Guide to SaaS Compliance Software—Tools, Risks & Best Practices

Table of Contents ToggleWhat Is SaaS Compliance?Why SaaS Compliance MattersKey Types...

Back

Back

Search for Keywords...

Blog

11/11/2025

Table of Contents

Updated January 30, 2026 with new data

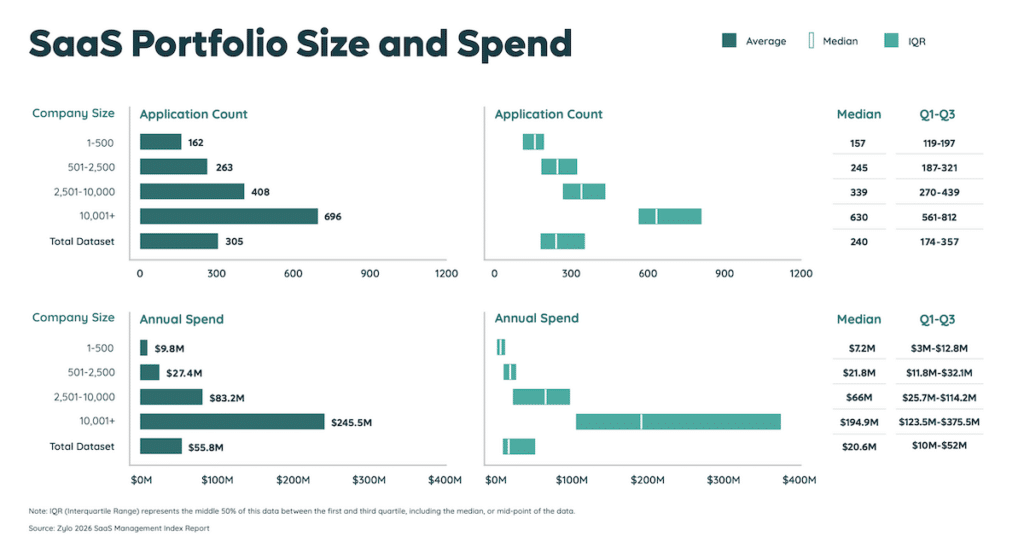

SaaS spending is soaring, reshaping how companies manage their software ecosystems. Zylo’s 2026 SaaS Management Index reports that organizations now spend $55.7M annually across 305 apps. As Gartner projects global IT spending to hit $5.4 trillion in 2025, much of it driven by SaaS and AI tools, the challenge isn’t just growth—it’s control.

Traditional vendor tracking struggles to keep pace with complex renewals, layered pricing, and decentralized purchases. Modern SaaS vendor management must go beyond contract spreadsheets to deliver visibility, governance, and performance insight, ensuring every application supports both efficiency and business outcomes.

Managing SaaS vendors effectively involves treating the process as a complete lifecycle, rather than a single transaction. Each phase builds visibility, strengthens accountability, and drives better ROI. There are several important elements to this process:

Start by reviewing what you already have before adding anything new. Inventory current tools, map features to business needs, and compare adoption and outcomes. If an existing solution can meet the requirement with configuration, integration, or additional seats, prioritize that path over a net-new vendor.

Use clear triggers to decide when selection is warranted:

Run a lightweight, governed selection process:

Then classify to sustain control after selection. Tier each vendor by spend, usage, data sensitivity, and business impact. Higher tiers get deeper due diligence and tighter governance: security reviews at intake, quarterly usage and value checks, and renewal gates tied to measurable outcomes. Grouping by department and risk makes it easier to spot redundancy early and ensures future selections are grounded in what is already working.

Once a vendor is selected, the onboarding stage defines long-term success. Teams should standardize steps for user provisioning, data access, and single sign-on integration to maintain compliance and accelerate adoption.

The 2024 High Alpha SaaS Benchmarks Report noted that AI-enabled SaaS tools are growing faster than traditional software, but they also introduce new complexity in setup and data governance. A documented onboarding plan with assigned owners ensures faster time-to-value while minimizing security and cost risks.

A vendor’s value shouldn’t be measured only at renewal. Continuous evaluation through the contract term should track metrics like:

Using performance dashboards helps identify which apps deliver measurable ROI and which have drifted into low use or redundancy.

Renewal preparation should begin at least three months before a contract ends to allow time for analysis and negotiation. As Gartner projects, 70% of leading SaaS vendors will shift to consumption-based or hybrid pricing by 2027, making proactive reviews essential.

If a vendor no longer meets needs, structured offboarding is just as critical. Exporting data, disabling access, and verifying contract closure prevents accidental renewal fees and lingering security risks.

Vendor management works best when it’s shared across departments. Finance, IT, and functional leaders each bring visibility the others need—cost data, integration details, and user adoption metrics.

On average, IT owns 15% of spend and 14% of apps; the rest lies with lines of business and individual employees. Cross-functional collaboration ensures SaaS decisions stay aligned with enterprise goals, not just departmental preferences.

When teams share data and decisions, SaaS portfolios become leaner, more secure, and better optimized for growth.

Strong SaaS vendor management helps organizations make confident decisions, improve efficiency, and strengthen governance across every department. The following outcomes show why a structured approach is essential to success:

A clear inventory of all software purchases—including shadow IT—forms the foundation of control. Visibility connects data from finance, procurement, and IT to show where spend originates and whether it supports business goals.

Organizations underestimate their SaaS spend by 3x and the number of applications by nearly 2x. By centralizing contract and usage data, teams can make faster, evidence-based decisions—removing guesswork and ensuring every purchase aligns with strategy.

Zylo data shows that the average portfolio introduces significant security and compliance risk. In 2025, 51% of applications have a “Poor” or “Low” risk score (Cloud Confidence Index). Unmonitored vendors increase exposure to security gaps, particularly as sensitive data becomes more widespread across multiple platforms. Vendor management allows IT and security leaders to verify compliance, track permissions, and maintain audit trails across all connected apps.

Overlapping tools are common when teams purchase independently. SaaS vendor management surfaces duplication early—consolidating licenses, negotiating enterprise terms, and improving adoption of existing solutions.

High Alpha’s 2024 SaaS Benchmarks Report found that AI-native and vertical SaaS platforms outperform traditional tools in efficiency, suggesting that focused, well-selected software stacks yield stronger ROI. Visibility into functional overlap makes it easier to standardize on best-fit solutions and phase out low-value tools.

Without centralized tracking, renewals can become reactive—driven by deadlines instead of data. Vendor management transforms renewals into a strategic checkpoint: reviewing usage, performance, and contract terms before recommitting.

Zylo’s 2026 data shows that organizations with renewal visibility could save up to 17% per contract cycle through renegotiation or right-sizing licenses. Tracking vendor KPIs quarterly ensures every renewal supports cost efficiency and continued business value.

The Ultimate Guide for Wildly Effective SaaS Renewals

Learn MoreEvery unmanaged vendor adds friction or roadblocks in your business operations. Streamlined SaaS oversight reduces administrative load, shortens approval cycles, and frees teams from managing disconnected data sources.

With Gartner projecting that software spend will grow 15.2% globally in 2026, disciplined vendor operations are key to scalability. Automating renewal alerts, spend reporting, and compliance workflows enables teams to focus on innovation rather than managing spreadsheets.

Proactive management improves collaboration with vendors themselves. When performance expectations and usage data are transparent, conversations shift from reactive problem-solving to long-term partnership building.

Regular check-ins and shared success metrics enable vendors to deliver better service, while organizations benefit from predictable costs and clearer value in every SaaS relationship.

Artificial intelligence is reshaping how organizations oversee software investments. From contract analysis to license optimization, AI tools are accelerating processes that once required weeks of manual effort. Vendor management now benefits from automation, prediction, and continuous learning—enabling smarter, faster decisions.

There are several key ways AI is transforming this function:

AI helps identify and categorize every SaaS tool across the enterprise—even those procured without IT’s involvement. Automated AI-powered discovery surfaces shadow spend and consolidates data from finance systems, expense reports, and identity providers into a single inventory.

Key benefits of automated discovery include:

Zylo data shows that nearly three-quarters of SaaS spend originates outside IT. AI-driven classification helps surface those hidden costs in real time and map them to:

Predictive models analyze historical usage, license activity, and market pricing to reveal optimization opportunities before budgets are finalized. AI can:

Organizations using automation for SaaS cost management identify savings opportunities faster than manual reviews. These insights help finance and procurement teams:

AI enables continuous monitoring of vendor compliance, from SOC 2 certifications to data-sharing practices. Natural language models can scan contracts for key clauses and identify red flags early.

Automated compliance systems can:

This ongoing oversight replaces one-off audits with continuous assurance. It helps organizations maintain compliance, reduce risk, and protect sensitive data without increasing headcount.

When AI tracks utilization and benchmarks contract terms, renewal planning becomes proactive instead of reactive. Machine learning models provide actionable intelligence to guide negotiations.

AI-powered renewal insights can:

Gartner’s 2025 forecast notes a rise in AI-enabled SaaS procurement systems, with vendors embedding automation to streamline renewals and optimize license allocations. By combining predictive analytics with human expertise, companies enter negotiations armed with data-driven leverage.

Even with mature processes, managing SaaS vendors can be complex. Pricing changes, expanding app ecosystems, and misaligned ownership often introduce friction. The good news: each challenge can be turned into an opportunity for greater efficiency.

Most organizations have an opportunity to improve in these areas:

Traditional seat-based pricing is being replaced by consumption and hybrid models—especially with AI solutions. These pricing models offer flexibility but often:

Vendor management systems that monitor real-time usage help translate variable billing into predictable budgets, ensuring teams pay only for what they use.

Many organizations treat renewals as mere check-the-box activities rather than opportunities to drive cost savings. Moving beyond transactional exchanges builds stronger partnerships and delivers better value.

When usage data and KPIs are shared openly, vendors can tailor success programs and provide more relevant support. This shift fosters collaboration, reduces churn risk, and encourages joint innovation—particularly important as AI-driven features evolve rapidly.

Replacing a vendor is rarely simple, but staying with an underperforming one is often more costly. Continuous performance tracking provides objective evidence to support transition decisions. With clear performance baselines, your teams can compare outcomes and switch with confidence when ROI drops.

Data centralization is the key to operationalizing SaaS Management. A SaaS system of record that tracks all contracts, spend, and ownership prevents lost data and disconnected workflows.

Integrating new vendors through a standard onboarding pipeline ensures compliance checks, role provisioning, and financial tracking are complete from day one. This approach supports collaboration between procurement, IT, and finance while keeping spend aligned with policy.

Unplanned renewals create immediate financial strain and often extend low-value contracts. Automated renewal alerts and dashboard visibility eliminate surprises, ensuring negotiations start early. Proactive tracking turns renewals into an advantage—empowering teams to control timing, terms, and total spend.

Modern SaaS portfolios grow too fast for ad-hoc oversight. A structured, measurable approach ensures every step—from governance to negotiation—supports business goals and minimizes waste.

Follow these best practices:

Governance provides the guardrails that keep SaaS investments aligned with enterprise goals. Establish a cross-functional governance council that includes finance, IT, procurement, and security leaders to define:

According to the 2026 Zylo SaaS Management Index, organizations with governance in place have greater spend visibility across departments and effectively remediate shadow IT risks. By documenting your strategy, it also standardizes review cadences and ensures every stakeholder works from the same data.

At minimum, conduct quarterly business reviews to help maintain accountability and uncover opportunities for improvement. In addition, ensure clear, consistent communication throughout the relationship to keep it collaborative instead of transactional. This helps:

Track spend at both the individual and departmental level, as it is the fastest route to eliminating waste. Categorize tools by business function—such as finance, marketing, engineering—and analyze license usage relative to active headcount.

Automated dashboards make it easier to identify unused licenses, negotiate volume discounts, or consolidate contracts. With Gartner predicting increased spending, proactive SaaS spend management will be even more critical for efficiency and budget accuracy.

With thousands of SaaS apps available on the market today, finding the right vendor is no easy task. Take a strategic approach to vendor selection and be clear on what criteria are most important—such as security compliance, integration capabilities, and scalability. This way, you ensure each new vendor fills a genuine business need.

Adoption drives ROI. Without training, even the best applications fall short of their potential. Encourage vendor-led enablement sessions and identify internal champions who can model best practices. Regular education and reinforcement ensure users fully leverage the tools the company is paying for.

Contracts should protect flexibility as much as price. Benchmark costs against market averages, verify SLAs, and include exit clauses for simple offboarding. Teams that begin reviews 90-120 days before renewal secure the most cost reduction per cycle. Preparation and data are the best negotiation tools.

Centralized documentation ensures transparency and compliance. Store every vendor contract, renewal date, and pricing detail in a shared SaaS system of record to create a single source of truth.

This documentation helps teams manage renewals proactively and simplifies security audits or procurement reviews. Over time, an organized record of decisions and performance outcomes builds a data trail that strengthens governance and accountability.

Treat vendor management as an evolving process. Schedule quarterly reviews to assess vendor tiers, adjust metrics, and capture lessons learned. This rhythm keeps your vendor strategy aligned with shifting pricing models, emerging AI tools, and changing organizational priorities.

SaaS Management is entering a new phase defined by smarter automation, flexible pricing, and tighter alignment between business outcomes and vendor performance. The next few years will see major changes in how organizations purchase, evaluate, and optimize software.

Key trends shaping this evolution include:

Traditional per-user licenses are being replaced by consumption-based and hybrid pricing models that tie cost to actual usage. This model benefits flexibility but demands visibility to prevent overspending.

Gartner forecasts that SaaS spend will reach $299B in 2025, a 19.2% increase driven largely by variable-use models. By 2027, most enterprise vendors are expected to incorporate some form of usage-based billing into their portfolios.

Organizations that adopt vendor management tools capable of tracking live consumption data will have the upper hand—translating fluctuating invoices into predictable budgets and informed negotiations.

AI is transforming SaaS from static systems into adaptive solutions. Vendors are embedding AI copilots, automation layers, and predictive insights directly into their platforms—often as premium add-ons.

The 2025 High Alpha SaaS Benchmarks Report found that 41% of SaaS companies now monetize AI features. These features drive new value but also introduce cost complexity, as usage metrics replace flat licensing.

For vendor managers, this shift means:

AI will also increasingly support vendor management itself—through predictive renewal analytics, automated contract parsing, and real-time risk detection.

Finance and IT are becoming increasingly interconnected in their management of software investments. Zylo’s Index shows that 75% of IT leaders now view software optimization as a cost-reduction strategy, placing SaaS Management squarely within financial operations.

This shift shows that the FinOps Framework—once centered on cloud infrastructure—now encompasses SaaS as a key pillar of spend control, accountability, and performance optimization.

With AI adoption and global privacy regulations expanding, vendor compliance oversight is no longer optional. Organizations are demanding clearer visibility into where data resides, how it’s shared, and which vendors handle sensitive information.

Chiefmartec’s State of Martech 2025 describes this as a move toward “hybrid governance,” where automated systems monitor compliance continuously while human reviewers manage exceptions. Successful vendor programs will blend automation with policy discipline to maintain trust and control as SaaS ecosystems evolve.

Managing hundreds of SaaS vendors doesn’t have to be reactive or complex. To get started, you need a system of record like Zylo and the right processes in place.

Effective vendor management is about unlocking business value of existing software investments and to preserve that value going forward. With Zylo, you gain the visibility, data intelligence, and automation needed to turn every contract, renewal, and license into a strategic advantage.

Zylo’s SaaS Management Platform enables you to:

Start building a smarter SaaS strategy and turn software management into a measurable business advantage. Explore how Zylo’s SaaS vendor management solutions can help you track vendors, optimize spend, and drive measurable value across the business. Request a demo to see how it works.

Table of Contents ToggleWhat Is SaaS Compliance?Why SaaS Compliance MattersKey Types...

Table of Contents ToggleThe Four Stages of Effective SaaS Vendor ManagementSelecting...

Table of Contents ToggleThe Four Stages of Effective SaaS Vendor ManagementSelecting...

Table of Contents ToggleThe Four Stages of Effective SaaS Vendor ManagementSelecting...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |