From Chaos to Control: Applying FinOps Thinking to SaaS

Table of Contents ToggleWhat are the most important elements to review...

Back

Back

Search for Keywords...

Blog

Table of Contents

We asked Rich Reyes of Connor Consulting, a leading provider of strategic IT consulting and compliance services for businesses, to weigh in on what elements are most valuable when reviewing your SaaS contracts and other agreements. Learn how this information can help businesses and IT leaders identify cost savings and value improvement opportunities.

All provisions of a vendor contract should be thoroughly reviewed. But there are a few commonly overlooked provisions that need to be proactively inspected in any cloud-based software or SaaS subscription agreement – especially as you negotiate a new deal or approach a renewal or termination date. Those provisions are the contract terms concerning data access and price protection post-expiration date.

Data is important to consider from a cybersecurity point of view. You want a clear understanding of who has access to data and where data is stored.

Data access is a very significant part of SaaS or cloud-based agreements. In the past, with on-premises software, you had direct access to your data after the contract ended, even if you were no longer licensed to use the vendor application. Today, your data is hosted by the vendor or stored off-premises, so it’s crucial to define and agree upon how long your data can be accessed after your SaaS or cloud contract terminates (e.g., 90 days), who can access the data and how, along with the format of the data that can be retrieved from the application.

In the event of application migration to a new vendor solution, you may find that your data is unusable if it’s not in a format or disposition that‘s supported by your new system. To avoid being stuck with “data confetti” after a cloud vendor separation, companies should pre-negotiate and stipulate these data access terms in their respective SaaS agreements.

From a commercial perspective, the pricing is essential because many customers start with “honeymoon pricing” for the first 12 to 36 months of their contract. If you don’t have a price protection clause that takes effect at the end of the term, SaaS and cloud vendors are known to increase pricing anywhere from 15% to 100%+, especially if the application(s) are sticky and core to your business.

For SaaS renewals, a Consumer Price Index (CPI) based annual uplift of no more than 5 percent is relatively standard. In the best-case scenario, there would be no annual increase in pricing for the current agreement term, but a 2% to 5% range is common or acceptable.

Both data issues and uncapped renewal pricing can create significant challenges when looking at an enterprise-grade application to deliver a mission-critical function for your business. If not already, be sure to include these items in your IT procurement or sourcing checklist when negotiating new SaaS agreements or when renewing existing ones.

It can be hit or miss. In a majority of cases, you’ll find that contract information stored on a shared drive or online file share location. Most organizations don’t have extravagant systems for contract management. In some instances, fully executed vendor agreements or records are still in the email archives of specific individuals.

Many organizations don’t always have the latest amendments or contracts in a centralized location, so what you find could be an older or unsigned version, missing key entitlements or subscription terms. You must then piece the puzzle together when trying to collect or gather all of the details around your SaaS arrangement with a vendor. In many cases, companies do not have a complete and accurate inventory of their vendor agreements, along with a handle over application deployments, so the challenge becomes finding the right people with the correct information who can help.

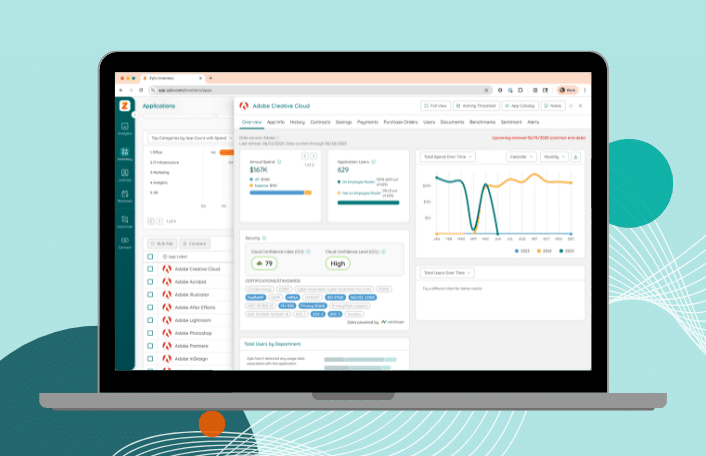

That’s where a solution like Zylo comes into play for SaaS Management. In the past, discovering all of those details meant working with several different stakeholders to understand their current application usage and inventory.

A technology like Zylo is beneficial and useful for organizations that have to create an inventory and baseline for each of their SaaS applications and need to manage key contract provisions within their supplier agreements. Within a single SaaS Management platform, companies can better understand their current SaaS application usage, subscription entitlements, and license compliance position, enhancing their ability to plan or forecast OPEX spend and improving their negotiating position with IT vendors for new agreements or renewals.

It usually goes one of two ways. You can sometimes find cost reduction or optimization opportunities for software not being used, or conversely, license compliance risk (over-consumption) that needs to be remediated or investigated. To assess your current SaaS licensing position, you must conduct a mock internal audit of your application environment, leveraging a solution like Zylo.

In many cases, SaaS vendors are well aware of the over-usage of their products and application features. They’re not necessarily going to perform a hard-nosed audit or bring in a third-party to certify usage, but those findings will generally prompt a commercial discussion around procuring additional software.

It’s not uncommon for users to leverage the functionality of an application feature or license for which their company has no proper entitlements, resulting in a retroactive charge plus ongoing subscription fees of the software.

Conversely, you may find license optimization opportunities when under-utilization of your software applications identified. Once known, you can often use that as commercial leverage to try and allocate those funds to additional or net new vendor products that you don’t have on your contract today, but plan to procure in the near future. SaaS vendors and their sales teams are incented by their ability to land and expand accounts, along with ensuring consumption of the products that they sell to customers.

In either case, it’s leading practice to proactively identify those situations (good or bad) and see if there’s an opportunity to remediate or fine-tune your licensing. If you don’t need specific licenses, you may be able to reduce your ongoing run rate with that vendor or supplier during the next renewal or commercial negotiation.

It’s not necessarily a question of whether cloud and SaaS software audits are coming, but when. And when these audits hit, for many businesses, the next issue will be whether the supplier takes a more traditional 3rd-party auditor approach, versus leveraging a softer inside sales or software asset management (SAM) strategy to identify any discrepancies and a resulting commercial resolution. I believe that the latter is more likely to occur.

In addition, I believe that cloud audits are inevitable, especially as more and more companies adopt SaaS or cloud solutions and take on a cloud-first or cloud-only approach to IT. There’s a good amount of license compliance risk in cloud environments (specifically around license usage and mobility rights) that will need to be assessed by vendors in due time. It’s never too early to begin formulating your own view of your current licensing position with your top SaaS or cloud suppliers.

As more businesses and organizations move to the cloud, is there a common mistake you see in terms of cloud or SaaS vendor management?

Many companies don’t perform the upfront due diligence on scrutinizing contract terms to ensure that they’re protected in the event of a vendor separation, inclusive of provisions detailed above such as data access and renewal price protection.

Companies can also make the mistake of not thoroughly evaluating and selecting technology suppliers. They may vet out a few well-known vendors, but don’t necessarily take into account the full range of capabilities that are required by each stakeholder function, so companies often end up with a solution that’s “half-baked” with feature gaps or limited in its effectiveness.

I think businesses must assess data integration requirements when selecting a new vendor application. This can be a considerable challenge when companies need an application to exchange or import data from other systems, but standard APIs or interfaces aren’t made available by the vendor, resulting in custom development. As part of your IT sourcing and procurement efforts, it’s leading practice to evaluate how a targeted application will communicate or interact with existing applications or processes across the enterprise.

If not, you may create added manual or disparate business clutter that further complicates your IT application environment. It’s a common issue that companies face when implementing a new SaaS/cloud application — and they end up spending more money than originally planned or budgeted to address integration shortfalls, increasing their overall TCO with the vendor.

_____

Connor Consulting is a global professional services and solutions firm focused on providing high-value software licensing compliance services and technology enablement to customers around the globe. What makes us different from our competitors is expressed in our motto: Unparalleled Experience, Inspired Outcomes. Our team of experts has decades of Big-4 and industry experience in providing clients with innovative compliance and software advisory solutions that have a direct and measurable impact on their bottom line. Learn more at connor-consulting.com

ABOUT THE AUTHOR

Rich Reyes, EVP, Connor Consulting

Rich Reyes leads the Software Advisory Solutions (SAS) practice for Connor Consulting. With more than two decades of experience in software contracts, sourcing, and asset management, Reyes brings a unique perspective to enterprise IT strategy and technology asset management.

Table of Contents ToggleWhat are the most important elements to review...

Table of Contents ToggleWhy Data Integrity Breaks DownWhat Does Data Integrity...

Table of Contents ToggleWhat are the most important elements to review...

Table of Contents ToggleShelfware DefinedWhy Shelfware HappensPoor Organizational OversightShadow IT and...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |