Table of Contents

In the age of SaaS, mergers and acquisitions can present more difficult integration challenges compared to years past.

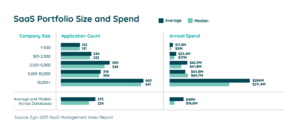

Today, cloud-based tech stacks are more numerous and complex. For example, the average enterprise now maintains approximately 660 SaaS applications, according to Zylo’s 2025 SaaS Management Index. The sheer volume of tools now makes tech discovery and prioritization an essential process in any M&A integration.

Fortunately, applying best practices sourced from modern SaaS management opens the door for cost-containment opportunities, risk mitigation, and increased efficiencies for years to come.

According to Harvard Business Review, between 70 and 90 percent of all mergers and acquisitions fail to provide the intended value. One of the most common reasons for failure is the inability to integrate the acquisition.

Consequently, in the case of mergers and acquisitions, taking control of the technology landscape is a game-changer, making the creation of a SaaS Integration Roadmap an absolute necessity.

6 Steps to Build a SaaS Merger Integration Roadmap

1. Align the M&A Team with Business Leaders

Post-merger or post-acquisition integration success begins with the M&A team responsible for project managing technology integrations.

To ensure an effective merger of tech stacks (if warranted), M&A teams must align with business units to devise an integration roadmap.

In today’s cloud-oriented and SaaS-dominant technology environments, it’s essential to recognize that business units are responsible for as much as 70% of all SaaS spending.

In simpler terms, for many companies, IT is not the primary source of software application purchases. This acquisition model paves the way for technology ownership to be distributed among multiple business units, teams, and even employees.

To uncover critical digital change agents, identify substantial SaaS investors within each business unit. Typically these are the business leaders who frequently make buying decisions that are integral to driving tech innovation across the enterprise. Throughout the integration process, hold regular stakeholder meetings to align business and IT strategies.

2. Discover Every SaaS Application Purchased Throughout the Enterprise

Discovering the current state of technology and the types of SaaS applications used on both sides of the M&A equation is a crucial first step for any integration manager. This due diligence aids understanding of the current picture and creating an accurate timeline for completing the integration itself.

“An integration project could take a year or as little as three months – so there is a reality that needs to be found,” says Hutton Henry, CEO of Beyond M&A, a UK-based consultancy that specializes in post-M&A technology integrations. “Step one is to discover the technology and landscape for both the buy-side and sell-side of the merger.”

Even without a post-merger integration, the average enterprise underestimates the number of applications present throughout its environment by up to three times. While a company may anticipate finding 200 to 300 applications, the actual inventory is more likely to be closer to 323 applications on average – and even more for enterprise at 609 applications. In the case of M&As, this high volume of shadow IT presents challenges, especially concerning security.

Complete a manual SaaS audit using a spreadsheet inventory or by implementing a SaaS management platform that features an accurate discovery process. To manually capture all SaaS purchases, expense reports are the first place to start. Secondly, consult heavy SaaS investors and digital change agents within the LOBs to uncover SaaS applications that may not have been accurately categorized when expensed.

After discovering all applications, the next step is to uncover the respective contracts and their associated content. Assign costs, functions, and buyers to all applications. Begin documenting these attributes in a single source of truth for all SaaS that will be integral when building a SaaS Integration Roadmap.

3. Record the Use Case for Each Application

To enter into integration decision-making with an informed mindset, collaborate with business leaders to capture the primary use case for each application. While the prima facie reason for an application’s business use case may be obvious, lack of clear mission focus contributes to “application creep.” This creep is characterized by multiple applications with overlapping functions and no clear business objective.

The fact that one in five employees purchase SaaS applications via expense reimbursement, which quickly leads to a lack of central oversight, compounds this mission creep effect.

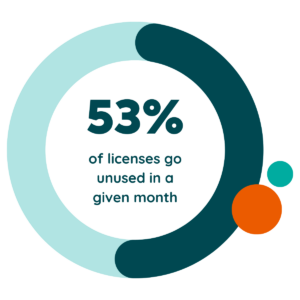

Defining each application’s use case during an M&A integration also aids an understanding of its effectiveness. According to recent Zylo data, in most businesses, 53% of application licenses are underutilized within an average 30-day period.

Defining each application’s use case during an M&A integration also aids an understanding of its effectiveness. According to recent Zylo data, in most businesses, 53% of application licenses are underutilized within an average 30-day period.

This widespread underutilization of applications cost companies money, time, and employee satisfaction. With each application use case (especially high-use applications) include the reasons for underutilization or successful utilization.

With more than two decades of experience as a global VP for SAP, Keith Hontz experienced numerous acquisitions and subsequent integrations. Now the Chief Revenue Officer for email service provider SocketLabs, Hontz says that licensing SaaS applications can represent a relatively quick cost-savings opportunity during a post-M&A integration.

“Compared to on-premises solutions, on the SaaS side of the house, it’s very easy to turn off or to switch license holders, especially if you’re a monthly subscription to another provider,” he says.

Included in the use case of each application should be the application’s potential for system-wide integration. As IT leaders look to innovate throughout the enterprise tech stack, consider not only how the application stands on its own but how it operated as part of the whole. Today, an application’s potential for integration is highly valued.

4. Identify and Mitigate Security Implications of Each Application

SaaS applications that haven’t been vetted for security pose a risk to the enterprise. Therefore, the first step to mitigating risk is gaining visibility into the current state for security posture during an enterprise-wide discovery of all applications (see step two).

“The most important aspect to keep in mind when integrating pre- or post-merger applications is to ensure that a new tech-stack cannot adversely affect your current applications, clients, and vendors in any way,” says Richard Hoehn, CIO/CTO of FreightWise. “This approach allows our dev-ops team to monitor, throttle and very quickly (either human or programmatically) disengage the two tech-stacks when something is wrong or outside of normal operations.”

Henry notes that evaluating security can be especially important when acquiring smaller companies. “In the smaller company, the use of SaaS products is reasonably open, but it might not be safe or secure,” he says. “And that’s part of the culture in smaller businesses, everyone trusts each other – but that’s not a substitute for governance.”

Focus risk mitigation efforts on applications that contain customer, financial, and business data, especially those that fall within the scope of regulation such as GDPR. While software housing sensitive data holds inherent risk, not every application was created equal: rank and document the breach probability of each application to use in the decision-making process.

Marigold Uses Zylo to Save on Sprawling SaaS Costs & Streamline M&A Technology Integration

Discover how Marigold unlocked the door to nearly $1M in SaaS cost savings with Zylo, while undergoing a M&A tech integration and cutting software waste from their portfolio.

5. Pursue Strategic SaaS Consolidation and Other Opportunities

Major cost containment opportunities exist when platform consolidation opportunities exist across the enterprises. Crucial to this step is determining how the organization measures and defines value. As business units continue to purchase technology, IT and business leaders must align on tech-specific KPIs.

Attack the obvious first: Sunset duplicative contracts. Then, considering the data pulled in previous steps, rank applications with overlapping functionality by cost, stakeholder/user sentiment, use case, integration potential, security, etc.

Hontz says an M&A integration is an opportune time to re-evaluate business tools and execution. “It’s a great time to make decisions about which [SaaS tool] requirements [for SaaS tools] are mission-critical, which are just “nice to have,” and which represent an opportunity to streamline and simplify,” he says.

6. Build a SaaS Merger Integration Roadmap, One Application at a Time

Armed with the nature, value, and contract of each application bought throughout the enterprises, create an integration plan for each application.

Plan for the renegotiation of the highly-ranked apps, while providing a timeline to sunset lesser apps of overlapping function. Build implementation plans for widely-introduced software. Additionally, isolate KPIs and set goals.

In the age of SaaS, technology stacks are forever growing and evolving. While the SaaS Integration Roadmap will be invaluable when driving M&A initiatives, the resulting system-of-record will remain relevant long after the initial integration is complete. To drive security and innovation, IT leaders must embrace continual discovery and monitoring.

SaaS Merger Integration Roadmap: The Key to Leadership Visibility

The lack of leadership visibility of enterprise-wide SaaS investments presents problems for innovative IT leaders. As the balance between innovation and “keeping the lights on” becomes ever more complex for IT leaders, alignment throughout the enterprise has never been more critical.

Through careful reporting and planning, the SaaS Merger Integration Roadmap creates alignment between IT, LOBs, and leadership throughout the M&A process. Through the roadmap, IT can meet the goals of innovation, cost containment, cross-department collaboration, and employee experience as a unified organization with a cohesive tech stack.