Table of Contents

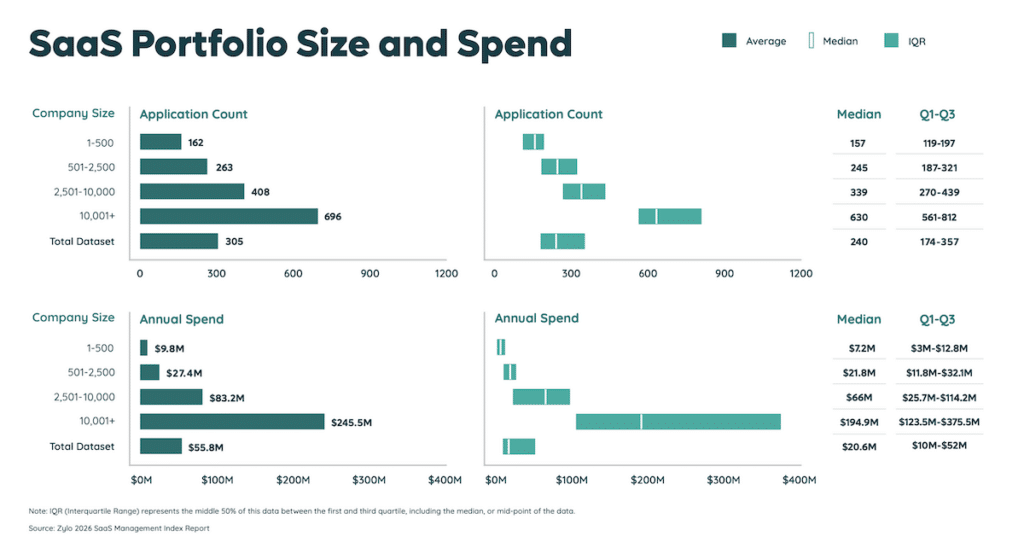

Software is often your second-largest operating expense, with the average enterprise spending $284M annually. So it’s no surprise that software investments carry a heavy financial burden for businesses. From an economic perspective, IT bears most of those costs, while the business drives the consumption of those licenses.

When IT absorbs the cost of applications used by multiple departments, they struggle to:

- Recoup costs they are incurring on behalf of the business.

- Identify opportunities to divest and give ownership to a department.

- Influence business users and leaders to care about the cost of inactive users or competing solutions.

That’s why demonstrating cost allocation via showbacks or chargebacks is essential.

Why Is Cost Allocation for SaaS Important?

Cost allocation involves identifying, aggregating, and assigning the expenses associated with IT and software resources to various departments, projects, or cost centers. This practice ensures that the costs are distributed fairly and transparently based on actual usage or assignment of licenses. It reduces wasted spending, drives business unit accountability, increases visibility, and improves budgeting accuracy.

Importance for Key Stakeholders

Cost Allocation for Software Asset Management

Software asset managers can pinpoint inefficiencies and areas where licenses may be underutilized. Gaining valuable insights into departmental software usage allows organizations to identify potential cost savings, areas for license optimization, and waste reduction. This not only helps in reducing unnecessary expenses but also supports better decision-making regarding software investments and renewals.

Cost Allocation for IT

The IT department needs transparency in software spending across departments to plan more effectively and allocate resources where they are needed most. More complete data aids them in budget planning and resource allocation. Clear visibility into how different departments utilize software resources drives accountability among department heads for license waste, ensuring that each department is responsible for its software consumption. Furthermore, IT can recoup its costs by charging departments for software usage and aligning expenses with users.

Cost Allocation for Departmental and Line of Business Leaders

Departmental leaders need to understand the financial impact of software usage. Once they know the software costs associated with their department, they are more likely to promote efficient and mindful license usage within their teams. This awareness can also free up the budget for evaluating other solutions, as departments may identify redundant or underutilized software that can be eliminated or replaced.

Cost Allocation for Finance

Finance can improve cost visibility and control across the organization with detailed insights into software expenses. The finance team can then better manage budgets and forecast future expenditures. This enhanced visibility also supports more accurate financial reporting and helps identify cost savings and optimization opportunities, leading to a more financially sound organization.

The Challenges of Not Allocating Costs

If you’re not allocating software costs, you may experience one or more of the following challenges.

Scrutiny over Software Spending

IT leaders often face scrutiny for their spending on behalf of other departments. That’s because IT is often viewed as a cost center rather than a revenue center in most organizations. Without a clear understanding of how IT expenses contribute to overall business operations, it can be challenging to justify the costs and demonstrate the value IT brings to the organization.

Lack of Accountability across the Business

Business units consume IT-owned SaaS licenses without understanding their contribution to IT’s overall costs. Often, this is due to a lack of cost transparency and business stakeholder accountability, which can result in inefficient resource usage and budget overruns. When departments are unaware of the financial impact of their software usage, they may be less motivated to use resources efficiently, leading to unnecessary expenses and budget overruns.

Combative Discussions with Stakeholders

Without clear, accurate, and factual data, conversations around SaaS spend and waste can quickly become combative or devolve

Inaccurate Budgeting

Budgeting for software is challenging, especially concerning headcount growth or reductions. As organizations grow or shrink, their software needs can change significantly. Without a robust cost allocation system, it becomes difficult to accurately forecast software expenses and adjust budgets accordingly, leading to potential overspending or resource shortages.

IT Chargeback vs Showback: What’s the Difference?

Showback

- It helps the business understand what costs are being spent on what resource and by which team. Showbacks provide a detailed breakdown of expenses, enabling departments to see their software usage and associated costs. This transparency fosters awareness and encourages responsible resource consumption.

- It’s typically informational only, focusing on driving awareness. Unlike chargebacks, showbacks do not involve actual billing. They serve as a tool to highlight costs and usage patterns, promoting accountability and informed decision-making without enforcing financial consequences.

Chargeback

- Each cost center is billed for the use of technology for a specific period. Chargebacks allocate IT services costs to the departments that use them, creating a direct financial link between usage and expenses.

- Unlike a showback, payment is required. Departments are charged for software usage, typically through internal accounting adjustments rather than cash transactions, ensuring that costs are appropriately distributed and recovered.

What’s the Business Value of an IT Chargeback vs Showback?

Chargeback

- Recover IT costs. By billing departments for software usage, IT can recuperate expenses and allocate funds more efficiently by billing departments for software usage.

- Improve budget planning and accuracy for IT and cost centers. Chargebacks provide a clear picture of software costs, aiding in precise budget forecasting and financial planning.

- Drive accountability of software spending across the business. Departments become more mindful of their software usage when they are directly responsible for the costs.

- Make it easier to enforce since payment is required from cost centers. The financial obligation ensures departments take ownership of their software consumption and associated expenses.

- Change consumption behavior so that users consider the cost when requesting a license. Knowing that their department will be billed, users are more likely to request licenses only when necessary, reducing waste.

Showback

- Demonstrate the business value of IT. They communicate the value of technology spending across the enterprise. Showbacks illustrate how IT investments support business operations, highlighting their importance and justifying expenses.

- Change consumption behavior by making users consider the cost when requesting a license. Even without direct financial consequences, awareness of costs can lead to more prudent software usage.

4 Need-to-Know SaaS Stats for IT Leaders

Learn MoreWhat Are the Drawbacks of an IT Chargeback vs Showback?

Chargeback

- Run the risk of friction between IT and business units. The financial burden of chargebacks can cause tension, as departments may resist or dispute charges.

- Require new processes to be built into accounting systems. Implementing a chargeback system involves significant changes to existing financial processes.

- Change management across the organization. Adopting chargebacks necessitates a cultural shift and ongoing effort to ensure compliance and acceptance.

Showback

- Driving accountability to costs is more difficult. Without direct financial consequences, departments may feel less compelled to manage their software usage efficiently.

- IT is unable to recoup software costs. Showbacks highlight expenses but don’t provide a mechanism for IT to recover the costs, potentially leaving IT budgets strained.

Power Your IT Showbacks and Chargebacks with a SaaS Management Platform

Effective cost allocation requires comprehensive visibility into various data sources, including payment, contract, usage, and HR information. This data often resides in disparate systems, making achieving accurate showbacks and chargebacks challenging. A SaaS Management Platform centralizes all necessary data, ensuring precise and insightful cost allocation. Optimize your IT financial management with a unified approach to showbacks and chargebacks.

Discover how Zylo’s SaaS Visibility & Inventory Management solution can streamline your cost allocation processes and drive business efficiency.