Table of Contents

Updated on February 24, 2026 with new data and insights.

AI adoption has skyrocketed. But when it comes to pricing, it’s like opening Pandora’s Box. It’s inconsistent, complex, and constantly evolving. As AI becomes embedded into nearly every SaaS platform, understanding the true cost of artificial intelligence is essential to controlling software spend in 2026.

TL;DR: AI Is Driving SaaS Cost Volatility and Governance Must Catch Up

- AI is increasing SaaS cost volatility. Consumption-based pricing and AI add-ons make budgets harder to predict and control.

- Hybrid pricing models drive surprise charges. In 2025, AI-native spending nearly doubled. Token usage, tier shifts, and AI upgrades often inflate costs mid-contract.

- Shadow AI is expanding spend and risk. Expensed AI tools bypass governance, increasing duplicate spend and security gaps.

- AI amplifies existing SaaS waste. Unused licenses and redundant apps become more expensive with AI premiums layered on.

- Proactive SaaS Management is essential. Continuous discovery, usage visibility, and renewal discipline are required to contain AI-driven costs.

How Much Does Artificial Intelligence Cost?

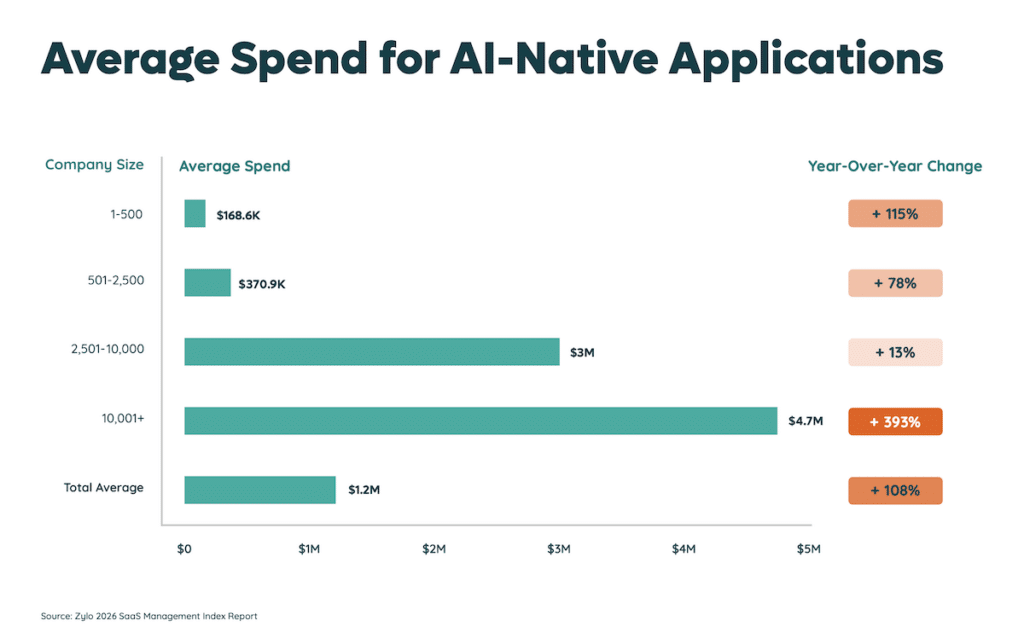

According to Zylo’s 2026 SaaS Management Index, organizations spent an average of $1.2M on AI-native apps. This is a 108% year-over-year increase, indicating AI costs will continue growing.

The question “How much does AI cost?” doesn’t have a single answer. AI pricing varies based on:

- Vendor pricing models (subscription, usage-based, flat-rate)

- Deployment model (cloud-based, hybrid, on-premises)

- Type of AI functionality (embedded vs native AI applications)

- Infrastructure and compute resource demands

- Required level of customization and integration

AI costs can range from a few dollars per user to hundreds of thousands in annual spend. Depending on your AI strategy, that cost could be small and incremental, or it could be significant and complex to manage.

In contrast, applications like Salesforce Agentforce and ChatGPT are consumption-based, charging a set rate per conversation or token. The more you prompt and output, the more you pay.

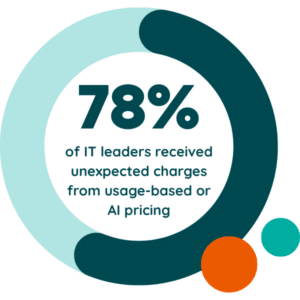

These usage- and outcome-based models add complexity to forecasting and make budgeting less predictable. In fact, 78% of IT leaders Zylo surveyed reported unexpected charges on SaaS due to consumption-based or AI pricing models.

2026 SaaS Management Index

Learn MoreFactors Impacting AI Costs

While pricing models define how vendors charge for AI, the actual cost of deploying and managing AI hinges on these key factors:

- The complexity and scope of your AI initiative

- Labor and infrastructure needed to build and maintain models

- Quality, availability, and volume of data used

- How you deploy and scale AI across the organization

- Regulatory and compliance overhead tied to industry or geography

These factors span from the intrinsic AI features to the external requirements that drive the overall investment.

AI Features and Functionalities

AI-native tools with advanced capabilities like generative text, computer vision, or autonomous decision making require significantly more compute power and often come with premium pricing.

For example, AI models with natural language processing, image generation, or real-time translation typically rely on high-cost GPU infrastructure and substantial development.

Project Type and Scope

AI use cases range from simple automations to enterprise-wide deployments. A narrow, internal-use chatbot costs far less than a fully integrated AI engine powering customer-facing applications.

Custom AI projects also require longer development cycles, testing, and dedicated engineering resources—all of which increase total cost of ownership.

Data Accessibility and Quality

Poor data quality is one of the most common and costly blockers to AI success. Without access to clean, labeled, and structured data, model training becomes inefficient and expensive.

Investments in data cleaning, tagging, governance, and integration with existing systems are often required before AI initiatives can scale.

Labor and Expertise

Skilled AI practitioners don’t come cheap. From data scientists to ML engineers, the talent needed to build, deploy, and refine AI models adds significant cost. In many cases, companies must also invest in training their current workforce to maintain or manage AI systems.

Infrastructure and Compute Resources

Training AI models, particularly those based on deep learning or generative AI, requires significant compute resources. According to MIT, by 2026, the electricity consumption of data centers is expected to approach 1,050 terawatt-hours

AI infrastructure and compute investments include:

- GPUs or cloud-based compute clusters

- Storage services to house large datasets

- Scalable deployment environments

The rise of consumption-based pricing in cloud platforms (e.g., per hour or per token) can further inflate operational costs as usage increases.

Regulatory and Compliance Costs

AI systems that process sensitive data must comply with privacy regulations such as GDPR, HIPAA, and others. Maintaining compliance can add cost via:

- Data residency requirements

- Explainability and audit tools

- Legal review and risk assessments

- Security controls and breach response capabilities

As AI governance evolves, so will the cost of staying compliant, especially in regulated industries like healthcare, finance, or government—per McKinsey.

Project Duration and Management

Even the most promising AI initiatives can run over budget if timelines extend due to poor planning, team misalignment, or shifting business requirements.

Many organizations underestimate the need for robust project management and stakeholder engagement, two critical levers in avoiding scope creep and budget bloat.

AI Pricing Trends to Watch in 2026

In 2026, we expect AI costs to be shaped by:

- Premium pricing for AI-enabled features in traditional SaaS tools

- Rising enterprise investment in AI-native platforms

- More granular, usage-based billing (per task, token, or conversation)

- Increasing reliance on open-source AI frameworks — with hidden costs

- Growing confusion around licensing, renewals, and total cost of ownership

AI pricing models are evolving faster than buyers can keep up. OpenAI’s CEO, Sam Altman, predicted that “AI prices will drop 10x annually,” but we’re seeing the opposite in the short term, especially among enterprise vendors.

For instance, Microsoft added Copilot to Microsoft 365 and raised subscription prices by $3 USD per month on January 16, 2025. Meanwhile, Google adjusted Workspace pricing and embedded AI at no added cost. These contrasting strategies reflect a broader trend: AI is becoming table stakes, but not every vendor agrees on how to price it.

“When you add AI and consumption-based pricing, we’re talking about more budget volatility and pressure on in-year spend, which kills innovation. Organizations are now incurring more unexpected changes and must start looking at their governance model in a different way.”

— Jez Back, Cloud Economist & Global Offer Leader at Capgemini Invent

SaaS Premiums on AI-Enabled Features

According to Zylo’s 2026 SaaS Management Index, annual SaaS spend rose 8% while the number of applications remained effectively flat. Increasing pressure now stems from pricing mechanics, especially consumption-based pricing. Vendors are charging more for AI, often by bundling features into higher-tier plans, regardless of usage or value.

Many organizations are pushed into more expensive SKUs without a clear business case or proven adoption. As a result, teams are struggling to justify these added costs, especially when:

- AI capabilities are underused or sit idle due to lack of enablement

- Visibility into AI usage and value is limited

- Functionality is bundled with other tools the business doesn’t need

In many cases, AI features are included as line items in renewals without clear ROI tracking or accountability. This leads to waste, especially in environments where feature usage is unknown or misaligned with team needs.

Rising Investment in AI-Native Applications

AI-native tools—like ChatGPT and Claude—are seeing rapid adoption and growing budget share, but many still lack the enterprise controls needed to manage them effectively. These applications are built around AI from the start, and their appeal is driving organic growth across departments.

One clear signal: ChatGPT became the #1 most-expensed app by number of transactions—according to our 2026 report—up from #2 in 2024. In addition, 16% of the 50 most expensed applications are AI-native apps (8/50 apps). This increase in expensed AI-native apps reflects a broader shift toward individual users introducing AI tools into their daily workflows, often without IT involvement.

| Rank | Application | Number of Transactions |

|---|---|---|

| 1 | ChatGPT | 11,030 |

| 2 | Apple iCloud | 5,732 |

| 3 | Canva | 5,650 |

| 4 | QuickBooks | 4,228 |

| 5 | OpenAI API | 4,044 |

| 6 | Godaddy | 3,444 |

| 7 | MailChimp | 3,382 |

| 8 | 3,377 | |

| 9 | Google Workspace | 2,959 |

| 10 | Spotify | 2,821 |

Source: 2026 SaaS Management Index

The result is a growing set of tools that are:

- Purchased outside of procurement

- Disconnected from centralized license management

- Lacking in usage governance or security review

This makes it difficult for organizations to understand what’s being used, who’s using it, and how much it’s costing. Without a system of record or ownership model, AI-native tools can quickly drive up spend and create risk, even when they offer real productivity value.

Cloud-Based AI Pricing Models

Usage-based pricing has become the norm for cloud-delivered AI, and it’s introducing budget uncertainty for IT, finance, and procurement. Vendors are shifting away from flat-rate pricing in favor of models that charge based on activity, not access.

This trend aligns pricing with real-time usage but creates volatility across the organization.

Key challenges with cloud-based AI pricing include:

- Unpredictable billing: Pricing is often based on variables like time used, tokens consumed, or data processed, which are difficult to estimate upfront.

- Delayed visibility: Finance and procurement teams frequently aren’t notified until after charges are incurred, making it harder to forecast or allocate spend accurately.

- No clear usage thresholds: AI tools may lack built-in usage caps or alerts, leading to overages that surprise IT leaders and budget owners.

- Poor integration with existing governance tools: Many AI platforms don’t plug into current SaaS Management systems, leaving teams blind to usage trends or contract changes.

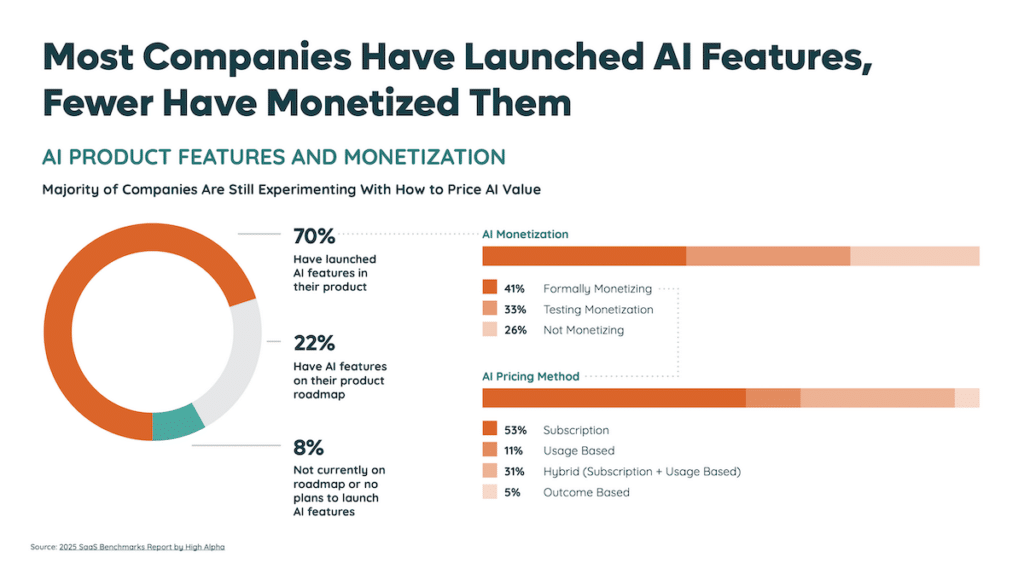

Adding to the complexity, a growing number of AI vendors are layering multiple pricing models into their platforms. According to High Alpha, nearly one-third (31%) of AI vendors rely on hybrid pricing models, combining subscription fees with usage-based or value-based charges.

This means buyers aren’t just managing one pricing structure. They’re navigating two or more per contract.

Open-Source AI and Cost Implications

Open-source models like LLaMA and Mistral are gaining traction, especially among technical teams. But “free” isn’t always cheaper.

Deploying open-source AI at scale still requires:

- Hosting and infrastructure (e.g., GPUs, cloud clusters)

- DevOps resources for deployment and monitoring

- Security and compliance oversight

- Ongoing model tuning and performance management

Without governance, open-source AI can create silos and shadow systems that bypass existing purchasing and security protocols, leading to surprise costs down the road.

Subscription vs. One-Time Payment Models

While subscription pricing still dominates, some vendors are testing alternatives to meet buyer demand for predictability.

Subscription models offer:

- Lower upfront cost

- Continuous access to updates and new features

- Greater flexibility for scaling up/down

One-time licenses offer:

- Long-term budget stability

- Lower total cost over time

- Simplified procurement and renewals

The trade-off? One-time licenses often require longer commitments and may lack portability across teams or business units.

Increasing Complexity in AI Licensing

AI licensing complexity affects everything from vendor selection to renewal negotiations. It also makes it harder to:

- Understand what you’re paying for

- Forecast true usage across teams

- Align pricing with value delivered

- Prevent exposure to shadow AI risk

- Drive user adoption

Vendors are introducing layered entitlements, microservices, AI usage thresholds, and bundled SKUs that vary by user, region, or function.

As Zylo Co-founder Ben Pippenger describes it, “every app has its own flavor,” highlighting how even major vendors like Salesforce and Zendesk now layer usage-based fees onto traditional per-seat contracts.

“We’re seeing the same trend we saw 10-15 years ago with cloud. It started with somebody saying, ‘I can’t wait for IT. I’m going to start an AWS account.’ That same thing is happening with AI right now. People are signing up with their credit cards, and then spending hits some critical threshold and the company suddenly moves to control and consolidate it.”

— J.R. Storment, Executive Director, FinOps Foundation

AI Pricing Models

AI vendors are using a variety of pricing models to monetize functionality, scale, and outcomes. Common AI pricing models include:

- Value-based pricing

- Usage-based pricing

- Subscription-based pricing

- Freemium models

- Flat-rate pricing

- License Fee models

- Performance-based pricing

- Hybrid pricing models

- Labor replacement pricing

- Outcome-based pricing

- Blended pricing

- Tiered pricing

- Agentic seat pricing

- Cost-Plus pricing

- Competitive pricing

- Penetration pricing

Understanding the structure behind each model is key to evaluating cost, forecasting spend, and aligning pricing with value delivered.

Value-Based Pricing

Value-based pricing ties the cost of AI to the perceived or delivered value, rather than usage or features. Key characteristics include:

- Pricing is set based on ROI potential, business impact, or competitive advantage

- Often used in vertical-specific tools (e.g., healthcare, finance, sales performance)

- Requires vendors to articulate and prove value over time

This model is common for vendors positioning AI as a strategic differentiator or performance driver. The logic: the more business value the AI tool delivers, the more a buyer should be willing to pay.

Buyer considerations:

- Hard to forecast: Without clear value metrics, pricing may feel subjective or unstable

- Negotiation-heavy: Contracts often depend on stakeholder alignment, use case complexity, and expected outcomes

- High expectations: Buyers will expect measurable performance improvements to justify cost

Usage-Based Pricing

Usage-based pricing charges based on how much of the AI service you consume, often by:

- Tokens

- API calls

- Resolutions

- Hours

- Other unit-based metrics

Key characteristics of usage-based pricing include:

- Pricing is tied directly to activity: prompts, responses, conversations, compute time, etc.

- Enables low-cost entry points with scalable spend as adoption increases

- Often used by API-first or infrastructure-based AI vendors

This model is common for generative AI platforms, APIs, and cloud-hosted services. The more you use, the more you pay.

Keep these considerations in mind when buying:

- Difficult to predict spend: Especially early in deployment or during usage spikes

- Lacks guardrails: Many tools don’t have caps, alerts, or thresholds to prevent runaway usage

- Cross-team coordination required: Finance, IT, and business units must align to track and control consumption

Subscription-Based Pricing

Subscription-based pricing charges a recurring fee (typically monthly or annually) for access to an AI product or service. Key characteristics include:

- Fixed fee per user, seat, or license over a defined period

- Common for AI add-ons in enterprise software (e.g., Microsoft Copilot)

- Often bundled into higher-tier plans with additional functionality

Buyer considerations:

- Predictable billing: Easier to forecast and allocate budgets

- May lead to overpayment: If AI functionality is underused or sits dormant

- Important to monitor value delivered: Especially for bundled features where AI is not the core driver

Freemium Models

Freemium pricing offers basic access to an AI product for free with advanced features, usage limits, or business capabilities gated behind a paid tier. Key characteristics include:

- Free tier includes limited functionality, usage volume, or output

- Premium tiers unlock enhanced features, enterprise controls, or support

- Often seen in AI-native tools targeting individual users or SMBs

Freemium is commonly used to drive user adoption and upsell to premium plans. It works best for viral tools or self-serve onboarding models.

Buyer considerations:

- Low barrier to entry: Great for testing but often lacks governance controls

- Sprawl risk: Employees may adopt AI tools without procurement or IT involvement

- Upgrade pressure: Free plans are often structured to push users into paid tiers quickly

Flat-Rate Pricing

Flat-rate pricing charges a fixed cost for unlimited access to the AI product or service, regardless of usage volume. Key characteristics include:

- One price for all users or an entire organization

- Typically includes unlimited usage within defined terms

- Rare among infrastructure-heavy or generative AI tools due to compute costs

This model offers simplicity and cost predictability but can misalign pricing and value if usage varies widely. It’s most common in early-stage tools or bundled offerings where usage is difficult to meter.

Buyer considerations:

- Predictable spend: Easier for budgeting and procurement approval

- Potential overpayment: Light users may pay disproportionately compared to value received

- Lacks incentives for optimization: No built-in feedback loop between usage and cost

License Fee Models

License fee pricing involves a one-time or recurring payment to access an AI product under a defined usage agreement. Key characteristics include:

- Fee is tied to the right to use the software, not the volume of use

- May be perpetual (one-time) or time-limited (renewed annually)

- Often found in regulated or highly customized environments

This model is often used for on-premises or enterprise-grade deployments where long-term access is required. It provides buyers with more ownership but also more responsibility for management and maintenance.

Buyer considerations:

- Higher upfront cost: May require CapEx approval or longer procurement cycles

- More control: Useful for organizations that need local deployment or custom environments

- Governance needed: Buyers must track entitlements, renewal dates, and contract terms

Performance-Based Pricing

Performance-based pricing ties cost directly to the results an AI product delivers, such as

- Increased sales

- Reduced errors

- Time saved

Key characteristics of performance-based pricing include:

- Pricing is triggered by KPIs, milestones, or performance benchmarks

- Common in AI tools for sales, marketing, and operations optimization

- Typically includes clear SLAs or outcome definitions in the contract

You pay only when the AI meets predefined success metrics. This model aligns pricing with business outcomes, but requires strong measurement frameworks.

Buyer considerations:

- Aligned incentives: Vendors are motivated to deliver measurable results

- Requires data transparency: Both sides need access to outcome metrics

- Complex to negotiate and enforce: May involve custom contracts and legal review

Hybrid Pricing Models

Hybrid pricing combines two or more pricing models. Most commonly, that’s a base subscription plus usage-based or performance-based components. Key characteristics include:

- Fixed fee covers baseline access or functionality

- Variable charges apply based on usage, outcomes, or premium features

This is increasingly common among AI vendors looking to balance predictable revenue with scalable pricing. It offers flexibility but adds complexity for both buyers and finance teams.

Buyer considerations:

- Harder to forecast: Monthly invoices may vary widely depending on usage

- Requires close monitoring: Usage tracking and contract transparency are essential

- May blur value alignment: Buyers must separate baseline cost from variable performance

Labor Replacement Pricing

Labor replacement pricing is based on the cost savings associated with automating tasks traditionally done by humans. Key characteristics include:

- Pricing reflects full or partial replacement of manual labor

- Framed around cost-per-agent, cost-per-hour, or FTE equivalency

- Common in agentic AI tools (e.g., AI chatbots, virtual assistants)

This model positions AI as a direct substitute for headcount and prices accordingly. lt is often used to justify high-value AI tools in customer service, content creation, or administrative workflows.

Buyer considerations:

- Strong ROI narrative: Easy to justify if headcount reduction or capacity gains are realized

- Can oversimplify value: Not all labor replaced equals the same business impact

- Ethical and cultural concerns: May raise internal questions about workforce impact

Outcome-Based Pricing

Outcome-based pricing charges only when the AI delivers a defined business result, such as:

- Conversions

- Leads generated

- Fraud prevented

- Time saved

Key characteristics of outcome-based pricing include:

- Pricing is activated only when specific outcomes are achieved

- Common in high-stakes AI use cases like revenue generation or cost avoidance

- Requires detailed metrics, tracking, and agreed-upon definitions of “success”

It’s similar to performance-based pricing but typically tied to a more specific, quantifiable outcome. This model transfers more risk to the vendor and aligns cost directly with value delivered.

Buyer considerations:

- Aligned with results: Easier to justify budget when payment follows value

- Complex to structure: Requires legal and operational clarity on what counts as a “successful” outcome

- Longer sales cycles: Often involves more negotiation and customization

| Application | Pricing Approach |

|---|---|

| Salesforce Agentforce | $2 per conversation |

| Intercom FinAI Agent | $0.99 per AI resolution |

| Intercom FinAI Copilot | 10 free tickets per agent, per month |

| Zendesk | Per successful autonomous resolution |

| Microsoft AI Copilot for Security | $4 per hour of usage |

| OpenAI | Per input/output token (GPT-4o) |

| 11X | Per task completed by the AI SDR |

| Clay | Per credit with a credit = a data point or action |

| Copy.ai | Per workflow credit |

| Relay.app | Per workflow step |

| Bardeen AI | Per automation credit |

| Zapier | Per task automated |

| Captions | Per AI video generation credit |

| Kittl | High watermark of AI credits per day |

| Synthesia | Per minute of video |

| Imagen | Per AI photo edits |

| Aftershoot | Unlimited AI photo edits |

| DeepL | Per user and editable file translation |

Source: 2025 SaaS Benchmarks Report by High Alpha

Blended Pricing

Blended pricing averages multiple pricing models into a single, simplified rate, such as combining subscription and usage costs into a flat monthly fee. Key characteristics include:

- Combines elements of usage-based, subscription, or performance-based pricing

- Packaged as a single monthly or annual fee for simplicity

- Often the result of negotiated enterprise agreements

Blended pricing is designed to reduce complexity for the buyer while giving vendors flexibility in monetization. It is common in mid-market and enterprise contracts where standard pricing doesn’t cleanly fit the use case.

Buyer considerations:

- Easier to forecast: Consolidates multiple pricing inputs into a predictable number

- May obscure true usage: Without detailed reporting, buyers may lose insight into what’s driving cost

- Important to validate assumptions: Blended rates should reflect real-world usage patterns to avoid overpaying

Tiered Pricing

Tiered pricing offers different levels of access or functionality at progressively higher price points. Key characteristics include:

- Pricing tiers are predefined (e.g., Basic, Pro, Enterprise)

- Each tier unlocks additional features, usage capacity, or support levels

- Common in PLG (product-led growth) or self-service models

This model is designed to support scalability while nudging customers toward higher-value plans. It is frequently used for both AI-native tools and AI add-ons in larger platforms.

Buyer considerations:

- Easy to understand: Clear upgrade paths make planning and comparison easier

- Can lead to upsell pressure: Vendors often gate key AI features behind higher tiers

- Watch for shelfware risk: Higher tiers may include features your team won’t use

Agentic Seat Pricing

Agentic seat pricing charges per AI “agent” or bot, similar to how traditional SaaS charges per user. Each seat represents a distinct AI worker with specific responsibilities or workflows.

Key characteristics of agentic seat pricing include:

- Pricing is based on the number of AI agents deployed

- Each agent may have its own permissions, use cases, or integrations

- Common in AI tools for customer support, sales enablement, or task automation

Buyer considerations:

- Aligns with headcount thinking: Easy to model if agents replace or augment human roles

- Can grow fast: More agents = more cost, especially if provisioned without governance

- Requires role clarity: Define what each agent does and track usage to avoid overprovisioning

Cost-Plus Pricing

Cost-plus pricing sets the AI product price based on the vendor’s internal costs plus a fixed profit margin. It’s less common in commercial SaaS but may appear in highly customized or services-heavy AI engagements.

Key characteristics of cost-plus pricing include:

- Pricing includes costs like compute, data labeling, infrastructure, and support

- Profit margin is added as a percentage markup

- More common in consulting-heavy AI implementations or bespoke model training

Buyer considerations:

- Transparent but inflexible: Doesn’t scale well with actual usage or performance

- Not value-aligned: You may pay more even if business impact is limited

- Useful for custom builds: Works best when outcomes are unpredictable and vendor cost is the primary risk

Competitive Pricing

Competitive pricing sets the AI product’s cost based on market rates, focused on winning market share—especially in crowded or early-stage AI categories.

Key characteristics of competitive pricing include:

- Prices are benchmarked against similar tools or features

- May be temporary or used during promotional periods

- Common in categories like AI transcription, summarization, or copilots

Buyer considerations:

- Easy to compare: Helpful when evaluating multiple AI vendors

- May sacrifice depth or support: Lower prices can mean fewer enterprise features or service guarantees

- Watch for post-promotion increases: Vendors may shift to hybrid or value-based models after adoption

Penetration Pricing

Penetration pricing sets a deliberately low entry price that’s more of a growth tactic, not a long-term pricing strategy. Key characteristics include:

- Introductory pricing is lower than market value

- Aims to remove cost as a barrier to adoption

- Often accompanied by aggressive free trials or discounts

Buyer considerations:

- Short-term benefit: Good opportunity to test value with low risk

- Expect future increases: Pricing typically rises as features expand or usage grows

- Read contracts carefully: Confirm whether introductory rates are time-limited or usage-capped

How the Cost of AI Is Impacting Business Revenue

Artificial intelligence can be an enabler of or a hindrance to company growth, depending on how well you manage AI costs. On one hand, unpredictable consumption-based costs can quickly cut into margins and offset any gains. On the other hand, the right investments can increase the speed of innovation, customer service resolution, or sales pipeline generation that boost growth.

AI costs impact revenue in four ways:

- Margin pressure: Expensive AI features bundled into SaaS tools can raise contract values without proportional revenue lift.

- Throttled adoption: Usage-based pricing causes some teams to limit AI usage, reducing the potential for productivity gains that could drive top-line growth.

- Competitive imbalance: Companies that can absorb higher AI costs may outpace peers, widening the performance gap.

- Forecasting challenges: Unpredictable spend makes it harder to project financial outcomes tied to AI initiatives.

In short, while AI promises revenue acceleration, its evolving pricing models are just as likely to compress margins or create unplanned spend. Organizations that lack oversight risk eroding the very financial outcomes AI is meant to enhance.

AI Costs in Relation to Business ROI

AI spend only drives ROI when it is directly connected to measurable business outcomes. Without governance, usage tracking, and clear KPIs, AI often becomes a cost center instead of a value driver.

To get a return on investment for AI, consider the following:

- Adoption vs. spend: Licenses and credits only matter if employees are actively using the tools.

- Direct vs. indirect benefits: Revenue gains (e.g., more deals closed) are easier to measure than indirect savings (e.g., time saved).

- Governance requirements: ROI depends on monitoring usage, aligning spend with strategy, and reducing waste.

- Risk of overinvestment: Without benchmarks, organizations may overspend on tools that deliver minimal value.

The challenge is turning potential into measurable outcomes. Companies must establish KPIs tied to productivity, efficiency, or revenue impact, and regularly assess whether AI tools are meeting them. By linking cost directly to performance, organizations can separate true value from hype-driven spend.

Predictions for the Future of AI Pricing

AI pricing will continue to evolve through 2026 and beyond. Here are a few predictions for how we think it will shape up:

- Innovation will reduce some costs, but enterprise-grade AI will remain expensive

- Market competition will introduce new pricing models and drive price pressure

- Global economic conditions will influence how quickly companies invest

- Compliance requirements will add new layers of cost and complexity

Organizations must prepare for continued change and uncertainty, with governance frameworks in place to track spend and align it with measurable outcomes.

The Role of Innovation in Cost Reduction

Innovation may help lower certain AI costs over time, such as infrastructure or model training. But enterprise-grade AI will remain capital-intensive. As Sam Altman noted, building and operating AI is one of the most expensive undertakings in Silicon Valley. This means vendors will continue to pass costs on to customers, even as efficiency improves.

Effects of Market Competition

Competition is already driving variety in pricing. Vendors are experimenting with freemium, usage-based, and outcome-based models to capture market share. Over time, this competition may push prices down. But it’s just as likely to create more complexity, with buyers managing multiple pricing structures across tools.

Influence of Global Economic Factors

Macroeconomic pressures such as inflation, interest rates, and global tech investment will directly affect how quickly organizations adopt AI. In tighter markets, companies may be more cautious about experimenting with AI tools that lack clear ROI.

AI Pricing and Compliance Pressure

Regulatory changes are expected to increase costs. From privacy requirements like GDPR to emerging AI-specific governance frameworks, compliance will require new investments in auditability, explainability, and risk management. These costs will be baked into AI pricing, raising the total cost of ownership for buyers.

Zylo Helps You Understand the True Cost of AI

AI costs are difficult to manage without visibility. Zylo makes it simple. With Zylo’s Discovery and Inventory solution, you can see every SaaS and AI tool in use, track adoption, uncover hidden spend, and ensure investments align with business priorities.

Contact Zylo for a demo and take control of your AI spending.

This article is brought to you by Zylo – the enterprise leader in SaaS Management. Companies such as AbbVie, Adobe, Atlassian, Intuit, Salesforce, and Yahoo leverage Zylo’s AI-powered platform and unparalleled professional services to fuel centralized SaaS inventory, license optimization, and renewal management.