Table of Contents

The global pandemic forever changed the way we define the workplace. No doubt, today’s new workplace looks radically different from just five years ago.

When the world pivoted to remote work in a matter of days, cloud-based software became a crucial lifeline to keep employees connected to the digital “office” so they could continue to do their jobs.

Now two years later, organizations are adapting to (and in many cases embracing) this new digital workplace. As a result of the hybrid pivot, not to mention the ongoing “Great Reshuffle,” we’ve seen new workplace trends emerge, causing several SaaS tools to experience record-breaking growth.

Trends Impacting the New Workplace and Beyond

From CIOs leading the digital revolution to giving employees freedom to choose their preferred SaaS, consider these new workplace trends impacting the technology space.

Fairness and Equity Will Play a Defining Role

Fairness and Equity Will Play a Defining Role

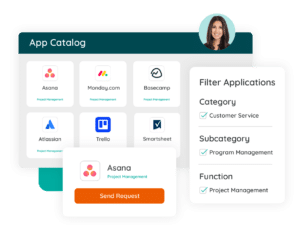

When it comes to technology, CIOs must take a leading role and focus on ensuring all employees — regardless of location — enjoy equal access to opportunity, information, resources, and especially technology. Curating a pre-vetted application catalog can make this easier by enabling employees to see all available tools and choose their preferred SaaS, not to mention streamline the onboarding process.

Employee Turnover Will Continue as Hybrid and Remote Work Become Commonplace

Technology plays a key role in retaining your employees. In fact, a recent study found 9 out of 10 employees said they’d take a pay cut to be able to use their preferred tech, while 7 out of 10 said they would be more likely to join a company if they were able to choose their own technology.

Automation Will Enable Managers to Build More Meaningful Relationships with Employees

Speaking of employee retention, as SaaS automation increasingly replaces mundane managerial tasks, leaders will be able to spend more time building deeper relationships with their teams.

According to Harvard Business Review, up to 65% of managerial tasks, such as approving expense reports or creating schedules, can potentially be automated with technology by 2025. “This goes beyond managing employees’ specific responsibilities and extends to managing their perception of their career trajectories, the impact of work on their personal lives, and their relationship with the organization as a whole.”

Technology Will Solve the Complexities of a Hybrid Workforce

Organizations will face increasing complexities caused by a hybrid or fully remote workforce. Technology can alleviate many problems by enhancing communication and keeping employees productive and engaged with their work and the organization.

Top SaaS Supporting the New Workplace

It’s now more clear than ever that organizations depend on SaaS to get the job done, and they use a wide range of cloud software.

Armed with two years of post-pandemic Zylo customer data, we conducted an analysis to determine the most popular apps during the first year of the pandemic (when we were all figuring things out) as well as in year two (March 2021 to February 2022) to identify maintained growth as organizations move to digital maturity.

Collaboration and Productivity Tools

The sudden pivot to remote work caused by the pandemic made us rethink collaboration, notably how employees communicate, swap and manage files, and remain productive while working from home. Not surprisingly, these tools grew dramatically, with Google Voice charting nearly 900% growth in year one, and Frame.io experiencing 180% growth in year one and increasing to 379% in year two.

Applications in the Collaboration and Productivity category include file storage and sharing, individual productivity, team collaboration, voice over internet protocol (VoIP), and web conferencing tools.

Most growth in year one: Google Voice (VoIP), Egnyte (file storing/sharing), Signiant (file storing/sharing), Libsyn (podcasting), and Doximity (networking).

Maintained growth into year two: Frame.io (video collaboration) , Miro (collaboration), Retrium (file storing/sharing), and Poppulo (employee engagement).

Largest investments by Zylo customers: Microsoft 365 (collaboration), Google Workspaces (collaboration), Slack (communication/collaboration), Zoom (video conferencing), Box (file storing/sharing).

HR Tools

With dispersed teams working around the globe, the need for cloud-based HR and talent management software became undeniably evident. For instance, Dayforce grew by more than 3,700% in year one, while SeekOut experienced 398% growth in year one and increased to 458% in year two. And with the “Great Reshuffle” showing no sign of slowing, we fully expect this SaaS category to experience continued growth.

The HR category includes applications for HR operations, talent management, recruiting, training, and e-learning.

Most growth in year one: Dayforce (HR operations), A Cloud Guru (training/e-learning), Qualified.io (talent management), MasterClass (training/e-learning), DataCamp (training/e-learning).

Maintained growth into year two: SeekOut (talent management), Absorb Anywhere LMS (training/e-learning), Jopwell (talent management), Bridge (training/e-learning), Articulate 360 (training/e-learning).

Largest investments by Zylo customers: Workday (HR operations), Dayforce (HR operations), LinkedIn Talent (recruitment), Workhuman (talent management), and BetterUp (talent development).

IT Infrastructure Tools

With global end-user spending on cloud software forecasted to total $563.8B in 2023, and reach nearly $680B in 2024, SaaS will soon become the most dominant form of software. And more SaaS requires new tools to manage security and compliance, not to mention support increasingly cloud-first infrastructures.

Top category leaders include Chrome Management Console, which grew by more than 2,500% in year one, and Okta, which grew 286% in year one and an additional 291% in year two.

Tools in the IT Infrastructure category cover performance management, backup and recovery, business process management, data integration, data quality, data security and controls, database/data warehouse, identity management, infrastructure, IT operations, IT security, monitoring, and network management.

Most growth in year one: Chrome Management Console (application management), Komprise (data integration), InfoBlox (data security and controls), F5 Networks (IT security), Grafana (database management).

Maintained growth into year two: Okta Adaptive Multi-Factor Authentication (data security and controls), Megaport (network management), UiPath Desktop (business process management), Subsentio (IT security), and Chronicle Security (IT security).

Largest investments by Zylo customers: Cisco (information technology and infrastructure), Datadog (database/data warehouse), ServiceNow (business process management), Splunk (database/data warehouse), Snowflake (database/data warehouse), and Okta (data security and controls).

Office Tools

Several SaaS companies in the Office category experienced significant growth as a result of the pandemic, and for good reason. These are the tools that enable individual contributors to work efficiently from anywhere, from designers to accountants to content creators. Tools that experienced record growth include Okta Lifecycle Management, which grew by more than 2,900% in year one, and Canva, which grew by 178% in year one and rose to 292% in year two.

The Office category includes apps for accounting and finance, authoring and publishing, calendar and appointment scheduling, contract management, design, email, identity verification, presentations, screen and video capture, surveys and forms, and video.

Most growth in year one: Okta Lifecycle Management (contract lifecycle management), HighRadius (accounting/finance), LawLogix (accounting/finance), Sphera (accounting/finance), logikcull (authoring/publishing).

Maintained growth into year two: Canva (design), Ironclad (contract management), GIACT (accounting/finance), Reduct.Video (video), Vertex (accounting/finance), Filmsupply (design).

Largest investments by Zylo customers: Netsuite ERP (accounting/finance), SAP ERP (accounting/finance), Vertex (accounting/finance), Trulioo (identity verification), and Qualtrics (experience management).

Large organizations spend millions on employee-led purchases of SaaS, with many tools flying under the radar of IT and Procurement. Want to better understand employees’ expense spending habits? Check out the top most expensed SaaS applications last year.

Fairness and Equity Will Play a Defining Role

Fairness and Equity Will Play a Defining Role