FinOps cloud cost management has become essential as cloud costs rise from compounding forces. Infrastructure scales automatically. SaaS expands beyond centralized oversight. AI introduces consumption-based pricing. Meanwhile, financial controls lag behind real-time technical decisions.

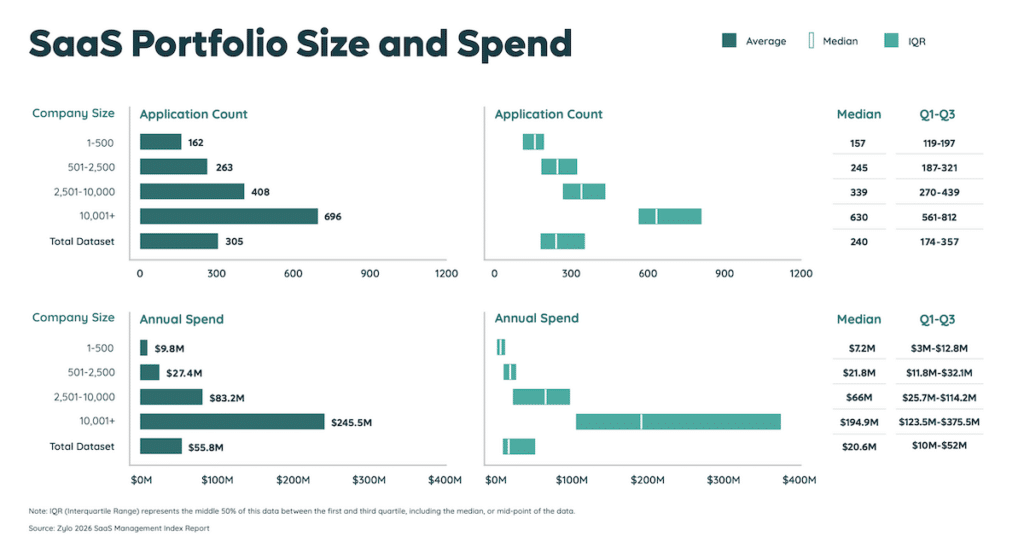

As a result, modern cloud economics are driven by usage volatility, not just application growth. According to Zylo’s 2026 SaaS Management Index, the average organization now spends $55M annually on SaaS. Spend increased nearly 8% year over year even though application counts remained flat. This signals a structural shift where pricing mechanics and consumption models are accelerating cost growth.

At the same time, unexpected charges tied to AI and usage-based pricing are disrupting budgets. More than three-quarters of IT leaders report surprise costs. Many have had to scale back projects to regain control.

In this guide, we’ll explain what FinOps cloud cost management is, why it has become critical in today’s consumption-driven cloud economy, and how it works in practice.

What Is FinOps Cloud Cost Management?

FinOps cloud cost management is a disciplined operating approach for managing cloud and SaaS spend in environments where costs change continuously with usage. It embeds financial accountability into day-to-day technical decisions and ensures cost is evaluated in real time, alongside usage and performance.

Modern cloud and SaaS pricing models create three structural challenges:

- Consumption-based pricing — Spend fluctuates daily instead of remaining fixed.

- Decentralized purchasing — SaaS and AI tools enter through business units, not just IT.

- Fragmented ownership — Finance, engineering, IT, and procurement manage cost with different data sets.

These challenges make traditional budget controls insufficient. Even when application counts remain flat, costs continue to rise. The average organization now manages more than 300 applications, and SaaS spend has increased year over year. This confirms a structural shift: pricing mechanics and usage dynamics—not portfolio expansion alone—are driving cost growth.

Pricing volatility also extends across the contract lifecycle. It is not limited to usage spikes or overprovisioned licenses. Zylo data shows that 79% of organizations encountered price increases at renewal. In other words, costs rise even when usage remains stable. Renewal events themselves have become a source of escalation.

FinOps cloud cost management responds by formalizing:

- Shared cost ownership across finance, engineering, IT, and procurement

- Continuous usage monitoring instead of periodic spend reviews

- Cost evaluation in context, alongside business value and performance

- Ongoing efficiency analysis across cloud, SaaS, and AI services

It replaces after-the-fact spend reviews with continuous cost accountability. As services scale and pricing models evolve, FinOps cloud cost management provides the structure to monitor usage, assign ownership, and maintain financial discipline across the full lifecycle of cloud, SaaS, and AI investments.

What Is FinOps, and Why Does It Matter?

FinOps is a cross-functional operating model that enables finance, engineering, IT, and procurement to collaborate on managing cloud, SaaS, and AI spend in real time. It’s an important business practice because modern technology costs are variable, consumption-based, and are directly shaped by day-to-day technical decisions.

FinOps matters because it:

- Aligns engineering decisions with financial accountability

- Turns unpredictable consumption into forecastable spend

- Reduces waste without slowing innovation

- Creates shared ownership across finance, IT, and product teams

- Embeds cost awareness into everyday workflows

Without a structured operating model, that variability leads to predictable outcomes:

- Surprise spend driven by consumption and pricing changes

- Budget overruns discovered after commitments are locked in

- Reactive controls that slow delivery instead of guiding decisions

When cost is treated as a lagging metric, organizations lose the ability to plan, forecast, and scale with confidence. In response, a majority of organizations now extend FinOps beyond infrastructure. According to The State of FinOps 2025, more than 60% actively manage SaaS spend and over half incorporate AI consumption into FinOps practices. These trends reflect a reality where cost volatility is embedded across the technology stack, not confined to cloud compute alone.

FinOps creates a shared operating language across finance, engineering, IT, and procurement. Cost becomes a first-class signal alongside performance and reliability, enabling teams to evaluate tradeoffs as work progresses, not after budgets are exceeded.

It also matters culturally. Modern delivery requires autonomy, but autonomy without accountability amplifies waste. FinOps embeds cost awareness into existing workflows so teams retain speed while understanding the economic consequences of their choices.

FinOps: Main Principles and Goals

Core FinOps principles include:

- Shared ownership across finance, engineering, IT, and product

- Transparency through timely, accessible cost data

- Continuous optimization instead of one-time cost reduction

FinOps principles exist to balance speed, accountability, and financial discipline in environments where costs change constantly. Shared responsibility is critical here. Cloud and SaaS spending is jointly owned by the teams that drive usage and the teams that manage financial outcomes.

Transparency enables action. When usage, pricing, and ownership are visible, teams can identify inefficiencies, right-size resources, and prioritize spend based on impact rather than assumptions. FinOps Foundation data consistently show that waste reduction and workload optimization rank among practitioners’ top priorities, underscoring the need for operational visibility over periodic audits.

Maximizing Value Through FinOps

FinOps is not about minimizing spend at all costs but rather maximizing value. Effective FinOps practices help organizations determine:

- Which workloads justify continued investment

- Which tools or services are underutilized

- Where incremental spend drives measurable business outcomes

As SaaS and AI consumption introduce additional volatility, these principles ensure that cost management supports growth and decision quality rather than becoming a constraint on innovation.

The Definitive Guide to SaaS Management

Learn MoreCloud Cost Challenges: The Business Impact

Cloud costs are difficult to predict because pricing is no longer fixed or linear. The challenges impacting businesses are:

- Cloud cost unpredictability and budget overruns

- Limited visibility across cloud and SaaS environments

- AI-driven pricing and consumption volatility

- Organizational misalignment and accountability gaps

Cloud Cost Unpredictability and Budget Overruns

Cloud costs become unpredictable because spend changes as usage changes. Autoscaling services, on-demand resources, and usage-based pricing mean costs can increase without a clear planning moment or approval step.

When cost signals arrive after usage has already occurred, a few things consistently happen:

- Budgets reflect what happened, not what is about to happen

- Variance is discovered late in the billing cycle

- Course correction comes after overruns, not before

These events make cloud budgets less reliable as control mechanisms. Even when overall usage is intentional, the timing and pace of cost accrual reduce your ability to intervene early. FinOps addresses this by treating cost as an operational signal you monitor continuously, not a number you reconcile at the end of the month.

Limited Visibility Across Cloud and SaaS Environments

Visibility remains one of the most persistent barriers to effective cloud cost management. Native cloud tools focus on infrastructure usage but rarely account for SaaS applications, AI add-ons, or hybrid licensing models that now drive a significant share of spend.

Without unified visibility, organizations struggle to:

- Attribute costs to owners or business outcomes

- Identify overlapping or redundant tools

- Detect underused licenses before renewal

According to Zylo’s 2026 SaaS Management Index, expense-based SaaS purchasing grew 267% year over year. That makes expensed applications one of the fastest-growing sources of unmanaged spend and visibility gaps. As cloud and SaaS environments converge, partial visibility undermines cost allocation, governance, and optimization efforts.

AI-Driven Pricing and Consumption Volatility

In 2025, 42% of SaaS companies monetize AI features through usage-based or hybrid models—per the 2025 SaaS Benchmarks Report by High Alpha. The danger is the volatility and unpredictability of AI costs. Zylo’s survey of IT leaders found that 78% experienced unexpected charges tied to AI or consumption in the past year.

- Costs rise through experimentation and feature adoption

- Usage scales unevenly across teams and workflows

- Financial impact appears after consumption has already occurred

As a result, spend can increase even when application counts remain stable. AI costs behave less like subscriptions and more like utilities (e.g., gas, water), accumulating quietly through normal usage. Without a way to monitor consumption in near real time, AI-driven charges surface late in the cycle, limiting your ability to adjust before budgets are affected.

FinOps helps manage this volatility by treating AI usage as a cost signal that requires ongoing visibility and evaluation, not a one-time pricing decision.

“We’re seeing the same trend we saw 10-15 years ago with cloud. It started with somebody saying, ‘I can’t wait for IT.

I’m going to start an AWS account.’ That same thing is happening with AI right now. People are signing up with their credit cards, and then spending hits some critical threshold and the company suddenly moves to control and consolidate it.”— J.R. Storment, Executive Director, FinOps Foundation

Organizational Misalignment and Accountability Gaps

While some cloud cost challenges are purely technical, others stem from fragmented ownership. For example, engineering teams control usage, finance manages budgets, and procurement negotiates contracts, but no single group sees the full cost lifecycle.

This misalignment creates systemic issues:

- Costs are questioned after decisions are made

- Optimization happens locally instead of holistically

- Accountability is unclear across teams

FinOps addresses these gaps by establishing shared ownership, common metrics, and decision frameworks that align cost with value at the point of action, not after overruns occur.

The Three Pillars Of FinOps

The three pillars of FinOps include:

- Informing teams with accurate, timely cost data

- Optimizing usage to reduce waste and improve efficiency

- Operating with governance and accountability at scale

Informing

You can’t manage what you cannot see. The Informing pillar focuses on delivering accurate, timely, and accessible cost data to the people making day-to-day decisions, including teams deploying workloads, launching features, and forecasting spend.

The Informing pillar requires having more than basic invoices to show stakeholders. Costs must be attributed in ways that reflect how the organization actually operates, including:

- Owners responsible for usage

- Services and applications generating spend

- Business units consuming resources

When cost data is current and contextual, teams can understand the financial impact of their choices while those choices still matter, not weeks later when invoices arrive.

Optimizing

Once visibility is established, the focus shifts to reducing waste and improving efficiency without sacrificing performance or speed. Common optimization activities include:

- Rightsizing overprovisioned resources

- Eliminating unused or redundant services

- Aligning usage with actual demand

To make optimization stick, it takes more than a one-time cleanup effort. In cloud and SaaS environments, usage patterns change continuously as new tools are adopted, AI features introduce variable consumption, and pricing models evolve. FinOps optimization is ongoing, enabling early identification of inefficiencies and reinvestment of savings before budget overruns occur.

Operating

The Operating pillar establishes the processes, policies, and governance needed to make cost management part of normal operations. It defines how decisions are made, how accountability is shared, and how success is measured over time.

Operating FinOps means embedding cost awareness into existing workflows, including:

- Planning and budgeting cycles

- Forecasting and variance review

- Performance measurement and accountability

This ensures optimization does not depend on individual effort or periodic audits. Cost management becomes part of how teams build, buy, and scale technology, allowing FinOps to remain effective as cloud, SaaS, and AI-driven environments grow more complex.

The Ideal FinOps Framework

FinOps is most effective when it covers the full scope of cloud and SaaS spend. A practical framework addresses three interdependent areas:

- Cost visibility and accountability

- Optimization and waste reduction

- Operational governance and forecasting

Cost Visibility and Accountability

A FinOps framework starts with consistent, trustworthy visibility into cloud and SaaS costs. Spend must be attributed to the teams, applications, and business units responsible for generating it.

Effective cost visibility depends on:

- Standardized tagging and allocation models

- Clear ownership definitions across cloud and SaaS

- Cost data aligned to how the organization actually operates

Accountability follows when cost data is timely and accessible. When spend is visible close to the point of usage, cost becomes part of everyday decision making. This matters because, if SaaS applications are not fully visible or tracked, it limits an organization’s ability to assign ownership or act on cost signals before renewal or overage events occur.

Optimization and Waste Reduction

Optimization focuses on continuously improving efficiency as environments evolve. Cloud infrastructure, SaaS portfolios, and AI-driven services change frequently, making static, one-time optimization efforts ineffective.

A FinOps framework relies on ongoing analysis to identify inefficiencies such as:

- Overprovisioned or idle infrastructure resources

- Unused or redundant SaaS applications

- Underutilized licenses and features

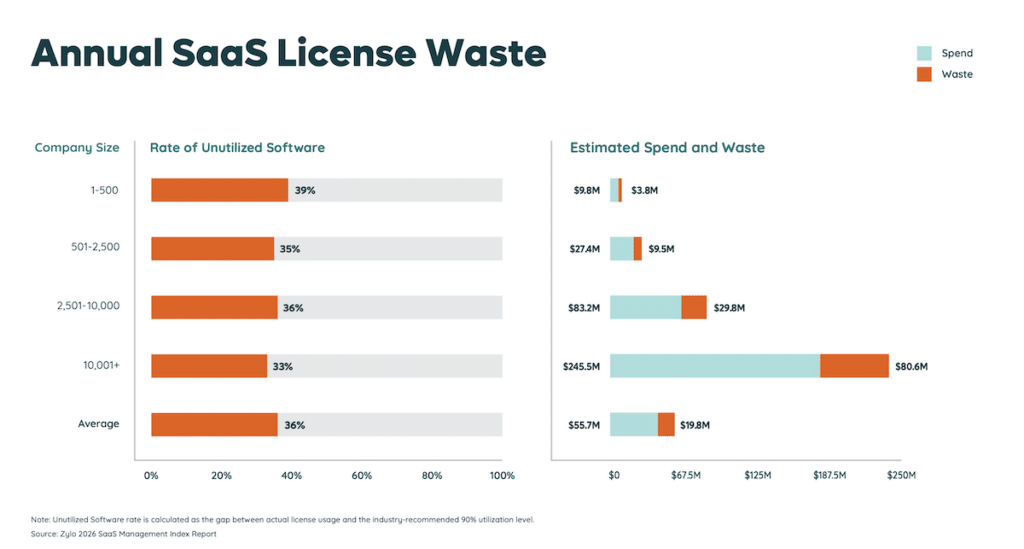

Identifying these inefficiencies matter because waste at the license and usage level is both common and measurable. Zylo’s SaaS Management Index reports that 46% of SaaS licenses are unused or underutilized within a 30-day period, representing significant, recurring waste that can only be addressed through continuous optimization rather than periodic reviews.

Waste reduction is most effective when it is repeatable and prioritized by impact. Usage trends and cost signals help distinguish between spend that supports critical business outcomes and spend that can be reduced without affecting performance, reliability, or growth.

Operational Governance and Forecasting

Operational governance defines how cost management is applied consistently across the organization. It establishes policies for provisioning, purchasing, and usage, along with clear approval workflows and accountability. Governance provides structure by aligning financial controls with how teams actually acquire and consume technology.

Effective governance typically includes:

- Defined purchasing and renewal processes

- Clear ownership for usage and spend decisions

- Regular review cycles tied to planning and budgeting

Forecasting connects current usage to future plans. By combining historical consumption with growth assumptions, pricing changes, and planned initiatives, organizations can model expected spend more accurately. This is increasingly important as SaaS and AI pricing shift toward variable and consumption-based models, where costs change during the contract term rather than only at renewal.

Governance and forecasting work together to reduce surprise costs by making spend more predictable, even when pricing and usage remain dynamic.

5 FinOps Best Practices for Cloud Cost Management

Apply FinOps best practices consistently as cost management for cloud and SaaS environments evolves. Here’s how to start:

- Establish cost transparency and tagging discipline

- Automate optimization and waste detection

- Drive cross-functional collaboration

- Measure continuously and enforce accountability

- Plan proactively for variable and consumption-based pricing

1. Establish Cost Transparency and Tagging Discipline

Start by implementing consistent tagging and allocation across your cloud infrastructure and SaaS applications. Make sure your tags clearly define:

- Who owns the cost

- Which application or service is driving spend

- What environment or business purpose the spend supports

If tagging is inconsistent or incomplete, reporting accuracy breaks down and accountability becomes unclear. You lose the ability to trace costs back to decisions, which forces you into reactive optimization instead of intentional control.

Use structured tagging to support chargeback or showback models, improve forecasting, and accelerate decision-making. When your cost data is reliable and well organized, you can evaluate tradeoffs confidently and correct inefficiencies before they escalate into material budget issues.

2. Automate Optimization and Waste Detection

Stop relying on manual optimization cycles that can’t keep pace with dynamic cloud and SaaS environments. Usage patterns change continuously, and periodic reviews allow inefficiencies to linger longer than they should.

Use automation to identify and address waste as it emerges, including:

- Rightsizing overprovisioned resources

- Detecting idle or unused services

- Flagging anomalous or unexpected spend

Automation is the only practical way to keep optimization aligned with real consumption instead of outdated assumptions. Reduce reliance on one-off interventions while maintaining efficiency without slowing delivery or creating operational friction.

3. Drive Cross-Functional Collaboration

Align finance, engineering, IT, procurement, and product teams around shared cost objectives. Each group controls different cost levers, and no single function has complete visibility on its own.

Build collaboration around:

- Shared goals tied to business outcomes

- Common metrics used across teams

- Regular communication around cost and usage decisions

Ensure teams understand financial guardrails at the point of decision. When you integrate cost awareness into engineering and procurement workflows, you prevent local optimization that creates larger inefficiencies elsewhere and keep cost management aligned with broader business priorities.

4. Measure Continuously and Enforce Accountability

Review cost signals frequently enough to influence decisions while they still matter. Avoid treating cost management as a periodic audit. Instead, make it part of your operating rhythm.

Monitor:

- Usage efficiency and utilization trends

- Unit costs and cost per service or application

- Variance between actual spend and forecasts

Tie ownership directly to performance metrics. When metrics are visible and tied to ownership, teams act on cost signals earlier rather than waiting for overruns to occur. Continuous measurement strengthens accountability and improves financial predictability.

5. Plan Proactively for Variable and Consumption-Based Pricing

Accept that modern cloud, SaaS, and AI pricing models are inherently variable. Traditional budgeting approaches assume costs remain stable until renewal, but that’s no longer true for most companies.

Instead:

- Model multiple usage scenarios

- Account for consumption-based and AI-driven pricing

- Build buffers for expected volatility into your forecasts

Treat variability as a standard operating condition. When you plan for fluctuation instead of reacting to it, you reduce surprise spend and make financial decision-making more resilient as usage and pricing evolve.

FinOps Key Performance Indicators (KPIs)

FinOps KPIs help you evaluate whether cloud and SaaS spend is visible, efficient, and aligned with business outcomes. They focus on signals that influence decisions, while costs can still be adjusted. Track these KPIs:

- Cost allocation and visibility

- Efficiency and utilization

- Cost optimization impact

- Forecasting and cost variances

- Accountability and engagement

Cost Allocation and Visibility Metrics

Cost allocation and visibility KPIs measure how much of your cloud and SaaS spend is clearly attributed and owned. Without reliable allocation, accountability and optimization stall.

Common visibility metrics include:

- Percentage of spend allocated to owners or teams

- Percentage of cloud and SaaS spend fully categorized and tagged

- Volume of unallocated or “unknown owner” resources

Visibility gaps remain widespread. Expense-based SaaS purchasing continues to grow, increasing the amount of spend that bypasses traditional visibility and allocation processes.

Efficiency and Utilization Metrics

Efficiency KPIs track how effectively resources and licenses are being used. They help you identify waste and prioritize optimization based on impact.

Typical efficiency metrics include:

- Infrastructure utilization rates

- SaaS license utilization rates

- Cost per user, workload, or transaction

Inefficiency scales quickly without proper monitoring. Average SaaS spend per employee increased 21.9% year over year, even as application growth slowed, signaling that usage efficiency—not tool count—is driving cost increases.

Cloud Cost Optimization Impact Metrics

Optimization impact KPIs measure whether FinOps actions translate into real financial outcomes, not just recommendations.

Common impact metrics include:

- Realized savings from rightsizing or license reductions

- Avoided spend from early anomaly detection

- Percentage of optimization actions completed

Tracking these metrics matters because optimization opportunities often grow faster than teams can act manually. Successful FinOps efforts will continuously measure the impact of optimization as usage accelerates.

Forecasting and Variance Metrics

Forecasting KPIs assess how closely expected spend aligns with actual consumption. In variable pricing environments, the goal is reducing variance over time, not achieving perfect precision.

Key forecasting metrics include:

- Forecast versus actual spend variance

- Trend of variance improvement over successive cycles

- Frequency of mid-cycle budget corrections

Using these metrics help determine whether cost signals are reaching decision-makers early enough to influence outcomes before overruns occur.

Accountability and Engagement Metrics

Accountability KPIs measure whether FinOps is embedded into daily operations rather than confined to finance review cycles.

Examples include:

- Percentage of spend reviewed by accountable owners

- Time to action on identified cost issues

- Participation in cost review or optimization cycles

When these metrics improve, cost management shifts upstream—closer to the decisions that create spend.

Tools and Platforms That Support FinOps

FinOps relies on accurate data, timely signals, and the ability to act before costs are locked in. Most organizations use a combination of native cloud tools and third-party platforms to cover the full scope of cloud and SaaS spend.

Native Cloud Cost Management Tools

Native cloud cost management tools are built into major cloud providers and focus primarily on infrastructure spend. They provide baseline visibility into usage, pricing, and trends at the account or service level.

These tools typically support:

- Cost and usage reporting for cloud services

- Budget alerts and threshold-based notifications

- Basic forecasting tied to historical infrastructure usage

Native tools are effective for understanding cloud infrastructure costs, especially early in a FinOps journey. However, they are limited to events within a single cloud environment. They do not account for SaaS applications, AI add-ons, or usage-based software costs that increasingly drive overall technology spend.

Third-Party FinOps Platforms

Third-party FinOps platforms extend FinOps beyond infrastructure by bringing together cost, usage, and ownership data across cloud providers and SaaS applications.

These platforms typically enable:

- Unified visibility across cloud and SaaS spend

- Cost allocation and ownership across teams and business units

- Ongoing optimization tracking and forecasting support

This broader view is critical as software spend becomes more distributed and consumption-based. SaaS Management Platforms like Zylo are designed to complement native cloud tools by filling the SaaS visibility and management gap.

By combining cloud cost data with SaaS usage, license, and contract insights, third-party FinOps platforms help you manage spend holistically and make informed decisions based on a complete view of your environment.

Make FinOps More Effective with Zylo

FinOps works best when cloud and SaaS costs are visible, actionable, and connected to ownership. As environments grow more complex and pricing becomes more consumption-based, managing costs with partial data creates risk and limits your ability to plan with confidence.

Zylo helps you extend FinOps beyond infrastructure by unifying cloud and SaaS spend, usage, and ownership in one place. With clearer visibility and continuous insight, you can reduce waste, improve forecasting, and align technology spend with real business outcomes.

If you’re ready to strengthen your FinOps practice across cloud and SaaS, Zylo can help. Request a demo to see how Zylo supports FinOps-driven cost management.

FAQs about FinOps Management of Cloud Costs

What is cloud cost allocation in FinOps?

Cloud cost allocation assigns cloud and SaaS spend to the teams or applications that use it. Instead of treating costs as shared overhead, you connect usage to ownership. Use consistent tagging, defined ownership, and shared reporting standards so cost data supports real-time decisions rather than post-bill reconciliation.

What is the primary role of a centralized FinOps team in cloud cost management?

A centralized FinOps team sets standards, improves visibility, and enables accountability without owning every spending decision. The team defines allocation models, establishes shared metrics, supports forecasting, and creates financial guardrails. Its goal is to help distributed teams make cost-aware decisions at the point of action.

What is the difference between cloud cost management and FinOps?

Cloud cost management tracks and controls spend, often after it occurs. FinOps embeds cost awareness into decision making. Instead of asking only what was spent, FinOps asks why it was spent and whether it delivered value. It connects financial accountability to engineering, IT, and business outcomes.

What are the three pillars of FinOps?

The three pillars of FinOps are Inform, Optimize, and Operate. “Inform” delivers accurate cost data to decision-makers. “Optimize” improves efficiency and reduces waste. “Operate” embeds governance, forecasting, and accountability into daily workflows. Together, these pillars ensure cost management remains continuous and actionable.

What tools, metrics, and KPIs are used to track and improve cloud cost efficiency in a FinOps model?

Use native cloud tools for infrastructure visibility and third-party platforms for cross-cloud and SaaS insight. Track KPIs such as allocation coverage, utilization rates, avoided spend, and forecast accuracy. Focus on metrics that drive action, not just reporting, so teams can correct inefficiencies early.

What is the best cloud monitoring tool for costs?

There is no universal best tool. Use native cloud platforms for provider-specific infrastructure costs and third-party solutions to unify cloud, SaaS, and consumption-based spend. As pricing becomes more variable and distributed, relying on a single system often creates visibility gaps.

How does FinOps Apply to SaaS and AI-driven spend?

Apply FinOps to SaaS and AI by extending visibility and accountability beyond infrastructure. Track license utilization, monitor consumption-based pricing, and connect software investments to outcomes. As AI pricing accelerates variability, disciplined oversight helps you reduce surprise costs and improve forecasting accuracy.

Is FinOps only relevant for large enterprises?

FinOps benefits organizations of all sizes. Smaller teams build cost discipline early and prevent unmanaged growth. Larger enterprises use FinOps to manage complexity, distributed ownership, and scale. The practices adapt to your environment and become more valuable as usage and pricing models evolve.