Table of Contents

Purchasing new software can be a tedious and drawn out process. First, you have to identify your requirements and list of tools you want to evaluate. Then, you weigh the pros and cons of each option. And, last, you need to get your CFO to say “yes.” To secure a budget for a SaaS Management Platform (SMP), it’s a similar process.

But how do you prove to your CFO that you need it and secure the necessary budget? It comes down to making a compelling business case that highlights the value and impact to your organization.

An SMP isn’t a standard line item in most budgets – yet. If you have your sights on an SMP for 2025, you need to carve out a budget now. Here’s how to do it and secure a budget for one.

Watch the short video for a quick rundown or read on for step-by-step guidance.

Get Inside Your CFO’s Mind

Before we jump into building your business case, let’s get inside the head of your CFO. What are they thinking about on a daily basis? Learning what’s important to your CFO is step one of crafting a compelling business case.

Being a financially-minded individual, your CFO’s love language – if you will – is facts and figures. But they’re also a strategic leader who impacts all areas of the business.

There are five key challenges they’re looking to solve:

- Visibility and predictability. One of the foundational elements of effective SaaS Management – from a CFO perspective – is visibility into software spending. Naturally, your CFO is concerned with cash flow and staying on track with software budgets. Understanding what spending looks like over time is essential to doing this. Because SaaS purchasing is distributed across the business, centralizing spending and renewal data with an SMP gives your CFO the upper hand on predicting software costs.

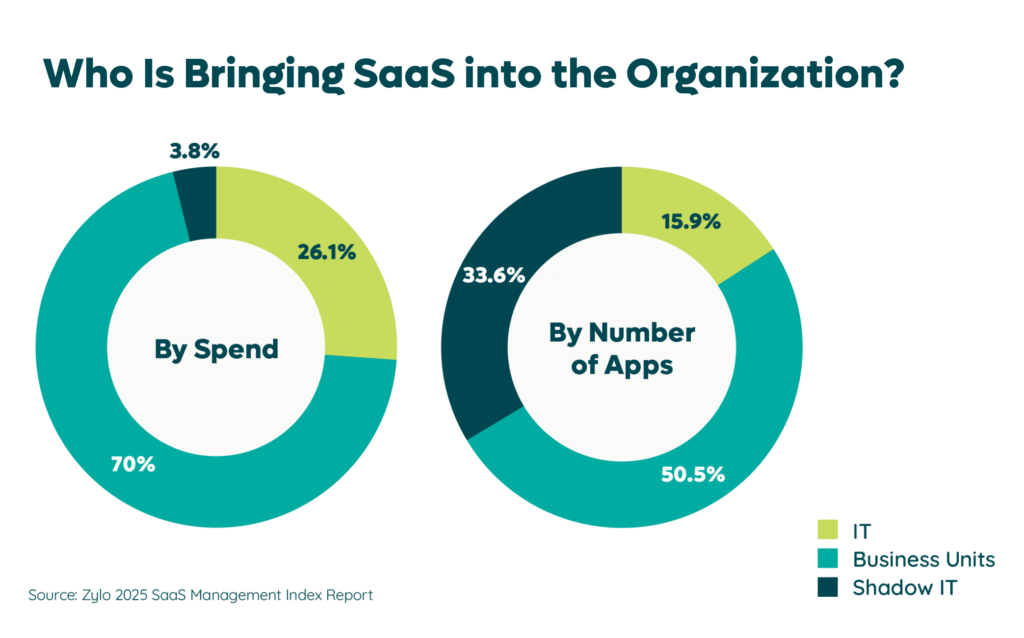

- Accuracy and control. With business units and employees being responsible for 72% of software spending, CFOs have less control over what’s being purchased. CFOs are growing increasingly concerned by purchases made outside of established corporate procurement processes. That’s because there’s significant waste within the business in the form of unused licenses and duplicate or redundant tools. In addition, more software providers are taking a “land and expand” sales approach that leads to unnecessary spending and overspending.

- Value and efficiency. Beyond keeping software costs contained, your CFO also wants to make sure the company is receiving the intended value from each tool. A component of that is ensuring software is purchased efficiently – from pinpointing redundancy and duplicate contracts to evaluating the purchasing channels.

- Scalability. In addition to the current state of spending, your CFO also regularly evaluates how the business’s tools and process will scale as it grows in the future. Will they help or impede growth? As a company grows, so does its SaaS inventory. A SaaS Management Platform will help the CFO understand if you have the right tools and infrastructure in place – and if not, where there are opportunities to make changes.

- Optimization. Your CFO cares deeply about the bottom line. With software often the second or third largest operating expense for an organization, optimizing costs is top of mind. A SaaS Management Platform offers quick time to value, where swift financial wins can be achieved to help improve runway. Likewise, your CFO will also be concerned with the long-term financial picture (see scalability above), and an SMP can help drive cumulative savings over time.

Steps to Secure Budget from Your CFO

Once you understand what’s important to your CFO, you can begin to build your business case. Your business case should depict big-picture benefits with specific examples and data.

To obtain buy-in, present a strong business case that explains:

- The business value of SaaS Management

- Why it’s time to change the status quo

- What to expect in terms of outcomes and time to value

“It is important to educate the CFO on the magnitude of the problem and be very specific on the size of the opportunity. I think that will go a long way in getting the CFO’s approval and support.”

— Jason Leet, CFO at Zylo

Step #1: Start with Desired Business Outcomes

A CFO has to think big picture and lay out strategic priorities for the business. Your business case must illustrate how an SMP supports and drives those outcomes.

Some common strategic goals supported by SaaS Management include:

- Maximizing the value of your software investments (in other words, ensure you’re actually using what you pay for)

- Reducing costs / increasing revenue

- Strengthening security posture

- Achieving operational excellence and efficiency

- Improving employee experience

- Driving innovation

For instance, if you’re hoping to increase revenue, you can share how SaaS Management helps you reduce operating expenses (OpEx). Watch the short video below for more on the business value of SaaS Management.

Our customer, Gibson Schnurr at Juni, said it perfectly on a recent podcast episode. “The cost of customer acquisition can be quite high versus the cost of optimizing your tech stack. I think [SaaS Management is] where you can really impact your bottom line.”

Step #2: Understand Your SaaS Portfolio’s Current State

To secure a budget for an SMP, you need to highlight the current state of your SaaS stack and highlight the problems to your CFO. For example, use the following data points to start:

- Total applications in your inventory

- Total cost of software

- Purchasing source (expense vs accounts payable)

Compile all the data that you can – even if you know you may not be capturing all of it. That lack of visibility can be another point of emphasis in your case.

Compare what data you do have to benchmarks to highlight the gaps to your CFO. Some notable stats to emphasize are:

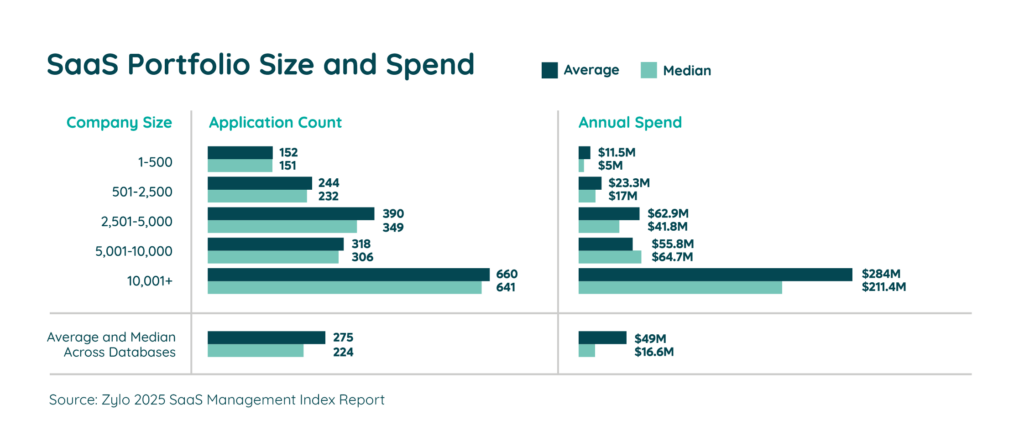

The average company has 275 applications and spends $49M on SaaS annually. You can see how that pans out for different size organizations in the visual below. Per employee, that cost averages $4,830 each year.

The individual employee is typically responsible for 3.8% of an organization’s SaaS by spend; however, that equates to 33.6% of applications. There’s a big gap between what you know versus what you don’t.

Step #3: Explain the Scale of the Problem

Use the data you’ve gathered – and the data you couldn’t gather – to highlight the risks of ignoring the havoc SaaS is wreaking on your business. If it’s a problem now, it’s only going to get worse.

The strategic planning assumptions in the 2024 Gartner® Magic Quadrant™ for SaaS Management Platforms explains the scale of the problem.

- Through 2027, organizations that fail to centrally manage SaaS life cycles will remain five times more susceptible to a cyber incident or data loss due to incomplete visibility into SaaS usage and configuration.

- Through 2027, organizations that fail to attain centralized visibility and coordinate SaaS life cycles will overspend on SaaS by at least 25% due to unused entitlements and unnecessary, overlapping tools.

- Through 2027, over 50% of organizations will centralize SaaS application management using an SMP, an increase from less than 10% in 2024.

2024 Gartner® Magic Quadrant™ for SaaS Management Platforms

Learn MoreStep #4: Compare Current vs Future State

The next step to help you secure a budget for a SaaS Management Platform is to showcase current vs future state. What are the potential benefits of an SMP? What are the risks of not using one? Your business case should be explicit in what outcomes you can expect and the risks of maintaining the status quo.

How You’re Managing SaaS Today vs. Tomorrow

For most organizations today, current state means using a spreadsheet or legacy software asset management (SAM) tool to manage SaaS. Explain what solution you have in place today and why it doesn’t work.

Here’s what’s at risk if you stick with spreadsheets and/or legacy SAM tools:

Spreadsheets

There are several drawbacks of using spreadsheets to manage SaaS. As soon as you input data, they immediately become outdated. Instead of continuous, comprehensive insights, you get a static, incomplete snapshot of your SaaS inventory. They’re also not scalable. As SaaS apps grow within your organization, so too does your data. It becomes unwieldy and labor intensive to manage. In addition, there are often multiple spreadsheets in use across the business, creating data silos that hinder collaboration and effective decision-making.

“The challenge is, inevitably, the moment you create those spreadsheets, they become outdated.”

— Karen Hodson, Global Procurement and Real Estate Officer at Marigold

Software Asset Management Tool

While traditional SAM tools have expanded to include SaaS Management features, their core capabilities remain rooted in on-premises software. There are many reasons why they just don’t work for SaaS. Here’s the short list:

- While beneficial for managing license compliance, they lack the necessary capabilities for effective SaaS discovery and spend management due to limited integrations with financial systems.

- They often require assistance from internal technical resources or service implementation partners to configure and run, taking significant time to achieve value.

- Usage data from SAM tools may not be sufficient for the nuanced needs of managing SaaS applications.

But there is one caveat. While SAM tools aren’t suited for managing SaaS, they should be part of a holistic software management practice for hybrid environments.

If you’ve already spent time and/or money on current solutions for SaaS Management, your CFO might be loath to give you even more budget for something new. You need to outline the current system and highlight exactly why it isn’t working.

Acceleration of Strategic Goals

In step one, we discussed how a SaaS Management Platform can support your strategic business objectives. Current state often looks like limited visibility into apps and spending, redundant software, unmanaged security risks, and more. Below are examples of future states you can achieve with an SMP supported by the right people and processes.

- Gain awareness of applications with security risks and put controls in place to protect the business.

- Establish clear ownership of applications to maintain accountability and proper management of each tool.

- Make informed rationalization, license reclamation, and rightsizing decisions to reduce waste and save money.

- Forecast and plan budgets more accurately and improve financial management with insight into spending trends.

- Detect employee-expensed apps (shadow IT) to control unauthorized usage and spending.

- Immediately see new SaaS applications entering the business to ensure compliance and avoid risk.

- Improve the employee experience by making it easier for employees to find and use the tools they need.

- Purchase, cancel, and renew SaaS – at massive scale – with insight gained from having up-to-date user, portfolio, and benchmark data.

Step #5: Share the Expected Return and Time to Value

Quantify the value that a SaaS Management Platform can help your organization achieve. Then, build a timeline for when that value will be realized.

Help your CFO understand what you expect the payback period to be and the long-term benefits. The larger your organization and the larger your SaaS portfolio – the larger your potential software savings and ROI.

Let’s consider the license waste rampant at all organizations today. Our data shows that companies waste 51% of their SaaS licenses on average, which equates to $18M a year. That is a considerable opportunity to save money, drive efficiency, and maximize software value.

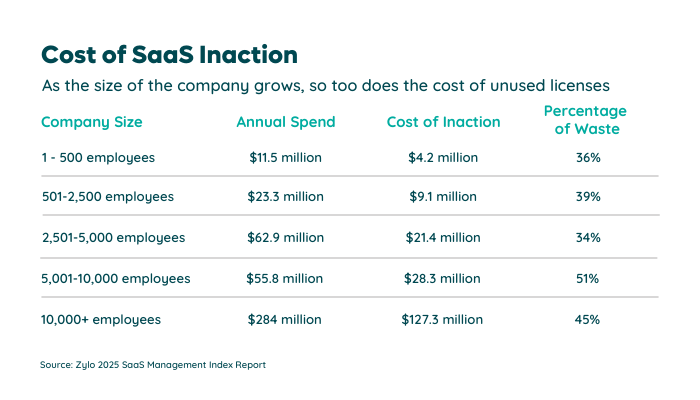

Here’s the size of the opportunity to reduce license waste by company size:

- 1 – 500 employees: $4.2M

- 501 – 2,500 employees: $9.1M

- 2,501 – 5,000 employees: $21.4M

- 5,001 – 10,000 employees: $28.3M

- 10,001+ employees: $127.3M

With an SMP, you can achieve savings and value in weeks or months, as opposed to quarters. At Zylo, we’ve seen organizations save millions in just months. Here are a few examples:

- Versapay identified that they were overspending on their SaaS by 30% and reduced software spend by 16% in the first 12 months.

- Within 6 months of a 2 year project, FIS was already over 80% of its savings target.

- REA Group identified more than $550,000 in potential savings across their top software applications.

Likewise, your organization stands to drive long-term results. Take these companies, for instance:

- Adobe unlocked $60M in cost savings and avoidance since starting its SaaS Management program in 2019.

- ModMed has reclaimed thousands of unused licenses and driven $3M+ in cost savings and avoidance over two years.

- AbbVie reduced expense spend by 47% over a two-year period.

See how other companies are using Zylo’s SaaS Management Platform to achieve their business objectives.

Secure Budget for a SaaS Management Platform with a Better Business Case

SaaS Management is a team sport. Position a management platform as an opportunity for Finance, and highlight the benefits your CFO would enable by approving a budget.

As with any initiative, you get out what you put in. SaaS Management is most successful when you have the right tools, people, and processes in place.

Take it from Russell Lester, a four-time CFO who implemented a SaaS Management Platform at his last three organizations. “[SaaS Management is] an opportunity for the finance team to be the hero to identify where there’s leakage or wastage in the system.”

By illustrating the business value of SaaS Management, why it’s time to change the status quo, and what outcomes and value to expect, you can build a strong business case for an SMP. Get that “yes” from your CFO to secure a budget for it, and you’ll be on your way to saving money, increasing efficiency, and reducing risk for your business.

See why other organizations use a SaaS Management Platform like Zylo to drive business results. Schedule a demo with our SaaS experts today.

— Karen Hodson, Global Procurement and Real Estate Officer at Marigold

— Karen Hodson, Global Procurement and Real Estate Officer at Marigold