistently trim the sales, to persistently right size whatever sort of SaaS expenditure you have in place.”

This enmeshed relationship between purchasing and software proves that finance is the key to managing software assets.

“When they go to sign a SaaS subscription contract, they’re committing their organization to multiple years of financial commitment, and they can’t do that without the participation of finance,” Tomeny says. “We’ve been talking for years about how important it is to bring the financial arm of the organization into the process of software asset management now there’s a much more compelling reason.”

In the SaaS age, this is what organizations can do to manage software subscriptions.

“We need to change the way that we do our practices and change our processes and governance to meet SaaS requirements,” Foxen says.

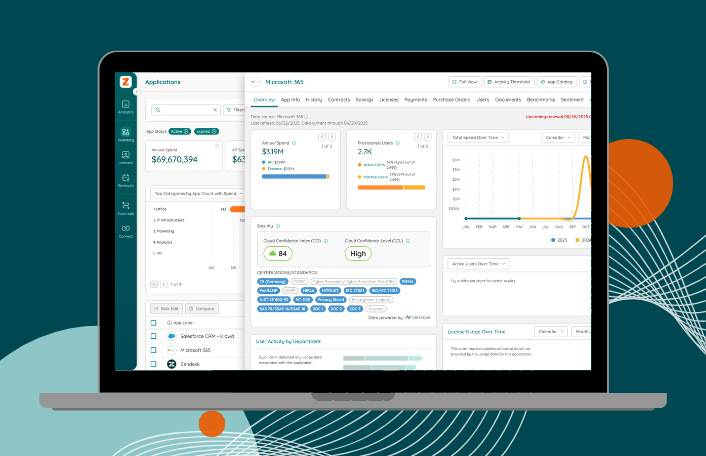

To learn more about SaaS management, and how to discover, manage, and measure your organization’s SaaS environment, schedule a demo of Zylo today.

Table of Contents ToggleHow FinOps Teams Commonly Understand SaaS—and What’s MissingSaaS...

Table of Contents ToggleWhat Is an E-Commerce Tech Stack?Why Your E-commerce...

Table of Contents ToggleSoftware Asset Management vs. SaaS: What’s the Difference?How...

Table of Contents ToggleSoftware Asset Management vs. SaaS: What’s the Difference?How...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |