Table of Contents

One of the biggest challenges in SaaS Management is limited visibility into software, spend, and risk. Applications often slip into use without oversight, leaving IT and finance teams unaware of what’s being paid for or how secure those tools are. Shadow IT, decentralized purchasing, and rapid employee adoption make the problem even harder to control.

SaaS discovery addresses these blind spots. By surfacing every application in use—sanctioned or not—discovery provides the foundation for cost control, stronger governance, and better alignment between teams.

Discovery Is Foundational to Effective and Holistic SaaS Management

Managing SaaS effectively starts with discovery, because you can’t manage what you can’t see. In fact, most companies don’t have a full picture of their inventory. According to our research, companies often underestimate their SaaS spend by 300% and apps by 170%..

A blindspot to that extent leaves organizations exposed to:

- Overspending on software

- Security and compliance risks

- Inefficiencies across the business

SaaS discovery is just the start. It must also be ongoing. That’s because, on average, organizations uncover about 7 new applications every month. If discovery is just a moment in time, you quickly lose visibility into new software—and the risks that go along with them.

What Is SaaS Discovery?

SaaS discovery is the ongoing process of identifying and cataloging all SaaS applications in use at an organization—a component of SaaS inventory management. By surfacing every app across IT, business units, and employee expenses (shadow IT), leaders gain insights to:

- Optimize license usage

- Consolidate redundant or unnecessary subscriptions

- Strengthen security

- Manage renewals with confidence

With discovery, organizations can shine a light on waste and risk, and reclaim value.

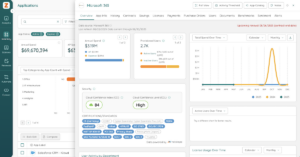

Using a SaaS Management Tool for Discovery

For many companies, SaaS applications are tracked manually. However, for comprehensive discovery, it requires a SaaS Management Platform (SMP).

For real-time visibility, modern discovery tools:

- Integrate multiple data sources

- Automate the discovery process

- Serve as a centralized system of record for SaaS

Using an SMP, saves time, improves data accuracy, and enables proactive management.

Why Visibility Is Important to Your SaaS Management Strategy

There are several ways SaaS visibility delivers value across the business. The following benefits highlight why visibility should be a priority in any SaaS Management strategy:

- Lack of centralized visibility

- Identify and eliminate shadow IT and shadow AI

- Mitigate security and compliance risks

- Know who has access—and why it matters

- Eliminate unnecessary costs and reclaim budget

- Quickly understand your SaaS usage and spend

- Save time across teams

- Empower employees with the right tools

- Establish a single source of truth

- Improve vendor negotiation

- Stay ahead of renewals

On our podcast, SaaSMe Unfiltered, Ksenia Kouchnirenko, VP of Enterprise Operations & Technology, shares how she stood up a SaaS Management program from scratch to bring visibility, accountability, and strategy to software decisions. Jump to 8:21 in the episode below to hear from Ksenia on why visibility is so important for effective SaaS Management.

Find All Your SaaS Wherever It Lurks

Discovery helps bring unknown software to light, regardless of how it entered the environment. Apps hide in surprising places:

- Employee expense reports

- Credit cards payments

- Free trials often bring in new tools without IT’s knowledge

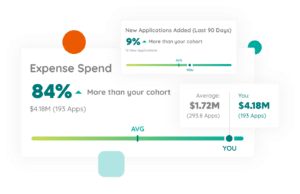

The scale of the problem is larger than most realize. The average company now manages a portfolio of 275 applications—though most underestimate that number by 2X.

IT is responsible for purchasing less than 20% of those apps, with business units and employees responsible for most purchasing. This decentralization makes discovery even more important, as it is the only way to establish a single source of truth.

Lack of Centralized Visibility

Without centralized visibility, each team sees only part of the SaaS picture. Establishing a SaaS system of record—or single source of truth—provides IT, SAM, procurement, and business leaders with a unified data set. This helps:

- Provide a complete picture of applications, spend, renewals, and risk

- Create transparency across teams

- Improve data integrity

- Establish a foundation for informed decision making

Centralized discovery resolves this issue by consolidating spend, usage, and ownership data into a single system. With every stakeholder using the same information, organizations can align strategies, enforce policies, and prevent waste.

Identify and Eliminate Shadow IT and Shadow AI

In 2025, nearly half of all SaaS apps in use come from shadow IT on average, creating blind spots in your software inventory. By identifying and eliminating shadow IT—and shadow AI—helps address the following risks

- Compliance violations

- Security risks

- Unexpected costs and duplicative spend

- Intellectual property concerns

- Surprise or unmanaged renewals

Without proper visibility and governance, shadow IT will continue to proliferate, increasing the size of your blind spots.

Mitigate Security and Compliance Risks

Every untracked application expands your organization’s attack surface. Without visibility, organizations face:

- Audit failures

- Data leaks

- Unmitigated vulnerabilities

Zylo’s 2025 report shows that 51% of applications have a “Poor” or “Low” Cloud Confidence Index (CCI) risk score. Meanwhile, 61% of unvetted shadow IT apps had a similar score. Many of these apps can access sensitive data, raising compliance and governance issues.

Without proper discovery, these tools can slip into the environment unchecked, leaving your organization vulnerable.

Discovery enables you to assess every application’s security posture and ensure compliance with regulations and internal policies. The result is reduced risk across the board.

Know Who Has Access—and Why It Matters

Leaders need more than an app inventory. They also need clarity on user access to mitigate unnecessary risk, such as:

- Overprovisioned accounts

- Former employees who still retain logins

- Third-party access

Discovery provides insight into who has access, allowing teams to align permissions with business needs and strengthen governance.

Eliminate Unnecessary Costs and Reclaim Budget

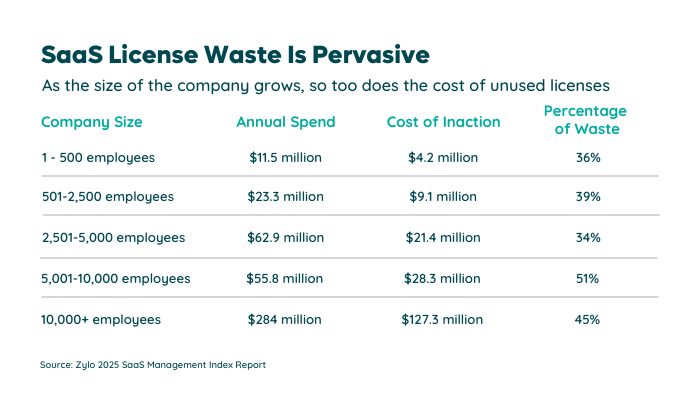

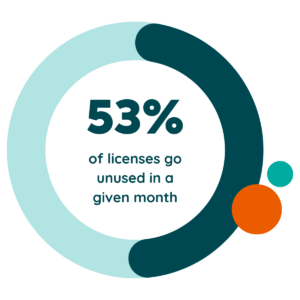

Visibility into your SaaS spend is critical to enable cost optimization. For instance, significant waste sits in the form of unused licenses and redundant software. According to the 2025 SaaS Management Index:

- On average, companies throw away $21M million each year on unused licenses.

- The top most redundant application categories (project management, team collaboration, and online training tools) can result in unnecessary costs ranging from $477,000 to $2.8M.

Quickly Understand Your SaaS Usage and Spend

Discovery makes usage and cost data transparent, which—evaluated together—is critical to make informed decisions on:

Renewals

Renewals- License reallocations

- Vendor consolidation

With visibility into license utilization, you can see exactly which apps deliver value and which drain resources. In 2025, only 47% of SaaS licenses are actively used in a given month. That’s a considerable amount of waste when the average company already spends $49M annually. And it stays hidden if you do nothing about it.

Save Time Across Teams

When you manually track software, it consumes time that could be spent on strategic work. For example:

- Finance teams dig through expense reports.

- IT teams chase down shadow apps.

- Procurement teams scramble to prepare for renewals.

Automated discovery eliminates those silos by centralizing data. The result is less time spent chasing information and more time spent driving value.

Empower Employees with the Right Tools

Visibility also improves the employee experience, such as:

- Ensuring employees have the right tools to do their jobs effectively.

- Improving collaboration by phasing out duplicate or redundant platforms.

- Reducing frustration by making it easy to find and request access to approved software.

Improve Vendor Negotiation

Discovery provides teams data that can be used to improve negotiation leverage. You can negotiate from a position of strength by knowing:

- How many licenses are used

- How much spend is allocated

- What overlaps exist

- Pricing benchmarks

Stay Ahead of Renewals

In 2025, our data shows that companies face an average of 247 renewals annually, which account for 85% SaaS spend. Without discovery, renewals sneak up, leaving little time for review or negotiation. Discovery tools surface upcoming renewals in advance, giving teams time to:

- Evaluate usage

- Consolidate contracts

- Prepare for discussions with vendors

The Definitive Guide to SaaS Management

Learn MoreBenefits of SaaS Discovery throughout Your Organization

The value of SaaS discovery extends far beyond IT. Every function that manages software, budgets, or employee productivity benefits from having a full picture of the SaaS environment. With shared visibility, teams can align on goals, reduce waste, and make better decisions.

Here are the key groups that see measurable impact from SaaS discovery:

- SaaS Discovery for Software Asset Managers

- SaaS Discovery for IT

- SaaS Discovery for Procurement

- SaaS Discovery for CIOs

- SaaS Discovery for Finance Teams

- SaaS Discovery for FinOps Teams

- SaaS Discovery for Marketing Teams

SaaS Discovery for Software Asset Managers

For software asset managers (SAM), discovery is the foundation of effective governance. A complete inventory shows:

- Which apps are in use

- Who owns them

- How they’re licensed

This visibility eliminates blind spots that create wasted spending and compliance risks.

With accurate data, SAM professionals can:

- Enforce purchasing policies

- Manage contracts more effectively

- Guide rationalization efforts

- Plan software lifecycles strategically

- Ensure every tool in the portfolio delivers value

SaaS Discovery for IT

IT teams are held accountable for security and performance even when they don’t control all software purchases. Discovery gives them the visibility to:

- Identify shadow IT across the organization

- Monitor app usage and adoption

- Close potential security gaps

- Track where sensitive data flows through unsanctioned tools

By integrating discovery insights with access controls and SSO, IT teams can:

- Reduce risk from unmanaged applications

- Maintain employee productivity

- Balance governance with enablement by knowing exactly which apps are in play

SaaS Discovery for Procurement

Procurement teams need full visibility to negotiate effectively and manage vendor relationships. Discovery equips them to:

- See all contracts and subscriptions across the organization

- Identify duplicate vendors or overlapping functionality

- Pinpoint underutilized licenses that drive up costs

- Track renewal timelines to avoid last-minute negotiations

Armed with this data, procurement teams can:

- Consolidate contracts to strengthen buying power

- Standardize purchasing processes across departments

- Secure better pricing and terms from vendors

- Align sourcing decisions with business needs

SaaS Discovery for CIOs

CIOs are tasked with aligning technology strategy to business goals while managing risk and cost. Discovery gives them the insight to:

- Understand the full scope of the SaaS portfolio

- Spot redundancies that undermine efficiency

- Identify security and compliance gaps

- Track spend across departments for budget accuracy

With this visibility, CIOs can:

- Set clear governance standards for SaaS adoption

- Drive consolidation to reduce sprawl and complexity

- Prioritize investments in tools that deliver measurable value

- Communicate SaaS strategy effectively to executive leadership

SaaS Discovery for Finance Teams

Finance leaders need accurate, real-time data to control costs and forecast spend. Discovery enables them to:

- See total SaaS spend across all departments

- Identify unused or duplicate licenses that inflate budgets

- Track recurring payments made through corporate cards or expense reimbursements

- Monitor renewals to anticipate upcoming costs

With this insight, Finance teams can:

- Reclaim wasted spend and redirect budgets

- Improve forecasting accuracy with complete SaaS data

- Enforce financial policies to reduce shadow purchases

- Partner with IT and procurement to optimize overall SaaS investments

SaaS Discovery for FinOps Teams

FinOps professionals focus on maximizing the business value of technology investments. Discovery provides the visibility they need to:

- Track SaaS costs at a granular, per-team level

- Monitor utilization to identify waste

- Highlight spending patterns that impact budgets

- Provide data for benchmarking against industry standards

With this foundation, FinOps teams can:

- Optimize license allocations to reduce overspending

- Partner with engineering, IT, and finance to align usage with business goals

- Improve chargeback and showback models for accountability

- Support continuous cost optimization efforts across the SaaS portfolio

SaaS Discovery for Marketing Teams

Marketing often adopts SaaS tools quickly to stay competitive, but that speed can create overlap and risk. Discovery helps them:

- Uncover all tools in use across campaigns and teams

- Identify redundant apps for project management, analytics, or content creation

- Track costs tied to credit card purchases or departmental budgets

- Ensure compliance when handling customer or prospect data

With this visibility, Marketing teams can:

- Standardize on the most effective platforms

- Eliminate unnecessary subscriptions to free up budget

- Strengthen data security across customer-facing tools

- Focus on tools that improve campaign performance and ROI

Common Challenges in SaaS Discovery

The most common hurdles organizations encounter in SaaS discovery include:

- Security and privacy risks

- Integration gaps limit discovery accuracy

- Employee trust and experience

- Using manual methods

Security and Privacy Risks

Some discovery tools collect data in ways that introduce security and privacy concerns—especially if they operate without user awareness or clear governance. For organizations in regulated industries, this can raise red flags and increase compliance risk. A discovery approach that’s both secure and transparent is essential to maintaining control without compromising customer trust.

Integration Gaps Limit Discovery Accuracy

SaaS Management Platforms use a variety of discovery sources that, if used alone, create a partial view of your portfolio. This results in inaccuracies and incomplete data, meaning some applications go undetected.

Employee Trust and Experience

Some discovery methods sometimes raise concerns about surveillance. For example, browser extensions or endpoint agents:

- Can feel invasive to employees

- Impact trust and morale

- May reduce internal compliance

- Drive employees to seek workarounds

Balancing governance with user experience is essential. Transparent communication and clear policies help employees understand that discovery is about smarter software management, not monitoring individual behavior.

Using Manual Methods

Manual tracking in spreadsheets or legacy SAM tools cannot keep pace with today’s SaaS growth. In addition, they are often:

- Prone to error or inaccuracies

- A point in time and quickly become out of date

- Spread across multiple departments, not in a single source of truth

- Incomplete inventories of just the applications you know about

“The problem with spreadsheets… there’s no real refresh rates, there’s no usage data.”

— Ksenia Kouchnirenko, VP of Enterprise Operations and Technology at Verkada

To avoid these pitfalls, a SaaS Management Platform is critical to automate the discovery process. Software is constantly entering and exiting the business, making it increasingly important to ensure discovery is ongoing.

Even Gartner validates this need. The analyst firm predicts: “Through 2028, over 70% of organizations will centralize SaaS application management using an SMP, an increase from less than 30% in 2025.”

By using an SMP instead of manual methods, you can:

- Continuously monitor your software environment and uncover shadow IT

- Get real-time insights for informed decision making

- Ensure an accurate view of your SaaS inventory, spend, and risk

- Proactively manage renewals

Top 10 SaaS Discovery Methods for 2025

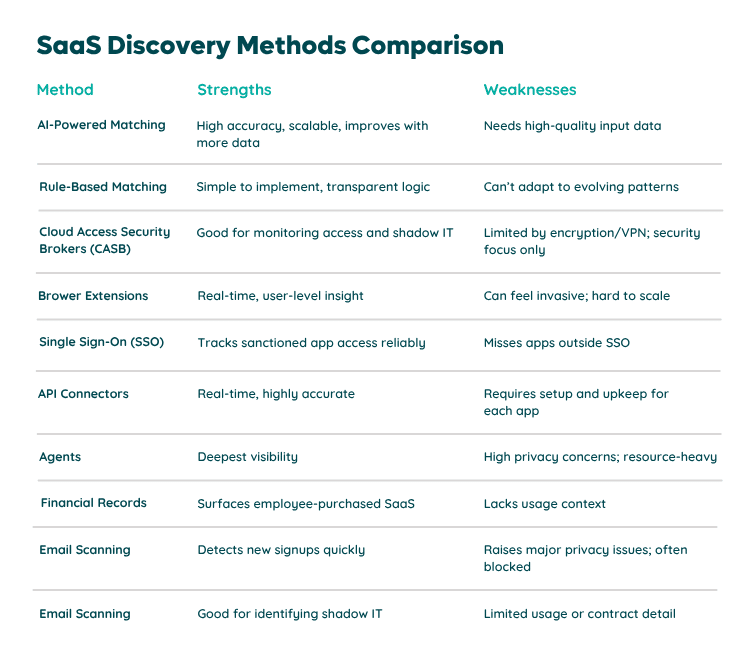

Organizations use a range of techniques to uncover SaaS applications, including:

- AI-powered matching model

- Rule-based matching

- Cloud access security brokers (CASBs)

- Browser extensions

- Single sign-on (SSO)

- API connectors

- Agents

- Financial records

- Email scanning

- Web proxy

No single method delivers perfect coverage, which is why layering approaches produce the most accurate results. Some methods excel at surfacing shadow IT, while others capture detailed usage data, and many involve trade-offs in terms of cost, privacy, or scalability.

Here’s a comparison of the most common discovery methods, highlighting where each performs well and where it has limitations:

AI-Powered Matching Model

AI models can detect SaaS applications by analyzing massive volumes of transaction and usage data, matching patterns against known application signatures.

- Strengths: High accuracy and scalability, improves over time with new data.

- Weaknesses: Requires high-quality input data to perform well.

The advantage of AI-powered discovery is accuracy and scalability. As more data flows through the system, the model improves and reduces the number of false positives.

For example, Zylo’s own AI discovery has processed more than $40B in SaaS spend and over 40M licenses to date. This demonstrates the scale at which machine learning can operate.

AI approaches are especially valuable in environments where portfolios expand rapidly. They excel at identifying long-tail SaaS applications that traditional methods miss, giving enterprises confidence in the completeness of their discovery efforts.

Rule-Based Matching

The rule-based discovery method relies on predefined rules to identify SaaS applications, such as matching transaction codes or URL patterns against known app signatures.

- Strengths: Easy to implement and interpret

- Weaknesses: Struggles with inconsistencies and evolving data patterns

It’s straightforward, transparent, and easy to explain to stakeholders. However, rule-based systems struggle when data is inconsistent or when new apps emerge that don’t fit existing rules. That rigidity makes it less effective in fast-changing SaaS environments.

Cloud Access Security Brokers (CASB)

CASBs provide strong visibility into cloud usage by monitoring access points and enforcing policies.

- Strengths: Good for identifying shadow IT and monitoring access

- Weaknesses: May miss usage in encrypted traffic or VPN environments; typically focused on security, not cost or usage optimization

They are effective at spotting shadow IT and tracking logins to unsanctioned apps, which makes them valuable in high-security environments. But they are designed primarily for security, not financial optimization. As a result, a CASB may miss traffic hidden in encrypted channels or VPNs.

Browser Extensions

By capturing activity directly in the browser, extensions deliver granular, real-time insights into user behavior.

- Strengths: Real-time, user-level insights

- Weaknesses: Can be perceived as invasive; often not scalable across large organizations

Browser extensions can reveal which apps are being accessed and how often. The downside is that they can feel invasive to employees, raising trust concerns. Not to mention, they are not easily scalable across a large enterprise with thousands of endpoints.

Single Sign-On (SSO)

SSO solutions are great for showing which sanctioned apps employees access with corporate credentials.

- Strengths: Great for tracking access to sanctioned apps

- Weaknesses: Doesn’t capture SaaS that bypasses SSO or is accessed via personal credentials

Using SSO for discovery simplifies visibility into adoption and helps confirm user counts for licensed software. However, SSO coverage is incomplete—apps purchased on corporate cards or accessed via personal accounts remain invisible to it.

API Connectors

API integrations with SMP deliver accurate and nearly real-time usage, license, and spend data directly from the source.

- Strengths: Highly accurate, real-time data

- Weaknesses: Requires app-specific setup and ongoing maintenance

The benefit of APIs is that they speak directly with the application, automating data transfer. The tradeoff is that each connector requires setup and maintenance. In addition, not every app offers an accessible API or, creating gaps in coverage.

Agents

Endpoint agents offer the deepest level of discovery by monitoring software activity across user devices.

- Strengths: Deepest level of visibility across the user’s environment

- Weaknesses: High privacy and security concerns; resource-intensive to manage

Agents can capture all apps in use, sanctioned or not. However, this depth comes at a cost: privacy concerns, high security requirements, and a significant effort to deploy and manage across a large workforce.

Financial or Payment Records

Credit card and expense report data reveal purchases employees make outside IT channels.

- Strengths: Useful for surfacing shadow IT and employee-purchased tools

- Weaknesses: May lack context on usage or value

Using financial records helps identify shadow IT, which are often duplicate or redundant tools. Still, financial records do not show usage or business value, so they must be paired with other discovery methods to generate more complete insights.

Email Scanning and Scraping

Some discovery tools analyze email activity to detect new SaaS signups, flagging apps as soon as a user creates an account.

- Strengths: Detects SaaS at the moment of signup

- Weaknesses: Raises significant privacy concerns; typically blocked in enterprise environments

While effective in theory, email scraping raises significant privacy concerns. In enterprise environments, this approach is often hindered due to data protection standards.

Web Proxy

Proxies track outbound web traffic, providing a lens into which SaaS tools employees access online.

- Strengths: Good for identifying shadow IT

- Weaknesses: Limited visibility into actual usage or contract details

Web proxies are effective for detecting shadow IT, but they lack depth. They can’t show how often apps are used, who owns the licenses, or what the costs are, which limits their usefulness in optimization.

Which SaaS Discovery Method Is Right for You?

No single discovery method solves every challenge. The right choice depends on your organization’s priorities, risk tolerance, and resources:

- For high-security environments, CASBs and agents may be essential.

- For cost optimization, API connectors and financial records give the clearest view of spend and shadow IT.

- For rapidly growing portfolios, AI-powered models scale most effectively over time.

The most effective strategy blends multiple methods. By layering your approaches, you:

- Achieve broader coverage across your SaaS environment

- Reduce blind spots that leave risk and waste unchecked

- Gain richer context for decision making by combining financial, technical, and user-level data

This mix creates a comprehensive and resilient discovery process that supports cost control, compliance, and growth.

How a Discovery Process Drives SaaS Visibility

A structured discovery process gives you the foundation for effective SaaS Management. Instead of piecing together information from scattered systems, treat discovery as a continuous cycle that delivers visibility you can act on right away.

Follow these steps to get visibility:

- Discover all your SaaS

- Catalog the data

- Track constantly

Step One: Discover All Your SaaS

Identify every application in use across your business—whether purchased by IT, a business unit, or an employee. Because most organizations we work with underestimate the size of their portfolio and spend, assume you have some blind spots.

Use a SaaS Management Platform like Zylo to automatically surface both sanctioned and unsanctioned apps.

Step Two: Catalog the Data

Once you’ve identified your applications, capture and centralize key data for each application in a system of record. Track:

- Spend

- Usage

- Contract terms

- Application owners.

This catalog becomes your single source of truth that IT, finance, and procurement can all rely on. By building your system of record with accurate data from the start, you’re well positioned to optimize spend, reduce risk, and drive business value.

Step Three: Track Constantly

Because SaaS portfolios change fast, it’s essential to keep your system of record up to date. With an SMP you can:

- Ensure ongoing discovery of new applications

- Set automated alerts to know when new apps are purchased

- Track key metadata for new applications

- Watch for shifts in usage or license allocation to prevent unmanaged costs from accumulating

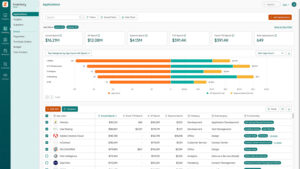

Using SaaS Discovery to Optimize Your Portfolio

Discovery provides more than a list of applications. When combined with ongoing analysis, it becomes a tool for optimization—helping you streamline your portfolio, prepare for renewals, and maximize the value of every license.

SaaS discovery helps optimize your portfolio by understanding:

- Number of applications in use

- Renewals on the horizon

- Spend

- License utilization

Number of Applications in Use

Most organizations underestimate how many SaaS applications they have—by a lot. Cataloging this total footprint is the first step in optimization. A comprehensive inventory enables you to:

- Identify duplicate tools

- Determine apps with overlapping functionality

- Simplify complexity across the business

Renewals on the Horizon

With nearly one renewal per business day, visibility into contract end dates helps procurement teams stay proactive. By centralizing contract and renewal information, you can:

- Build a renewal calendar that ensures alignment across stakeholders

- Prioritize renewals by impact

- Operationalize key milestones for renewal execution

- Ensure time to assess business needs and negotiate with SaaS vendors

- Drive more cost savings that can be reinvestmented in the business

Spend

With financial discovery, organizations get visibility into their total SaaS expenditures. By reconciling financial records with license and usage data, leaders can:

- Get an accurate picture of total spend

- Highlight overspending

- Reclaim wasted budget

Reduce wasted SaaS spend by:

- Rightsizing license quantities at renewal

- Canceling redundant and unnecessary applications

- Consolidating duplicate spend and contracts

License Utilization

License utilization is an indicator of waste—and an often underrated optimization lever. SaaS discovery paired with usage analytics shows where licenses are sitting idle. It helps you:

- Deprovision inactive and improperly offboarded users

- Reallocate license to users who need one

- Ensure spend matches value

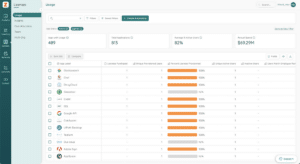

Benchmarking Your SaaS

Discovery data is more powerful when measured against benchmarks, providing a sense of where optimization opportunities exist.

Here are three areas where benchmarking adds value:

- Portfolio benchmarks

- Popular applications benchmarks

- Price benchmarks

Benchmarks turn raw data into strategic guidance. They provide context that helps decision makers prioritize:

- Rationalization

- Renegotiation

- Reallocation of the budget

Even high-level comparisons can uncover millions in potential savings. By layering Zylo’s Benchmarks on top of discovery, organizations shift from reactive cost-cutting to proactive portfolio management.

Portfolio Benchmarks

Benchmarking the size of your SaaS portfolio helps understand how your environment compares to those of your peers. It can help you:

- Gauge tool proliferation

- Understand where growth is occurring

- Identify potential areas for consolidation

For example, organizations with similar employee counts may average a set number of applications, while yours could be significantly higher. Upon this discovery, you would want to investigate where duplication and rationalization could reduce complexity.

Popular Applications Benchmarks

Popular Applications Benchmarks

By comparing your adoption of top applications with peer usage, you can determine whether your teams are aligned with industry trends or using niche tools that add cost without a clear advantage. For example:

- You use Apple iCloud for file sharing, but Microsoft OneDrive is more widely used. This could be a case to evaluate other vendors if iCloud is not serving your needs.

- Your marketing team uses Miro to collaborate, but you also have Lucid Suite, Slack, and Google Workspace. This indicates functional overlap, which you may want to evaluate reducing.

Understanding popular applications benchmarks help procurement and IT standardize on widely adopted tools, reducing support overhead and improving collaboration.

Price Benchmarks

SaaS pricing varies widely by vendor and contract terms. Benchmarking helps determine whether you are paying more than comparable organizations for the same applications.

Based on the previous Miro example, let’s say you plan to renew it. The vendor quotes you $315 per license per year for 20 users, which is above the price benchmark. You’d take the insight to renewal and use it as leverage to negotiate a fairer rate and stronger contract terms.

“Benchmarking data is a powerful tool to drive your SaaS strategy. As a CIO, I’m always trying to balance how I equip my teams with the best tools while ensuring we’re making smart investments. Zylo Benchmarks is a powerful tool that will help technology leaders achieve that elusive balance.”

— Cynthia Stoddard, former Senior Vice President, and Chief Information Officer at Adobe

Best Practices in SaaS Discovery

You can’t manage SaaS effectively without a reliable process for visibility. Instead of piecing together information from scattered systems, build discovery into your daily operations as a continuous cycle you can act on right away.

Here are the four key steps you need to follow for successful SaaS management:

- Setting clear evaluation data

- Involving cross-functional teams

- Prioritizing security and compliance

- Ensuring scalability and integration

Setting Clear Evaluation Criteria

Before choosing a discovery solution or process, define what success looks like.

- What is our goal for SaaS discovery?

- What types of SaaS do we need to uncover?

- Are we focused on shadow IT, usage optimization, contract management, or all of the above?

Establishing clear goals helps you:

- Choose the right tools

- Set realistic expectations

- Measure impact

- Ensures your team is aligned on what matters most

- Define what “complete discovery” means in your environment

Involving Cross-Functional Teams

SaaS doesn’t live in just one department—so your discovery efforts shouldn’t either. Involving stakeholders from IT, procurement, finance, and individual business units:

- Brings broader insight and more accurate data

- Builds trust in the process

- Improves program adoption

- Keeps stakeholders engaged and proactive

Prioritizing Security and Compliance

Discovery tools must strike a balance between visibility and responsibility. Look for solutions that:

- Respect employee privacy and

- Support compliance standards (like SOC 2 or GDPR)

- Avoid invasive practices like scraping emails or browser monitoring—especially in enterprise environments.

Security shouldn’t be compromised for the sake of discovery. Select tools and practices that both identify risks and mitigate them.

Ensuring Scalability and Integration

What works for a 500-person company won’t scale to 10,000. As SaaS portfolios grow, discovery systems must scale with them, supporting:

- Thousands of apps

- Multiple data sources

- Evolving business needs

Prioritize tools that integrate easily with your existing systems: SSO, financial platforms, and SaaS providers. Seamless integrations reduce manual work, improve data accuracy, and make continuous discovery part of your everyday operations—not a separate project.

SaaS Discovery in Action

SaaS discovery isn’t just a concept—it’s delivering real results for organizations of all sizes. Here’s how five leading companies have used Zylo’s platform to uncover blind spots, reclaim budget, and drive strategic outcomes.

- Modernizing Medicine: Visibility Powers License Optimization

- BlackLine: SaaS Discovery Fuels Better Governance

- Adobe: SaaS Discovery Enables App Rationalization and Standardization

- The Home Depot: Applying FinOps Thinking to SaaS

- MGM Resorts: Building Visibility and Reducing Redundancy

Modernizing Medicine: Visibility Powers License Optimization

Healthcare software company Modernizing Medicine turned to Zylo to gain better visibility into its growing SaaS ecosystem. With multiple departments purchasing software independently, the organization lacked a centralized view of:

- Applications

- Ownership

- Spend

After adopting Zylo, the team discovered over 300 SaaS applications, many of which were unmanaged or duplicative. This visibility helped ModMed streamline license management, eliminate inefficiencies, and reduce manual effort.

“We were playing a game of Whack-A-Mole,” said Trenton Cycholl, VP of IT and Digital Business. “It was a very manual process, and the data wasn’t always accurate. With Zylo, we now have a single source of truth that gives us the visibility and confidence we need.”

Outcomes driven by SaaS discovery:

- Avoided $1.4M in unnecessary costs by reclaiming 2,800 unused licenses via automation

- Saved $1.6M by canceling 122 unused apps and rightsizing licenses at renewal

- Secured 156 applications behind single sign-on, supporting compliance efforts

BlackLine: SaaS Discovery Fuels Better Governance

BlackLine partnered with Zylo to better manage its expanding SaaS inventory. Within weeks of implementing discovery, the company identified about 90 applications that had never been formally accounted for in their inventory.

“With Zylo, we quickly found tools that were unused or duplicative and were able to take immediate action, saving over $100,000 in annual SaaS costs.” said

— Julie Day, Staff IT Asset Manager at BlackLine

That immediate visibility laid the groundwork for stronger governance: aligning ownership, closing gaps in access and permissions, and ensuring that all apps met internal policy standards before renewal or expansion decisions.

Outcomes driven by SaaS discovery:

- Avoided $60,000 in unnecessary costs in just the first month of it program

- Increased applications enabled with single sign-on (SSO) by 400%

- Reduced expense software spend by 49%

Adobe: SaaS Discovery Enables App Rationalization and Standardization

Adobe’s SaaS spend was growing faster than revenue, but limited visibility made it difficult to manage usage, reduce redundancy, or support employees effectively. With Zylo, the team discovered 2,600 SaaS applications—nearly 50% more than estimated.

“Zylo provided the AI we used to identify current titles and categorize them according to functional area, saved approximately 500 hours at the onset of the project and became the backbone of how we divided our software portfolio.”

— Vinod Vishwan, Sr. Director, Head of Business Planning & Operations at Adobe

From there, Adobe rationalized its portfolio, identifying and eliminating redundant tools and underutilized subscriptions. With clear visibility, the IT and SAM team standardized on fewer software titles for shared functions, reduced overlap, and strengthened vendor agreements.

Outcomes driven by SaaS discovery:

- Identified and categorized 2,600 applications, gaining complete inventory visibility

- Achieved $60M in cost savings and avoidance

- Rationalized apps and standardized to 400 preferred software titles,

The Home Depot: Applying FinOps Thinking to SaaS

Home Depot’s story shows how applying FinOps principles to SaaS starts with discovery. By mapping all SaaS usage and spend across departments, Home Depot identified redundant tools and overlapping efforts. They instituted better intake and procurement controls, ensuring new purchases fit into existing contracts or tools.

The Home Depot example highlights how discovery isn’t a one-time audit, but rather a continuous process that must be applied to control spend and avoid surprises during renewals.

“I’m telling you, you’ve got a problem. You just don’t know that it’s a problem yet until you start going down this path and trying to identify everything that’s out there.”

— Ridge Fussell, Sr. Manager of FinOps at The Home Depot

MGM Resorts: Building Visibility and Reducing Redundancy

MGM Resorts used its 2025 FinOps journey to reset SaaS discovery efforts. Early in the process, they discovered that they had 42 different project management tools in use — a clear sign of redundancy. They developed a new software intake process to prevent future duplication and ensure that new software requests were reviewed against existing software.

The change wasn’t just technical: it involved change management, communication, and establishing new accountability for software ownership. The result was better governance, more coherent spend, and a foundation for optimizing rather than reacting.

From Visibility to Value: Measuring SaaS Discovery Results

To deliver real business value, organizations must translate visibility into measurable results. That requires:

- Defining key performance indicators

- Monitoring post-implementation performance

- Continuous evaluation and optimization

- Aligning discovery with broader IT and business goals

Defining Key Performance Indicators

Key Performance Indicators (KPIs) set the foundation for measuring success. At Zylo, we recommend tracking:

- SaaS application count

- Annual SaaS spend

- Spend source breakdown

The most effective SaaS KPIs go beyond surface-level counts and reveal how applications affect budgets, risk, and productivity. By consistently tracking a handful of meaningful metrics, organizations create a baseline to compare progress over time.

SaaS Application Count

The number of SaaS applications in your portfolio is a simple but telling measure. Tracking the application count before and after discovery reveals how much hidden software was brought into view and whether rationalization efforts are reducing software sprawl.

Annual SaaS Spend

Annual spend is the headline number for SaaS Management due to its impact on the business. Monitoring spend over time highlights whether discovery and optimization are delivering financial improvements or if costs are still accelerating unchecked.

Spend Source Breakdown

Breaking down spend by department or cost center provides clarity into ownership in a decentralized purchasing environment. This metric shows whether governance initiatives are gaining traction and helps pinpoint areas where rogue spend still prevails.

Monitoring Post-Implementation Performance

As mentioned before, SaaS discovery must be ongoing to ensure new applications are surfaced as they appear. By monitoring performance after initial discovery, you can understand whether shadow IT remediation efforts are working.

Continuous Evaluation and Optimization

Ongoing evaluation and optimization of your SaaS portfolio is essential to achieve business results. It helps you regularly identify and act on opportunities to:

- Save money

- Avoid unnecessary spending

- Improve software adoption

- Mitigate security and compliance risks

By regularly comparing utilization, spend, and renewal outcomes against KPIs, organizations can identify underused licenses, redundant tools, or unfavorable contract terms. Automated workflows, like license reclamation, drive ongoing efficiency rather than one-time savings.

Aligning Discovery with Broader IT and Business Goals

The ultimate measure of discovery’s value is its impact on strategic goals. Visibility enables CIOs and finance leaders to align technology portfolios with company priorities, whether that means:

- Gaining inventory visibility and insights (powered by SaaS discovery)

- Avoidance of unnecessary and preventable costs

- Realized, hard cost savings

- Maintained record of compliance

When discovery is tied to broader goals, it becomes more than cost control. It becomes a driver of business performance.

The Future of SaaS Discovery: AI’s Growing Role

Discovery methods are evolving rapidly, and artificial intelligence is at the forefront of this shift. AI enhances SaaS discovery in three main ways:

- Automated matching models that process millions of data points daily

- Real-time anomaly detection that flags unexpected spend or new sign-ups

- Continuous learning that improves accuracy as portfolios grow

Traditional approaches like rules or connectors still have value, but AI now enables a level of scale and precision that wasn’t possible before. In 2025, enterprises using AI in their discovery workflows are:

- Finding more applications

- Identifying shadow IT faster

- Improving overall data quality

The result is a discovery process that can keep pace with a steep portfolio growth rate. As SaaS adoption accelerates, AI ensures that discovery remains accurate, proactive, and scalable.

Strategically Manage Software with Zylo’s SaaS Discovery & Inventory

Effective SaaS discovery is the foundation for cost control, risk management, and stronger governance. When paired with visibility, it gives IT and finance leaders the clarity they need to reduce waste, improve security, and align software portfolios with business priorities.

Zylo’s platform was built to make this process seamless:

- Continuously monitoring your environment

- Surfacing hidden apps

- Uncovering savings opportunities across even the largest portfolios

With discovery as the first step, organizations can move confidently from visibility to optimization, ensuring SaaS investments deliver lasting value.

Ready to see the power of SaaS discovery in action? Schedule a demo with Zylo today and discover how complete visibility can help achieve your business outcomes..

Frequently Asked Questions About SaaS Discovery

What is the SaaS discovery process?

SaaS discovery is the practice of identifying every application in use across an organization, including sanctioned and unsanctioned tools. The process involves mapping applications, usage, and spend so leaders gain full visibility into the technology portfolio.

How can SaaS discovery benefit my organization in terms of efficiency and cost savings?

Discovery helps you identify duplicate contracts, underutilized licenses, and unauthorized purchases—all of which drive waste reduction. Once the software landscape is fully visible, organizations can reclaim millions annually by right-sizing license counts, consolidating overlapping tools, and controlling renewals more effectively.

What are the key features to look for in a SaaS discovery tool?

The most effective tools combine multiple data sources—financial records, SSO logs, CASB integrations, and AI matching models—to capture both sanctioned apps and shadow IT. Look for platforms that offer real-time monitoring, customizable reporting, and automated workflows to enable quick action on discoveries.

How can I implement a SaaS discovery process in my existing IT infrastructure?

Implementation typically begins with connecting financial systems and access management tools, followed by the layering in of API connectors. By integrating discovery into existing IT and procurement workflows, organizations build a single source of truth without creating extra manual work.

What challenges might my organization face during the SaaS discovery process, and how can they be overcome?

Common challenges include privacy concerns, incomplete data, and resistance from employees wary of oversight. These can be mitigated by choosing transparent tools, clearly communicating goals, and aligning IT, finance, and business leaders on the purpose of discovery: reducing risk and enabling smarter software investment.

Renewals

Renewals — Ksenia Kouchnirenko, VP of Enterprise Operations and Technology at Verkada

— Ksenia Kouchnirenko, VP of Enterprise Operations and Technology at Verkada

Popular Applications Benchmarks

Popular Applications Benchmarks — Cynthia Stoddard, former Senior Vice President, and Chief Information Officer at Adobe

— Cynthia Stoddard, former Senior Vice President, and Chief Information Officer at Adobe — Vinod Vishwan, Sr. Director, Head of Business Planning & Operations at Adobe

— Vinod Vishwan, Sr. Director, Head of Business Planning & Operations at Adobe — Ridge Fussell, Sr. Manager of FinOps at The Home Depot

— Ridge Fussell, Sr. Manager of FinOps at The Home Depot