From Chaos to Control: Applying FinOps Thinking to SaaS

Table of Contents ToggleSaaS Budget Forecast: Identify Current SpendingIdentify Who Is...

Back

Back

Search for Keywords...

Blog

Table of Contents

IT leaders and CIOs are tasked with accurately managing and allocating software expenses. Yet, they often lack full oversight of purchasing. This challenge grows as most software acquisitions are made by business units and individuals outside IT’s direct control.

For the software that IT is aware of, creating accurate budgets is further complicated by factors such as:

The absence of a centralized tool to manage crucial data—like spending, contracts, and usage—makes budgeting even more challenging.

According to the 2024 Gartner® Magic Quadrant for SaaS Management Platforms™, organizations that don’t achieve centralized visibility and coordinate SaaS life cycles will overspend by at least 25% through 2027 due to unused entitlements and overlapping tools.

Accurate SaaS budget forecasting helps prevent surprise costs, manage cash flow better, and meet financial goals. Here’s how.

2024 Gartner® Magic Quadrant™ for SaaS Management Platforms

Learn MoreIn his guide to practical IT management in modern business, “Truth from the Trenches,” seven-time CIO Mark Settle notes an obvious but often under-emphasized aspect of optimizing the financial management of technology. “Sound financial management ultimately relies on timely and accurate financial information,” Settle wrote.

The first step toward accurately forecasting a SaaS application budget is to understand the current state of SaaS-based software spending in your organization. In general, SaaS applications quickly become hidden or obscured because they are easy to acquire, simple to deploy, and frequently utilized by users of all skill levels.

The first step toward accurately forecasting a SaaS application budget is to understand the current state of SaaS-based software spending in your organization. In general, SaaS applications quickly become hidden or obscured because they are easy to acquire, simple to deploy, and frequently utilized by users of all skill levels.

With that in mind, answering these three critical questions can determine the current state of spending:

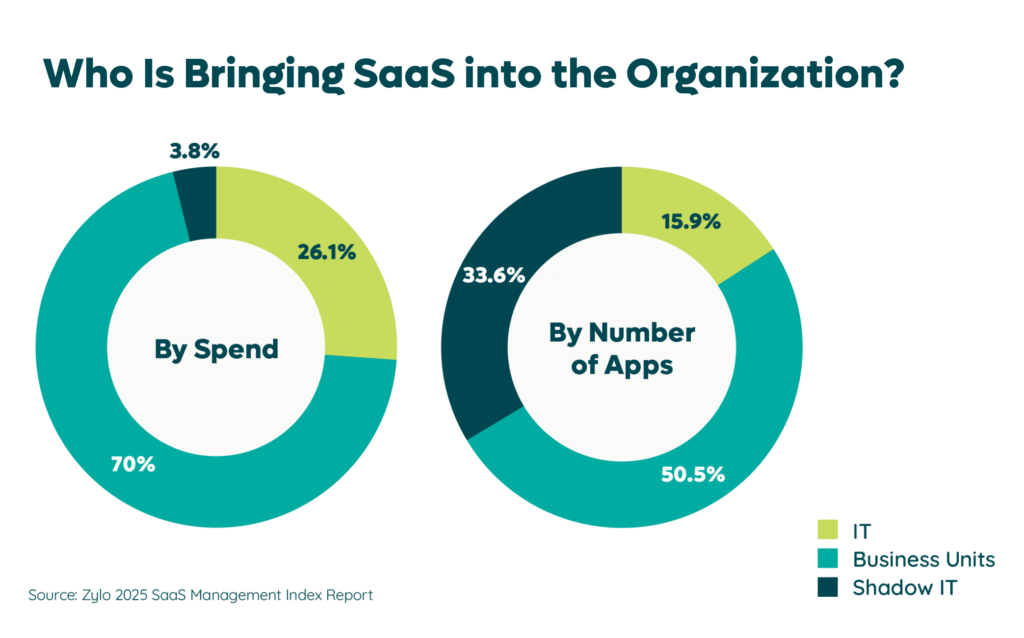

IT departments no longer have sole control over technology spending, with 74% of SaaS expenses now owned outside IT. Business units, empowered by an abundance of specialized tools, are increasingly responsible for software purchases. For example, marketing technology options have exploded from 150 tools in 2011 to over 13,000 today.

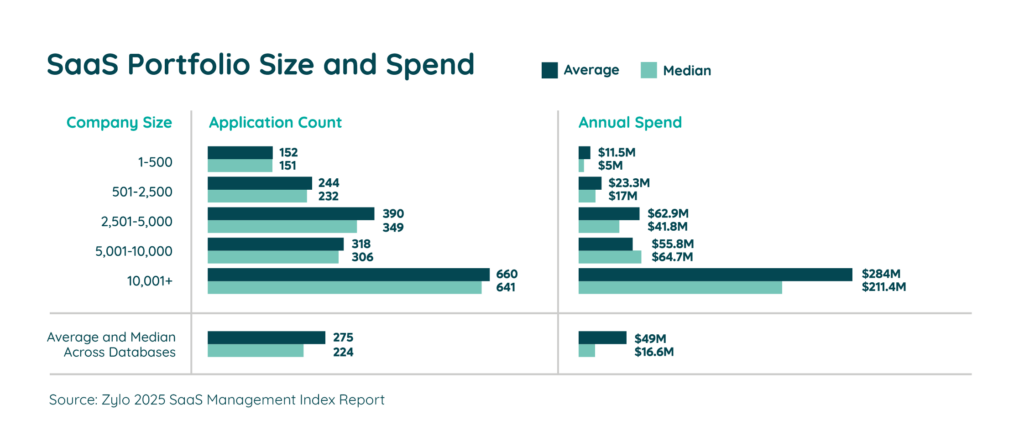

Despite this shift, it’s still IT’s job to track costs, ownership, and effectiveness across the organization. Financial transaction records often serve as a reliable source for identifying ownership. However, the sheer volume of data can be overwhelming. With an average of 275 SaaS applications per organization, manually tracking contracts, spend, and usage is impractical.

But how do you identify the individuals or business units purchasing SaaS? By following the money.

Starting with who purchased an application gives you a good starting point to track down owners. Zylo’s SaaS discovery tool uses AI and machine-learning algorithms to streamline this process. It accurately identifies every instance of SaaS in the organization, including purchases made by individual employees via expense.

For most businesses, SaaS application spending typically falls into two main categories: accounts payable and expense. According to Zylo’s research, nearly half of SaaS spending comes from employee-led purchases.

Employee expense purchases, typically unplanned, can lead to unnecessary or duplicate spending. Reducing or preventing these purchases when feasible ensures a more accurate budget, helping you stay on track throughout the year.

Employee expense purchases, typically unplanned, can lead to unnecessary or duplicate spending. Reducing or preventing these purchases when feasible ensures a more accurate budget, helping you stay on track throughout the year.

Discovery isn’t just for tracking down owners. It also helps surface costs and spending sources. This level of visibility helps prevent wasteful spending, helping you accurately assess upcoming costs and budget accordingly.

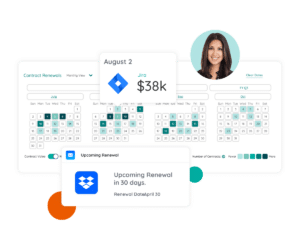

On average, organizations experience 247 SaaS renewals each year, or one SaaS application renewal every day, according to Zylo data. Frequently, these renewals result from automatic renewal clauses hidden in the original purchase agreement or contract.

When they’re unexpected, auto-renewals can catch you by surprise. Left unmanaged and unplanned for, they result in spending money on tools you no longer need and throwing off your budget.

Knowing when to expect to pay for applications is essential for planning quarterly budgets and better managing cash flow. To achieve this foresight, it’s crucial to first discover every SaaS application or subscription currently used within the organization. With a complete inventory, it’s possible to identify individual owners and scour purchase agreements (or other application details) to find renewal dates.

Look at your contract data to understand your payment terms—whether you’re paying monthly or annually. Then, set up a renewal calendar so you know when those costs renew. Proactively planning your renewal strategy can help IT leaders and application owners avoid unplanned costs, improving budget accuracy throughout the year.

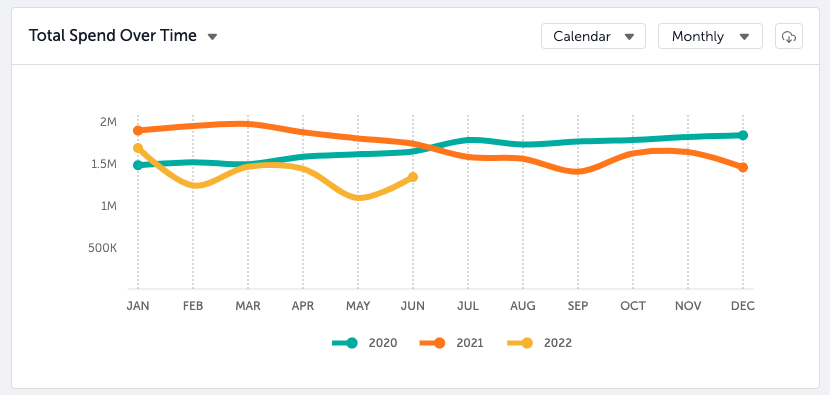

The second step in accurately forecasting your SaaS budget is anticipating future spending trends. Gartner projects that SaaS spend will grow by 15-20% annually through 2026. This growth is partly driven by employees increasingly seeking out their own software tools, contributing to overall spending. Without centralized visibility and coordinated management of SaaS life cycles, organizations risk overspending by at least 25%.

While some organizations have successfully managed to lower their SaaS spend, maintaining control over these costs requires constant vigilance. Even organizations actively managing their software portfolios with tools like Zylo’s SaaS Management Platform (SMP) must continuously monitor and adjust their budgets. Taking your eyes off this process can lead to chaos and unplanned expenses creeping back in.

Every company’s spending trajectory for SaaS will be unique, but one constant remains. Few companies, if any, will spend less year-over-year on cloud-based subscription software. The discovery process mentioned earlier can help uncover historical financial data for software transactions across multiple years, making it easier to chart a growth curve and predict future spending.

However, it’s crucial to recognize that simply applying a flat rate, such as the average 15% year-over-year increase, may not accurately reflect the complexities of your organization’s SaaS needs. Instead, budgeting for SaaS requires a more dynamic and agile approach.

Consider these cost-inflating factors as you budget for next year:

By accounting for these factors, you can create a more accurate and responsive SaaS budget that aligns with your organization’s evolving needs. This will ultimately help you manage cash flow and avoid unplanned costs.

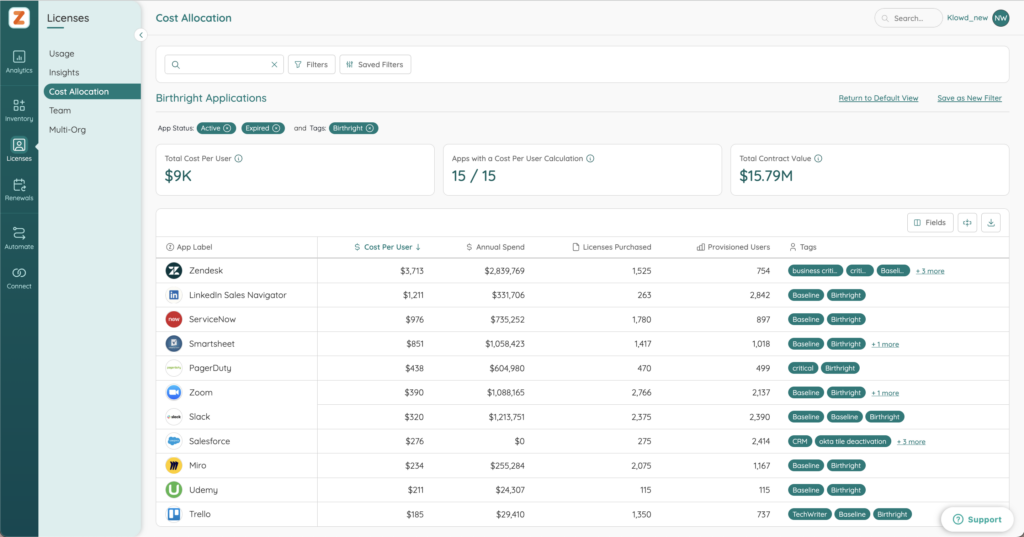

Adopting a cost-per-user budgeting model can significantly enhance your ability to forecast growth accurately, avoid underestimating expenses, and prevent mid-year financial scrambles. This model breaks down the cost of each application per employee, offering a granular view of your software expenses.

To calculate cost per user, identify which applications each department uses. If you consider the Engineering team, this includes essential tools necessary for their roles, such as GitHub, and supplementary tools, like Copilot. Next, determine the cost of a license for each app. Finally, assess what percentage of the team actively uses each tool to get an accurate picture of the real cost per user.

With this detailed insight, your organization can more effectively allocate resources, ensuring that every dollar spent on SaaS contributes directly to your teams’ productivity and efficiency. This approach not only improves budgeting precision for IT and business units, but also helps optimize software usage across the organization.

With business units purchasing their own software – as opposed to IT – it’s incumbent on them to take more responsibility for technology within their budgets. It’s not just about the software they buy but also their consumption of IT-owned applications.

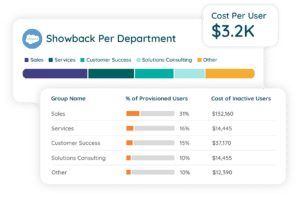

Cost allocation is a powerful strategy of assigning software costs to specific departments or teams based on actual usage. It helps you:

Cost allocation is a powerful strategy of assigning software costs to specific departments or teams based on actual usage. It helps you:

There are two approaches you can take here: showbacks or chargebacks. Showbacks allow departments to see usage costs without being directly billed, promoting awareness and responsible consumption. Chargebacks go a step further by billing departments for actual SaaS usage, ensuring they contribute to the cost of their software consumption. Both methods promote accountability, helping to prevent overspending and encouraging more thoughtful resource usage.

These mechanisms improve transparency and drive departments to be more mindful of their SaaS expenditures, ultimately leading to a more accurate and efficient budget. With a clearer understanding of cost distribution, organizations can better align spending with their strategic goals, making it easier to stay on budget throughout the year.

Guide to Managing SaaS Costs

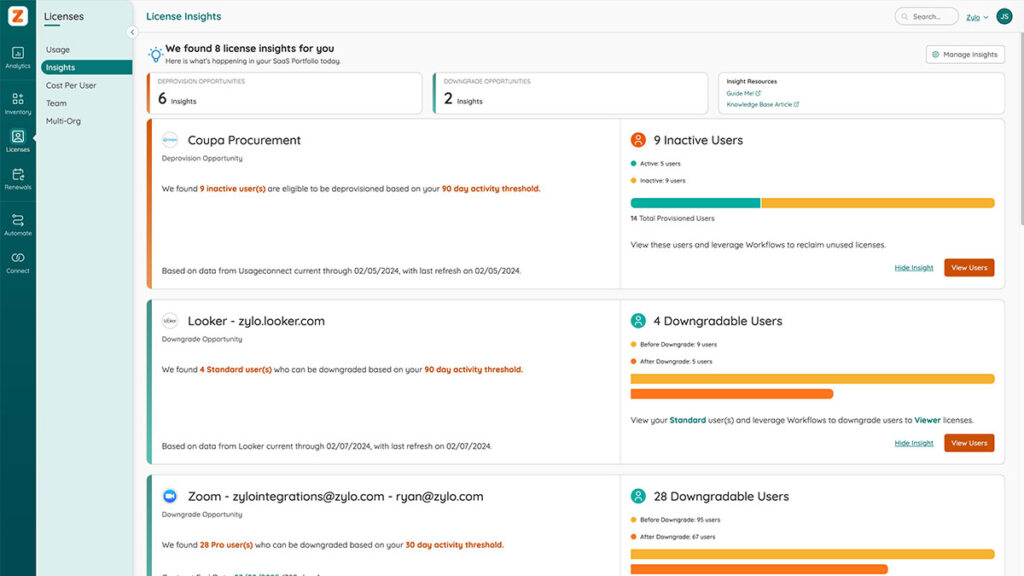

Learn MoreAuto-renewals and overages can throw a wrench in your budget. Likewise, a short financial runway can put strain on your budget. An effective way to combat this is to optimize and reduce your SaaS costs. Using a SaaS Management Platform to track your budget throughout the year can help you pinpoint any risks and opportunities to save money.

Since increased SaaS costs are virtually guaranteed, reduce those costs by avoiding overages, reducing license waste, rationalizing apps, and rightsizing contracts, to name a few. Ideally, while every business experiences a growth curve of increased spending, you can flatten that curve by identifying and managing what you previously couldn’t see.

Today’s CIO strives to transform IT from a cost center to a revenue generator by optimizing SaaS SaaS costs and finding savings opportunities.

“CIOs are helping drive innovation to break down silos across the organization and create new value streams,” says IBM CIO Kathryn Guarini. “They serve as connectors across business functions and are engaging more with the CEO to develop technology strategies that drive agility and efficiency, and, ultimately, lead to business growth.”

The distributed nature of SaaS ownership can be a problem – but it also makes it a great place to discover cost savings. These opportunities can enable better budgeting by letting you know what costs you have and when you’ll incur them.

Here are a few ways deploying a robust SaaS Management strategy leads to cost savings on current tools and more accurate forecasting:

Shadow IT is much like finding a hidden water leak in your home. It represents a significant source of unaccounted-for spending in your organization. These employee-led software purchases, often made via expense reports or credit cards, account for an average of 1% of an organization’s total SaaS spend. It may sound like a slow leak, but like water damage, the results add up over time.

Identifying and evaluating shadow IT is crucial for developing effective governance policies and procedures for software sourcing and procurement. Organizations can significantly reduce unmanaged spending by prohibiting employee expense reimbursements for unapproved software and establishing a review board, ensuring that all software acquisitions align with company policies and budgetary constraints. By finding the leaks in your budget, you can plug the holes and prevent future damage.

Evolving Your SaaS Governance Framework for the Digital Workplace

Learn MoreCompetition is a natural force in the organic evolution of the SaaS market. In addition, users often have the luxury of choice among multiple applications to solve business problems. Specific verticals, such as web conferencing, productivity tools, and collaboration and messaging platforms, are exceptionally competitive.

“When I’ve been a part of SaaS businesses and startup and scale-up organizations, you often have six or seven project management tools. You have four or five collaboration tools. You have Zoom, Slack, all these different solutions,” says Chris Ortega, CEO at Fresh FP&A and Fractional CFO. “That’s a greenfield opportunity that a lot of CFOs can get immediate cash flow impact and big wins that don’t necessarily need a big swoop of cost-cutting measures around your people.”

Consolidating this competition by standardizing around a single – or just a few – duly chosen application eliminates confusion, helps enforce governance, and can lead to savings.

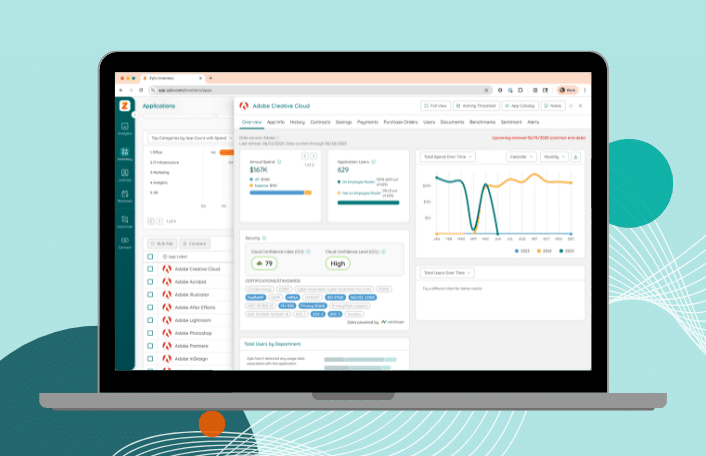

Adobe Drives Innovation and Massive Savings with Zylo

In the past 4 years, Adobe has rapidly scaled from $9B to $18B. This growth has made an already complex environment even more complex. Learn how they leveraged Zylo to get complete visibility into their SaaS portfolio, unlock millions in cost savings and avoidance and improve the employee experience.

Once an application has been selected and standardized, disparate user licenses (such as those acquired under employee-led acquisition) should be consolidated under an enterprise license agreement (ELA).

ELAs are preferable because they leverage the purchasing power of the entire organization and enable discounts not available to individual end-user license agreements (such as multi-year agreements), which lead to reduced per-user costs.

An additional benefit from ELAs includes the ability to negotiate other contract terms, such as enhanced security or privacy terms.

End-user utilization frequently reveals opportunities for cost savings. In fact, 53% of licenses sit unused each month, which equates to $21M in wasted spend annually. Once identified, you can recoup that waste by reclaiming and redeploying license to users who are more likely to use the app. If underutilization is widespread (i.e., most users do not use it effectively), eliminating the application altogether (and therefore its cost) can also yield savings.

Accurately examining the entire picture of SaaS application spending, including discovering acquisition sources, spending channel mix, and renewal planning, enables technology leaders to forecast spending more accurately and deliver cost savings.

These actions and more become available only when these leaders commit to enacting a robust SaaS Management strategy.

“Companies follow due diligence and process when looking at their revenue and people strategies,” Ortega says. “You should take that same diligence into your operational SaaS spend, and partner with tools like Zylo to help you on that journey.”

Accurate SaaS budget forecasting is critical for managing your organization’s software expenses, and a SaaS Management Platform is an essential tool to do this. With always-on, comprehensive discovery, an SMP enables you to fully understand what applications you have, how much you’re spending, and who is acquiring software. This real-time visibility ensures no software purchase goes unnoticed, allowing for more accurate forecasting.

By centralizing application, spending, and usage data, an SMP provides a single source of truth that enables you to track costs over time and allocate them appropriately across the business. This centralized approach simplifies budget management and enhances your ability to make data-driven decisions.

Moreover, an SMP helps identify cost optimization opportunities by highlighting underutilized software and redundant tools, enabling you to avoid incurring unnecessary costs. This proactive management helps you save money while maximizing the value derived from your software investments.

Ready to learn more about how Zylo Discover can help companies like yours improve software budgeting, forecasting, and more? Request a demo!

Table of Contents ToggleSaaS Budget Forecast: Identify Current SpendingIdentify Who Is...

Table of Contents ToggleWhy Data Integrity Breaks DownWhat Does Data Integrity...

Table of Contents ToggleSaaS Budget Forecast: Identify Current SpendingIdentify Who Is...

Table of Contents ToggleShelfware DefinedWhy Shelfware HappensPoor Organizational OversightShadow IT and...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |