Table of Contents

Updated February 6, 2026 with new data.

The primary goal of FinOps leaders is to keep cloud infrastructure costs both lean and predictable. Unit economics is clear, workloads adjust on demand, and usage maps directly to spending. This model is quite efficient until SaaS is involved.

Treating SaaS the same way you handle AWS or Azure will cost you down the line. SaaS does not scale down automatically. It hides in expense reports and subscriptions automatically renew, whether they’re being used or not.

Consider this:

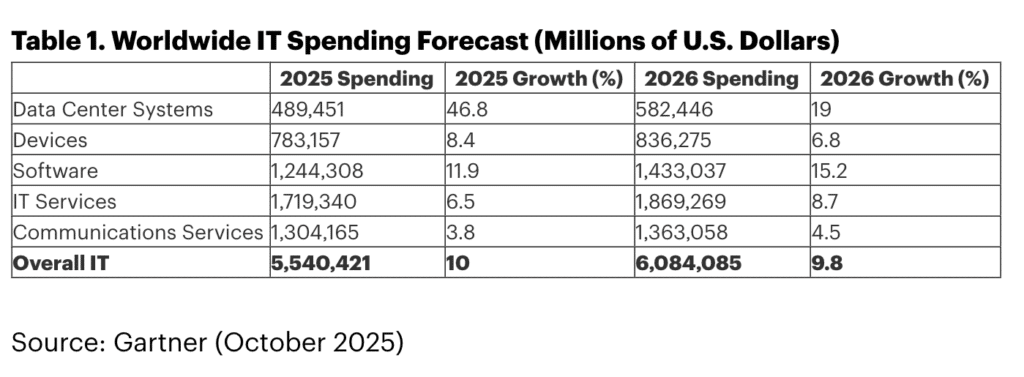

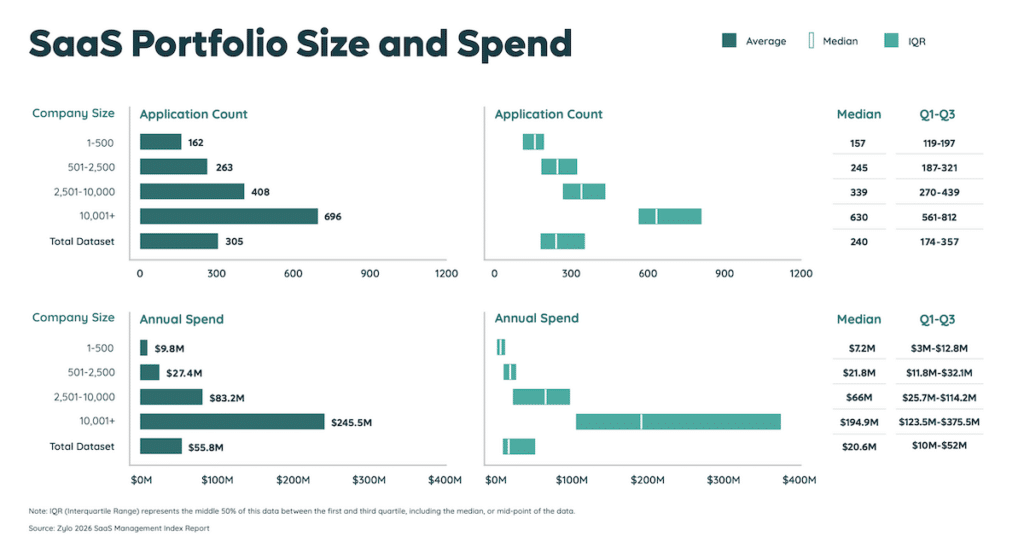

- $1.4T. That’s the forecasted global software spend for 2026—more than either PaaS or IaaS, according to Gartner. Per company, that averages $55M in annual SaaS spend.

- Expensed software might seem minor in cost, but it accounts for nearly half the apps in use, adding chaos and risk.

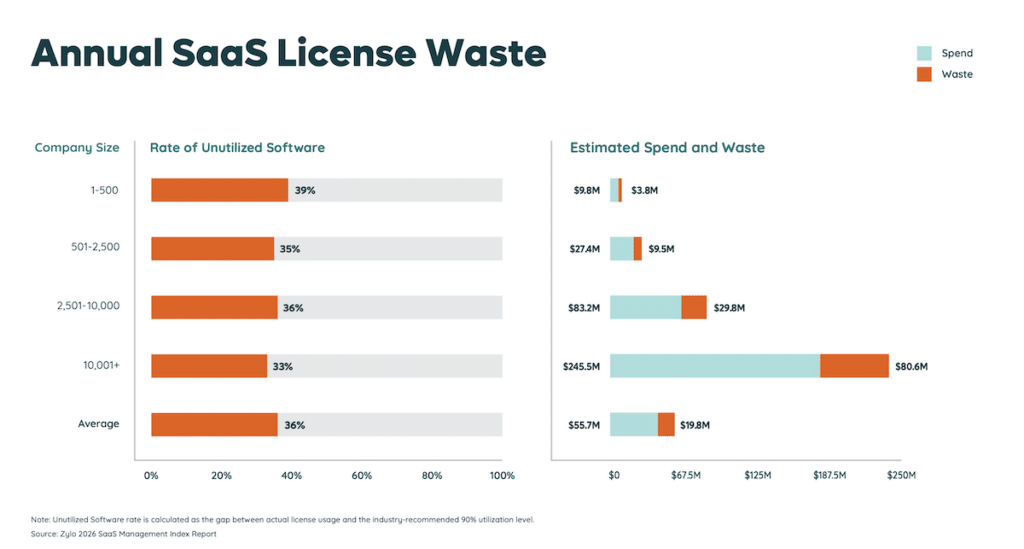

- Organizations waste an average of $19.8M a year paying for unused licenses.

Cloud FinOps helps keep computing efficient, but SaaS FinOps takes on different challenges, such as decentralized purchasing, inflexible contracts, and hidden waste.

Smart teams don’t fight this with more manual work. Instead, they take steps to modernize how they manage SaaS. For example, they might:

- Maintain a current app inventory

- Tie license spend to real user activity

- Monitor and plan for renewals

- Use a dedicated SaaS Management Platform to handle scale

Controlling SaaS costs calls for more than usage monitoring, though. Spending is fragmented across departments. Pricing models vary from seats to envelopes to usage-based AI features. Renewal dates are scattered. And the “unit economics” that work well for cloud systems don’t usually apply cleanly to SaaS.

When FinOps teams treat SaaS as an extension of cloud, they expose the company to:

- Inaccurate forecasting

- Fragmented spending reports

- Little leverage with vendors

This puts both cost predictability and accountability at risk. To combat this, effective FinOps teams are starting to manage SaaS on their own terms. They aim to build visibility, align usage to contracts, and enforce governance to cut down on waste.

How FinOps Teams Commonly Understand SaaS—and What’s Missing

FinOps professionals know how to control cloud costs. Infrastructure spending follows a predictable pattern of workloads in, spending out. Resources can be tagged, scaled, and shut down without delay when demand drops.

Many assume SaaS works the same way. After all, vendors like Snowflake or Datadog price according to consumption, so FinOps teams expect usage to match cost. But SaaS breaks this rule in ways that catch even the most disciplined teams off guard.

“FinOps leaders are used to thinking in terms of unit economics and usage-based models, but SaaS licensing brings in all kinds of other factors: seat-based, consumption-based, and hybrid models. There are a lot of metrics that don’t really exist in the traditional FinOps world.”

— Russ Eicholtz, Enterprise Program Manager at Zylo

SaaS Licensing Is Multi-Layered

Unlike cloud systems, SaaS combines fixed and variable pricing. This blending can make costs sticky, meaning that you pay for seats even if no one logs in.

Let’s look at how SaaS works in practice:

- Seat-Based Pricing: A company pays for every employee with an account, whether they log in daily or not. Tools like Slack, Zoom, or Salesforce typically use this model. If 200 seats are licensed but only 150 people actively use them, buyers still pay for all 200.

- Consumption-Based Pricing: Some SaaS apps imitate cloud systems by charging for usage, such as the number of API calls, data processed, or emails sent. But unlike cloud offerings, these plans often include minimum spend commitments.

- Outcome-Based Pricing: Newer SaaS offerings charge based on results. For example, some AI customer support bots bill per resolved ticket, or marketing automation tools charge per lead converted.

- Hybrid Pricing: Plenty of enterprise-grade SaaS tools combine a flat user license with a consumption component. CRMs may charge a base fee per sales rep, plus extra fees for each marketing email blast or contact enrichment request.

Without tight monitoring of real user activity, companies routinely pay for more than they use, as well as renewing those costs each year.

Shadow IT Purchases Compound the Problem

Unlike cloud technology, SaaS is easy for any employee or department head to adopt. It just takes a credit card and a few clicks.

Need a design tool? Someone buys Canva. Need a note-taking app? Someone subscribes to Evernote.

This is classic shadow IT in practice.

This behavior tends to lead to hidden apps nobody is tracking, duplicate tools performing the same tasks, and renewals that slip through the cracks. Over time, spending this way overwhelms spreadsheets and bloats budgets.

Vendor Sprawl Multiplies Blind Spots

A common cloud environment is composed of several strategic vendors. In SaaS, business leaders juggle hundreds of applications (nearly 700 on average at larger companies). Each app also has different license terms and billing structures.

Businesses add new apps constantly (about 8/month on average) from enterprise collaboration suites to more niche productivity tools and plugins.

License counts fluctuate, and ownership pivots as teams undergo changes. Without live visibility, it’s incredibly difficult to keep spending aligned with actual usage.

Tom Battle, a Zylo FinOps expert, describes the daily reality:

“When you’re a FinOps person, you’re used to working with three or four vendors that all fit into defined buckets. Then SaaS shows up, and suddenly you’re dealing with 500 vendors, each with their own way of classifying spend and licensing.”

The Cost of Treating SaaS Like Cloud

Applying the cloud cost control playbook to SaaS almost guarantees:

- Incomplete spend data

- Budget overruns you spot after renewal

- Little leverage to renegotiate terms

- Missed opportunities to reclaim unused licenses

In a cloud system, you can right-size an EC2 instance or kill idle storage instantly. In SaaS, if a department renews 100 seats but only needs 60, that budget overflow locks in for another year.

Modern FinOps teams know this is fixable, but only by managing SaaS as a separate expense category, not just another “cloud cost.”

SaaS vs. Cloud: A Practical Comparison for FinOps

Most FinOps teams have carefully-planned cloud cost controls dialed in. Workloads move up or down, usage drives spending, and billing is detailed and transparent. SaaS flips this logic, and the differences can blindside even experienced teams.

Here’s a side-by-side breakdown to make the contrast crystal clear.

Cost Drivers: Cloud vs. SaaS

Cloud Infrastructure

- Pricing models: pure usage based (compute hours), storage GBs, IOPs

- Elasticity: real-time scaling up/down

- Spend predictability: high if workloads are stable

- Common blind spots: orphaned resources, zombie instances

- Control levers: auto-scaling, tagging, automated resource optimization

SaaS Applications

- Pricing models: user-based licensing, consumption/usage, outcome-based, hybrid

- Elasticity: fixed term, limited elasticity, many costs locked until renewal

- Spend predictability: medium to low, as spend is scattered across departments or cost centers

- Common blind spots: unused licenses, duplicative spend/contracts, redundant apps, shadow IT, security and compliance risks

- Control levers: automated license reclamation, tech stack consolidation, enforcing purchasing policies

Forecasting: Cloud Predictability vs SaaS Surprises

Cloud cost forecasting is relatively straightforward. Simply match capacity to demand and make adjustments as time passes. SaaS forecasting is messier, on the other hand. Costs do not scale down just because usage drops. Seats and feature bundles lock users into their contract until the next renewal period.

Key risk points:

- Over-renewing: Teams renew more seats than they need, which pads budgets with unused licenses.

- True-ups: Under-contracting can backfire as well. If usage grows mid-term, vendors may hit you with surprise true-ups at a premium rate.

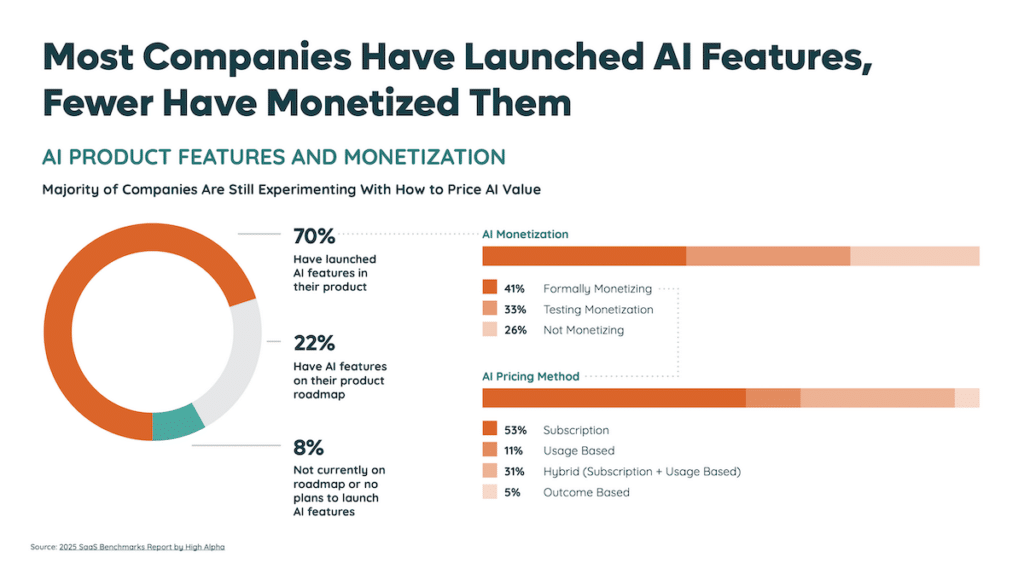

- Add-ons: Generative AI features, extra modules, or advanced analytics often bill separately and may grow unpredictably. High Alpha’s SaaS Benchmarks show that approximately 74% of companies monetize AI features.

Procurement and Renewals: More Moving Parts

Cloud contracts sit with a few central vendors, while SaaS contracts are more scattered, owned by department heads, renewed by managers, and often hidden in expense lines.

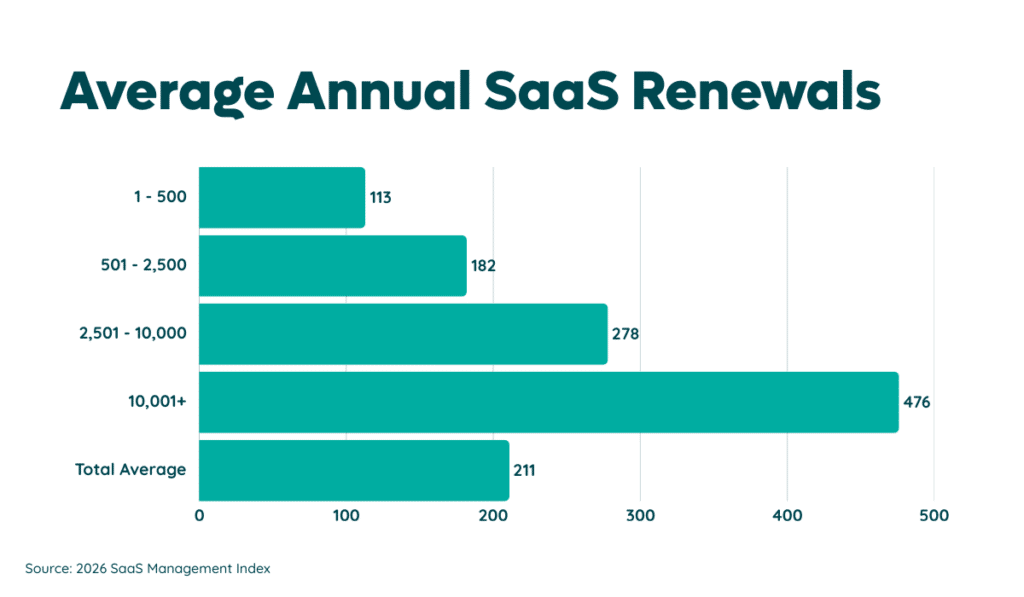

The average company manages 211 renewals per year, so keeping track means more than marking a date on a calendar. Each renewal calls for validating license counts against usage, checking for redundant tools, and aligning with stakeholders to consolidate issues.

When businesses miss this window, contracts auto-renew on the vendor’s terms, with more seats and higher rates than necessary.

Operational Accountability: Different Owners, Different Rules

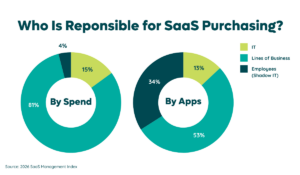

Cloud spending tends to funnel through IT and engineering, which helps enforce more consistent controls. SaaS spending is more complex, as marketing, sales, HR, and employees each buy what they need, when they need it.

Without a unified SaaS Management layer, governance breaks down, duplicate apps lead to redundant data, and license waste costs businesses in terms of departmental budgets.

Combining FinOps discipline with SaaS-specific management reclaims this control and aligns cost with the actual needs of users.

Why Traditional FinOps Alone Fails at SaaS

The FinOps Foundation now recognizes that SaaS spending is a key component of a company’s overall cloud financial management, which needs to be managed alongside infrastructure costs. Yet many teams still rely on infrastructure-focused tactics like monitoring usage and mapping costs.

As mentioned, SaaS costs are more sticky, as purchasing is decentralized, and usage data are fragmented. Without an upgraded playbook and the right tools, even mature FinOps teams struggle to keep SaaS spending predictable.

Here’s where the traditional approach falls short, and what needs to change.

1. Visibility Is Fragmented

Infrastructure visibility is straightforward in that everything flows through cloud billing dashboards and resource usage logs. For SaaS, spending and usage data are scattered across spreadsheets, vendor admin consoles, and mountains of possibly misclassified expense reports.

Speaking of which, 51% of SaaS purchases are misclassified or miscategorized in expense reports, according to Zylo data. This hides spending from forecasting models and delays license optimization until it’s too late.

Without well-maintained records of every app, cost center, owner, and license status, teams end up reconciling outdated lists. Meanwhile, unused licenses continue to auto-renew in the background.

2. Optimization Doesn’t Happen by Itself

In cloud systems, auto-scaling takes on much of the heavy lifting. With SaaS, license costs persist until you actively retire them. Inactive users don’t automatically lose seats. Duplicate apps continue to take up space as teams solve problems using parallel tools. And upsells inflate invoices when no one is tracking them.

Optimizing SaaS software means aligning license counts to real user-level activity, then enforcing it ahead of renewal dates. Without automation, this process is quite time-consuming, which is why it rarely happens in full.

Teams that automate license reclamation workflows see the biggest ROI, as they get rid of inactive seats, rightsize contract tiers, and reclaim wasted budget.

3. Governance Depends on Cross-Functional Alignment

Cloud governance is naturally centralized within IT and engineering teams. SaaS, on the other hand, is everyone’s problem, due to how purchasing power is distributed company wide.

Today, 85% of total SaaS spending sits with lines of business and employees, not the IT department. Marketing teams buy campaign tools. Sales teams license prospecting apps. HR spins up training platforms. Individual employees subscribe to niche productivity tools on P-cards.

Bring FinOps, Procurement, IT, Software Asset Management, and business units onto the same page—supported by a SaaS Management Platform. This ensures everyone works from shared, accurate data. The result is predictable spending, stronger negotiations, and fewer surprises.

How to Adapt: Practical Steps to Modern FinOps for SaaS

Knowing SaaS costs are different from cloud is one thing. Acting on it is what sets great FinOps teams apart. Modern teams combine the best parts of classic FinOps with SaaS-specific strategies and purpose-built tools.

Here’s how to upgrade your playbook.

1. Centralize SaaS Discovery

You can’t govern what you can’t see. Shadow purchases, expense-based buys, and fast team-level signups hide spending across different departments. Spreadsheets and manual surveys almost always fall behind.

When discovery is continuous, hidden spending surfaces right away. IT and Finance departments see what’s actually in use and can prioritize which apps to optimize or negotiate.

2. Connect User-Level Activity to Spend

Many teams don’t know their complete SaaS spending. And even when they do, it doesn’t provide the full picture. While spending data does show what you’re paying for, the real opportunity comes from knowing what’s being used: who logs in, how often, and whether licensing justifies its cost.

Connecting real user activity to each license is how teams spot inactive or underutilized licenses, rightsize contracts, and make accurate budgeting forecasts.

This user-level visibility ensures you don’t renew seats for people who never log in and helps negotiate usage-based contract terms with confidence.

3. Operationalize License Governance

Seeing waste is just one step, but recovering money is where real ROI happens. With SaaS, expired seats don’t automatically disappear, and vendors don’t call to remind clients about seating needs. Then, contract renewals come up according to the vendor’s schedule, not the client’s.

Automated governance means setting up workflows that:

- Reclaim inactive licenses on a routine basis

- Enforce approval steps for buying new tools

- Send renewal alerts well in advance

This turns license control from an annual spreadsheet chore into a daily safeguard against waste.

4. Proactively Manage Renewals

SaaS renewals can sneak up quickly, and the average organization may deal with hundreds of renewals a year. Without a structured process, teams tend to rely on just renewing with the same plan and locking in unnecessary costs. Worst still, those renewals are often automatic.

Proactive renewal management means:

- Tracking renewal dates in a shared calendar

- Getting usage and expense reports well before the renewal window

- Involving stakeholders early

- Using current data to push back on overages, upsells, or unnecessary increases

When done right, renewals stop being a last-minute fire drill and become a strategic way to save. Over time, this discipline alone can drive millions in savings.

5. Make SaaS Management a Core FinOps Function

Traditional FinOps handles cloud infrastructure quite well. Extending that effort to SaaS brings the same accountability and forecasting predictability to the entire cloud budget.

When SaaS Management becomes part of FinOps, teams work from shared, real-time data. They regularly catch license waste and fix it automatically, and procurement negotiates stronger deals based on collected evidence.

Together, FinOps and SaaS Management provide finance leaders the forecasting accuracy they need and empower IT and Procurement with a reliable data set. This means less guesswork, fewer surprises, and more budget reclaimed for strategic priorities.

Debunking Common SaaS Cost Myths

Even experienced FinOps teams fall for outdated assumptions about SaaS. These myths fuel hidden waste, inflated renewals, and surprises that erode budget control.

Here’s what to watch for, and the facts to replace guesswork with real governance.

Myth 1: “SaaS spend is just a small piece of Cloud costs.”

According to Gartner, global SaaS spending is predicted to reach $299B in 2025. Many teams assume infrastructure is the bulk of cloud costs, but SaaS portfolios now span hundreds of apps. Each has its own contract, seat licenses, and add-ons.

Myth 2: “Long-tail spend applications don’t add up to much.”

Alone, one $35k software subscription doesn’t put your budget at risk. The reality is that you have hundreds of long tail apps that add up to millions. A SaaS Management Platform like Zylo helps surface the full picture of your software spend so you can rationalize duplicative, redundant, and low-value apps.

Myth 3: “Unused licenses don’t waste that much money.”

They add up faster than you think. Organizations waste an average of $19.8M annually on unused SaaS licenses. A big driver? Teams renew more seats than they actually use or get hit with costly true-ups when usage spikes beyond contracted terms. Without license reclamation and usage checks, this waste compounds every year.

Myth 4: “Shadow IT isn’t a big deal anymore.”

Shadow IT is still a hidden drain on budgets and a threat to security. Expensed apps make up only 3.7% of total SaaS spend but represent 45% of all apps in use. This creates fragmented information that no spreadsheet can track completely.

Employees now adopt AI chatbots, code generators, or plugins without IT oversight, which also drives up unapproved spending and data privacy risk.

Myth 5: “Renewals are simple. Procurement handles it.”

Most Procurement teams are stretched thin and juggling hundreds of contracts, often scattered across departments. Many renew automatically by default, which effectively locks in outdated pricing and surplus seats. Without usage data and a shared calendar, negotiation capabilities are lost before they’ve even developed.

Myth 6: “We can manage SaaS with spreadsheets.”

Spreadsheets can’t keep pace, and manual trackers fall behind as employees add new tools, seats shift, and costs spike. A SaaS Management Platform closes this gap with real-time discovery, automated tracking, and workflows designed to stop waste before it starts.

Bring FinOps Discipline to SaaS

Your FinOps team has an established framework for controlling cloud spending. Now it’s time to bring that same rigor to SaaS.

SaaS spending is growing faster than any other cloud category. It hides in expense reports, renews itself, and locks in costs whether tools get used or not.

Top-performing organizations fix this by blending proven FinOps processes with dedicated SaaS Management. They get a complete picture of every app, tie spending to actual user activity, and automate workflows to keep waste in check all year.

This means predictable budgets, stronger negotiations, and no more last-minute license fire drills.

Don’t wait for another budget cycle to find out you’ve overspent on SaaS by millions. Learn the fundamentals of SaaS Management by downloading The Definitive Guide to SaaS Management.

Book a personalized demo to see how top-performing organizations use Zylo to reclaim wasted spend and lock down renewals before they become problems.