Table of Contents

Imagine that your organization suddenly stops innovating with technology. As a result, conversations about new SaaS applications also screech to a halt. How would that affect the company’s future? Would you remain competitive?

For most C-Suite executives, subscription-based software has become irreplaceable. It is now a fundamental part of connecting with employees, current and prospective customers, partners, and vendors. By providing their teams with quick access to the tools they need to innovate, businesses scale faster. Without these technologies, an organization would lose its ability to compete in the market.

“I think the important thing is to use technology to innovate as a business. To do that, you need to manage the cost as aggressively as you can so that you can divert your resources to the things that make a difference.”

— Keith Sarbaugh, CIO at Zoetis

Similarly, once a company begins to invest in SaaS, it becomes woven into the fabric of how the company conducts business.

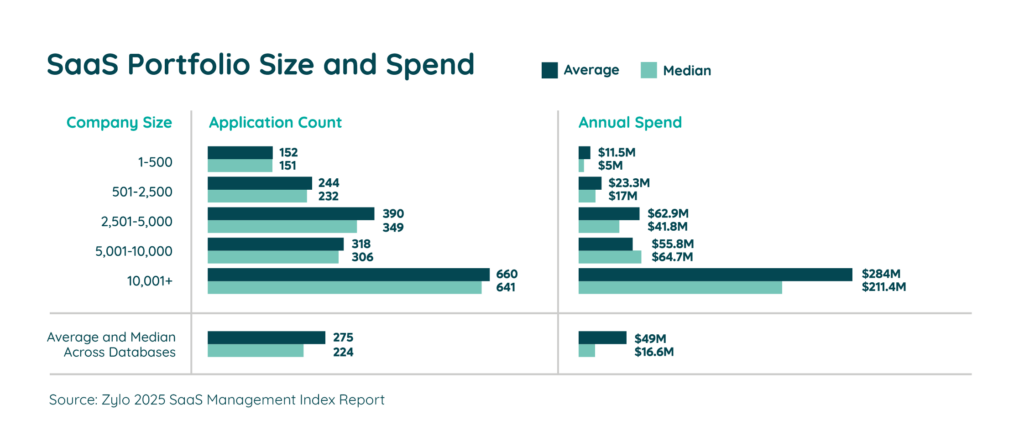

A software spend shift from a fixed capital expenditure (CapEx) — as was the case with on-premises tools — to an operational expense (OpEx) reveals this. It’s largely due to the ease of SaaS acquisition. According to Zylo data, large enterprises an average of 660 applications, nearly half of which are expensed by employees. On average, that equates to 12 new SaaS tools entering their environment every 30 days.

According to Gartner, “These trends are broadly illustrated by an increase in the ratio of OpEx in overall IT budgets, from 70% in 2014 to 77% in 2020. About half of IT and financial management leaders report their OpEx versus CapEx ratio significantly increased over the last three years with the use of public cloud.”

With strong staying power, SaaS adoption continues to grow rapidly. Gartner forecasts end-user spending on SaaS to grow 18.9% to total $244 billion in 2024. To keep up, modern organizations must rethink IT budgets.

Subscription-Based Software Shifts Focus for IT Departments

While subscription-based software is becoming more ingrained into every level of activity across their organization, IT departments face the largest impact. There are several ways it is causing IT to shift its focus.

Less Tactical, More Strategic

Less and less, the CIO and IT team deploys software and manages services for on-premises software. Instead, the revolution of SaaS allows IT to focus on optimization and strategy, rather than the tactical nuances.

In fact, the 2024 State of the CIO states that “Thirty-five percent of respondents now identify as strategic CIOs with almost half (49%) expecting to play that role over the three-to-five-year horizon.”

Focus on SaaS Spend Management

With the rise of SaaS came the subscription model and license-based pricing. Now, with increasing prevalence, usage- and credit-based pricing have entered the scene.

Whether it’s seats or credits, it’s increasingly difficult to understand what your organization needs. Either way, you run the risk of wasting what you don’t use or incurring overage costs.

Data utilization metrics help IT demonstrate a return on investment and clearly articulate the value of the SaaS tool or software, justifying spend and budget increase requests.

Guide to Managing SaaS Costs

Learn MoreCost Allocation Becomes Critical

IT is responsible for more applications than ever before. While consisting of just 16% of the total SaaS portfolio – an average of 106 applications – it is typically more than what we saw in the on-prem world.

As budgets and overall spending increase, allocating costs for software shared by departments becomes more critical. It not only provides budget relief for IT, but it increases accountability among business leaders to be more responsible with software spending.

How Organizations Are Allocating IT Budgets

If SaaS has become irreplaceable to the enterprise organization, then how has it affected budget distribution and planning for C-Suite executives? How are they allocating their budgets differently to account for software and subscription-based growth — or are they?

We surveyed IT and SAM leaders about their 2024 budgets to understand how they’re allocating funds for software. In short, it was a mixed bag. Nearly half (45.8%) said their budget was remaining flat or decreasing. Meanwhile, 41.7% experienced nominal increases of less than 5%.

Despite economic uncertainty, Gartner projects worldwide IT spending to total $5.7T in 2025, a 9.3% increase from 2024. Specifically, software spending is projected to total $1.2T, a 14% increase from 2024, which is also the second fastest growing category behind data center systems.

It’s safe to say, IT organizations are spending when it makes sense, but they remain focused on responsible business growth.

For companies that are spending, what’s driving this behavior?

According to Gartner: “Cybersecurity spending is also driving growth in the software segment. In the 2024 Gartner CIO and Technology Executive Survey, 80% of CIOs reported that they plan to increase spending on cyber/information security in 2024, the top technology category for increased investment.”

“AI has created a new security scare for organizations,” said John-David Lovelock, Gartner Distinguished VP Analyst. “Gartner is projecting double-digit growth across all segments of enterprise security spending for 2024.”

SaaS has become irreplaceable for companies across all industries. But despite the CIO and CFO’s best efforts, SaaS costs are on the rise. It’s only going to continue growing as a line item in your company’s budget. Put simply: You can no longer ignore SaaS costs.

Decentralized Software Purchasing Increases the Need for Collaboration

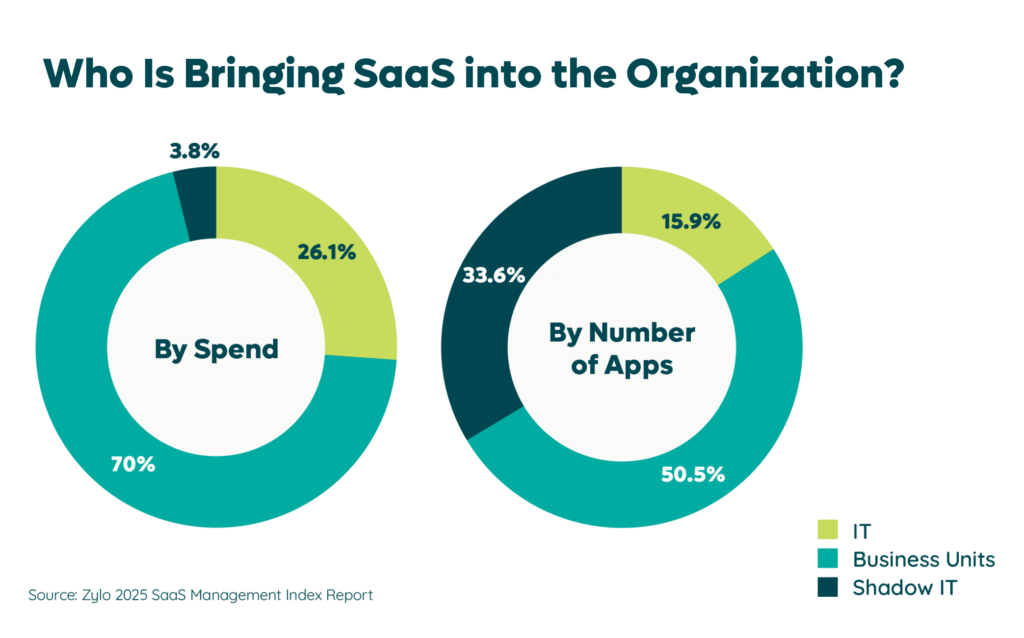

Over the last four years, IT’s control over SaaS applications and spending have diminished. Our data shows that IT is now responsible for 3.2% less spending and 30.8% fewer applications than they did in 2021. Today, business units and employees are responsible for 26% of SaaS spending and 16% of apps.

As a result, this trend of decentralized software purchasing makes it essential for IT departments to collaborate across the business on budgets. That is all the more challenging when anyone in the organization can acquire tools with the digital swipe of a credit card. IT and finance teams may not even know their organization committed to spending a certain amount with a vendor until the invoice hits their desk.

Effective budget collaboration starts with working from the same sheet of music – so to speak. Having a SaaS Management Platform like Zylo makes this possible by centralizing the spending and usage data required for budgeting decisions. It also enables you to easily allocate costs for shared software to lines of business. This ultimately drives more accountability and responsible spending behavior at the department level.

Effective budget collaboration starts with working from the same sheet of music – so to speak. Having a SaaS Management Platform like Zylo makes this possible by centralizing the spending and usage data required for budgeting decisions. It also enables you to easily allocate costs for shared software to lines of business. This ultimately drives more accountability and responsible spending behavior at the department level.

Confidently & Effectively Manage Your IT Budget in Partnership with the Business

SaaS applications are irreplaceable to organizations and they continue to grow their inventories at incredible rates. The pace certainly hasn’t slowed over the past decade, and won’t be doing so anytime soon. Especially as organizations rely on subscription software more than ever before — and for many positive reasons.

In the face of the positive changes and growth, CFOs, CIOs, and CEOs must ensure their organizations manage and optimize SaaS to gain full visibility into utilization, spend, and feedback. It ensures their budgets provide the best impact to their bottom lines — especially as budgets are being closely monitored.

While ownership is no longer solely in the hands of IT professionals, it still frequently falls upon IT to pinpoint each tool’s cost, ownership, and effectiveness for the business as a whole, and forecast for the future.

How is your organization allocating IT budgets for SaaS spend — but more importantly, managing the outcomes?

Want more? Learn how to create more accurate SaaS application budget forecasts.

ABOUT THE AUTHOR

Eric Christopher

Eric Christopher is CEO and Co-Founder of Zylo, the leading SaaS management platform. After 14 years of buying and selling software, Eric knew there had to be a better way to manage cloud applications within a company. Eric started his career in sales at ExactTarget from 2002 to 2010. He spent the next six years in Chicago leading sales teams at Shoutlet and Sprout Social Inc., and founded Zylo in 2016.

—

—