5 Industry Experts Weigh In on the 2026 SaaS Management Index

Table of Contents ToggleThe Subscription Economy Continues to Evolve3 Predictions for...

Back

Back

Search for Keywords...

Blog

Table of Contents

Do you remember your first mobile phone? Your first laptop? Or even the first time you used a fax machine? Of course you do. At the time, it probably seemed like those technologies were revolutionary — and they were. Take the mobile phone for example: never before had consumers been able to take their phones with them to make calls on the go.

Now, studies indicate that many individuals spend more time interacting with their smartphones than they do with other human beings, and that development has occurred in just the past few years. We do everything on our phones from texting to banking to logging recent sales activity for our jobs to attending virtual video meetings with those on other continents. But 5 years ago, that wasn’t the case. And just a few decades ago, personal computers were just being introduced for the very first time.

As subscription-based services are the norm for how technology is delivered to businesses and enterprises across all industries, geographies, and even company size, what will the industry look like five, 10, or even 20 years from now?

Executives that have been in the enterprise space for more than five years know that the technology landscape is changing rapidly. Executives that used to work with procurement and IT teams to source on-premise software and work through huge global installation projects have now pushed down purchasing decisions to departmental units who make decisions about SaaS and often times even work through the implementation process with the vendor directly.

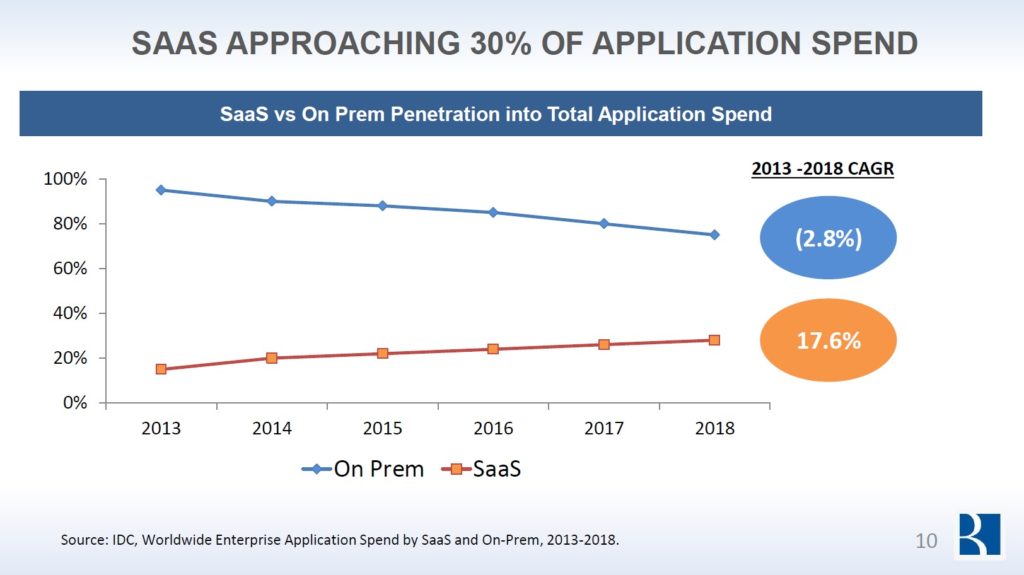

Year by year, spend on SaaS and subscription-based services as a whole are rising while costs are decreasing on traditional on-premise software, as illustrated below (source: IDC).

And as the technology landscape progresses, the consumer will continue to evolve, buying patterns will change, and delivery methods will continue to improve. All of these changes will lead to continued innovation and perhaps, a disruption in the way organizations buy and even sell SaaS and subscription-based products in general.

In a recent article by Justin Jackson, he poses the question, “What if customers were able to buy the web application and host it on Amazon Web Services themselves? They could buy the software once, and deploy it to servers they control. In most web apps the application layer and the database layer are separate. If the creator of the software released a new version, the customer could then purchase that upgrade, and deploy it themselves.”

The article goes on to say that the industry shouldn’t discount the threat of open source as according to Justin, there have always been open-source alternatives. “Up until now, there have been barriers to use (mostly installation, updates, and licensing) but those could be solved. Security, upgrades, maintenance and customer support have always been a concern with self-hosted setups. However, Infrastructure as a Service (IAAS) providers have a tremendous opportunity to step-up here. If you’re paying $300 / month for 5 SaaS products, why not just come over to another platform and self-host similar apps for $100 / month?’”

We’ve already seen SaaS shift the way companies pay for software. With today’s SaaS pricing, the most common model is for companies to pay per user or “seat” or less commonly by product usage. But in the future of subscription-based models, we may see a shift in pricing to even more of a customer-focused model.

According to a recent Openview article by Steven Forth, Slack is rewriting the rules on pricing in a way that will impact everyone who has a subscription revenue model. Steven explained that, like most people, “I have had trouble with companies that make it hard to change a subscription (‘a commitment is a commitment’ they tell me). So I was surprised and delighted to be working with a company that automatically gave me a credit for reduced use. It makes me more loyal to Slack, and more willing to commit to higher levels of subscription, as I trust they will be flexible and act in my best interests. Is this an aberration? Something that other SaaS companies can ignore? Is it an end state? Or could it be a transition to something else? I believe it is the latter.”

Steven went on to share that Slack has very good analytics to predict future use and that it uses these to adapt its pricing to optimize revenue and renewals. He asks, “Is your SaaS company doing this? If not, you better get started. Because adaptive pricing models like Slack combine the best of predictability and adaptability.”

While Slack is leading the way of this new adaptive pricing model, the shift is likely to continue as SaaS becomes even more focused on delivering exceptional customer value.

Hundreds of new subscription-based products are being introduced to the market each year, both for B2C and B2B. As an executive, you know firsthand how difficult it can be to evaluate all of the different players and keep on top of the changes to ensure that your organization is using the best solutions that provide the greatest output and value.

As the SaaS landscape continues to grow, it will be important for the market to consolidate both in terms of mergers and acquisitions, but perhaps most importantly through the separation of platforms versus features.

For example, large players in the CRM or marketing automation space will likely gravitate towards being a platform. They have big, complex APIs that can integrate to virtually any technology, and they themselves offer a suite of products. These big players will become the database of records for sales, marketing, customer success functions, and so on.

However, as new SaaS companies emerge that can add significant value to a CRM platform, for instance, they will simply because “features” that can latch onto the platform to add even more value. The benefit to executives is two-fold: Fewer platforms for employees to store data and sign-in to, and more features and uses for those platforms.

Zylo is the leading SaaS optimization platform that transforms how companies manage and optimize the vast and accelerating number of cloud-based applications organizations rely on today. The platform provides an online command center for all cloud-based software used across a company, giving an organization visibility into what software is used, how much is spent and how to optimize their cloud software investments.

ABOUT THE AUTHOR

Eric Christopher

Eric Christopher is CEO and Co-Founder of Zylo, the leading SaaS management platform. After 14 years of buying and selling software, Eric knew there had to be a better way to manage cloud applications within a company. Eric started his career in sales at ExactTarget from 2002 to 2010. He spent the next six years in Chicago leading sales teams at Shoutlet and Sprout Social Inc., and founded Zylo in 2016.

Table of Contents ToggleThe Subscription Economy Continues to Evolve3 Predictions for...

Table of Contents ToggleWhat Is SaaS Compliance?Why SaaS Compliance MattersKey Types...

Table of Contents ToggleThe Subscription Economy Continues to Evolve3 Predictions for...

Table of Contents ToggleThe Subscription Economy Continues to Evolve3 Predictions for...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |