5 Industry Experts Weigh In on the 2026 SaaS Management Index

Table of Contents ToggleWhat FinOps Means in the Modern Cloud EnvironmentWhy...

Back

Back

Search for Keywords...

Blog

01/02/2026

Table of Contents

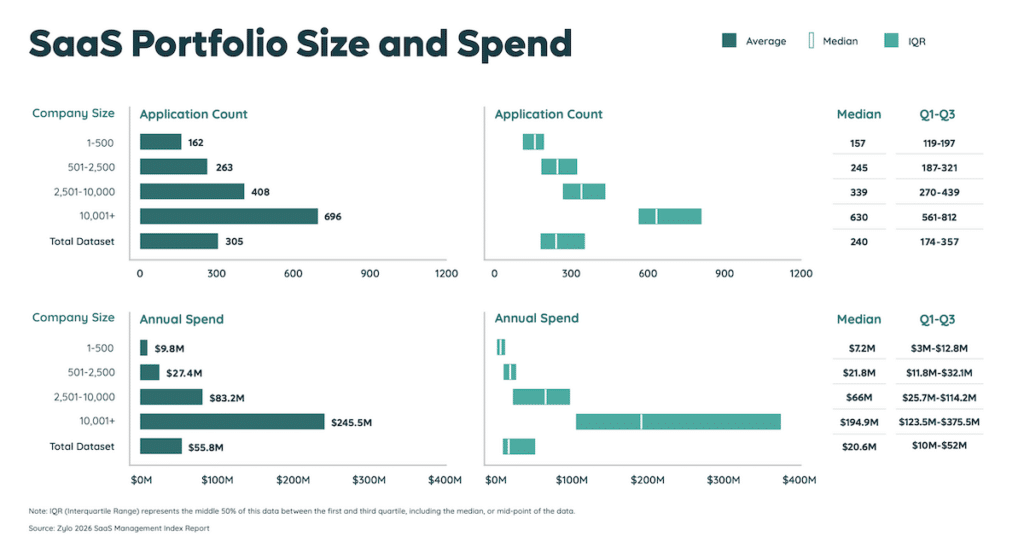

Over the last 12 months, managing costs beyond public cloud has been a top-three priority for FinOps, and will continue to be critical in 2026. The challenge: Zylo’s 2025 SaaS Management Index shows that large enterprises manage an average of 696 SaaS apps, with more added every day. This makes it harder to track spending, measure efficiency, and prove the value of every dollar. The solution: FinOps software.

Modern FinOps practices depend on real-time data, shared accountability, and automated insights. With a FinOps tool in place, you can scale those foundations and ensure ongoing cost optimization as your cloud and SaaS footprint grows.

In 2026, Gartner projects worldwide IT spending (including IaaS and SaaS) to reach $1.43T, a 15.2% year-over-year increase. As costs continue to balloon, FinOps becomes an increasingly important business practice to control costs and drive financial accountability, while enabling innovation.

To do that, modern cloud environments require operational discipline and collaboration across engineering, finance, and procurement. Through shared data, teams can:

FinOps software centralizes financial and usage data needed to manage and optimize cloud and SaaS spend. It allows teams to:

Using FinOps software includes a variety of benefits, including:

With a FinOps tool, you get a single view of spend and usage by service, project, and department across your cloud provider (e.g., AWS, Azure, Google Cloud) and SaaS. Better cloud spending visibility enables you to:

FinOps software gives you clearer control over cloud and SaaS costs. Instead of reacting to end-of-month invoices, you gain continuous visibility into consumption patterns and unit costs. This helps teams make faster, more informed decisions and reinforces shared accountability.

FinOps platforms help finance, engineering, and procurement teams work from a single source of truth. When everyone sees the same numbers, it becomes easier to assign ownership and drive cost-aware behavior. You can:

This transparency helps you avoid finger pointing and strengthens decision making. Teams understand how their actions affect cloud and SaaS costs, and you gain a clearer link between resource consumption and business value.

Shared dashboards and standardized reporting bring together engineering, finance, and product teams. Instead of siloed conversations, FinOps tools support a collaborative approach that lets everyone participate in:

These platforms also help you establish common terminology and shared KPIs. Teams can coordinate around:

And do so without debating how the numbers were calculated.

FinOps software eliminates the need for spreadsheets, automating many of the time-consuming tasks that slow down cloud cost management. It increases operational efficiency by:

Real-time visibility and historical usage data from FinOps software speeds up budget planning cycles. As a result, it is easier to:

FinOps tools improve cost allocation by linking usage to teams, projects, or applications at a granular level. By implementing showbacks, you help teams understand their cost footprint. Meanwhile, chargebacks bill teams based on actual consumption.

This accuracy helps drive cost-conscious decisions where teams can:

FinOps software helps improve outcomes by providing recommendations for license rightsizing, eliminating waste, and shifting to more efficient pricing models. You get insights that help engineering teams tune workloads and finance teams negotiate cloud and SaaS contracts with better data.

These optimization opportunities compound over time. As visibility improves and accountability rises, your environment naturally becomes more cost-efficient.

As organizations adopt more software, costs become more unpredictable. FinOps tools help you understand consumption patterns across cloud and SaaS, enabling:

FinOps software is the operational backbone of a modern FinOps practice and includes the following core capabilities.

FinOps software gives you clearer insight into your cloud and SaaS spending and helps you shift from reactive reporting to continuous management. These platforms strengthen governance by improving tagging and allocation accuracy while reducing manual effort. Together, these capabilities create a stronger operational foundation and help teams make confident cost decisions.

FinOps tools help you identify waste, rightsize resources, and evaluate pricing models. You can analyze:

This visibility enables faster and more proactive optimization. Most platforms also provide prescriptive recommendations. These insights guide engineering teams toward more efficient architectures and help procurement negotiate better terms during renewals.

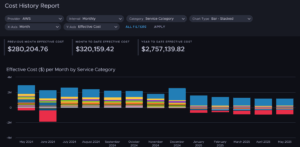

Real-time dashboards help you track consumption as it happens and spot cost spikes before they become problems. You can:

Advanced analytics then help you look ahead with more confidence. They allow you to compare historical trends and evaluate seasonal patterns so your forecasts reflect actual behavior rather than assumptions.

FinOps software supports stronger cost allocation and governance by helping you:

FinOps software strengthens efficiency through automation and direct cloud integrations. You can:

FinOps depends on accurate, consistent tagging. Software platforms help you:

FinOps software should integrate with your cloud provider and financial systems to unify disparate data. This enables you to:

These connections enable more accurate reporting and reduce the effort required to reconcile invoices with actual usage. Alignment between technical and financial data enables all teams to collaborate around a single source of truth.

FinOps platforms analyze workloads and suggest ways to reduce excess capacity. You can quickly find opportunities to:

By taking these actions, you maintain a leaner, more cost-effective environment. In addition, engineering teams understand context and measurable impact before changes are made.

FinOps software lets you model how different factors, such as usage changes, new projects, or pricing updates, may affect spend. This capability:

Cloud cost management approaches vary depending on whether you’re talking to practitioners or vendors. Practitioners make decisions under daily pressure, while vendors build platforms shaped by their own design philosophies. To understand each approach and where they align, examine:

FinOps practitioners must manage rapidly changing cloud and SaaS environments while supporting innovation. Engineers need clear, actionable insights. Finance depends on reliable cost allocation and forecasting data. Procurement needs timely visibility to strengthen renewal negotiations.

The biggest major challenge is data overload. Practitioners often work from disconnected dashboards, vendor portals, and spreadsheets that lack context. As a result, they struggle with:

These gaps make it harder to manage costs effectively and maintain accountability across teams.

Vendors often emphasize automation and analytics, but they approach these priorities differently. Some rely on cloud provider data, while others enrich it with additional intelligence. Many also design around AI-driven insights, yet the depth and quality of those capabilities vary. You’ll see tools focus on:

Vendors also differ in how they balance usability with control. Some favor engineering-centric workflows, while others prioritize detailed financial oversight. The most effective tools combine both to support rapid decisions and provide a clear justification for each recommendation.

Effective FinOps tools support the full cost management lifecycle without adding operational burden. They typically include:

Strong tools also integrate with engineering systems and financial platforms, so every team works from consistent data. Adaptability matters as well. Platforms should handle simple tagging checks and more complex multi-cloud requirements without forcing teams to rebuild processes.

Alignment occurs when FinOps software delivers insights practitioners can act on immediately. Different teams benefit in different ways:

When tools bridge these needs, organizations create a shared operational language. That alignment supports predictable spending and helps cloud and SaaS environments scale without introducing unnecessary cost or friction.

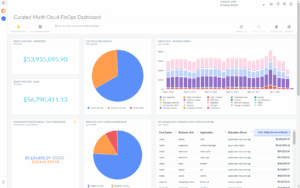

FinOps software comes in several forms, from comprehensive platforms to targeted point solutions. Each of the following categories supports different levels of visibility, automation, and governance, giving you options that match your team’s maturity and cloud environment.

Full-stack FinOps platforms provide broad, end-to-end visibility and governance for teams to manage cloud costs and optimize the value of all technology investments. They support:

Organizations often use full-stack platforms for breadth but layer on specialized tools to cover gaps as their FinOps practice matures.

Point solutions for FinOps focus on targeted capabilities and offer deeper functionality than broad platforms in specific areas. They are commonly used for:

Teams adopt specialized tools when they need advanced analytics or automation that general-purpose platforms do not provide. They can add value quickly, but they also increase complexity when not integrated into a broader cost management workflow.

Native tools—such as AWS Cost Explorer or Azure Cost Management—offer a starting point for teams early in their FinOps journey. They provide baseline visibility, budgeting, dashboards, recommendations, and cost allocation features.

Because they pull directly from provider data, they deliver reliable foundational reporting. However, these tools fall short when organizations need:

New FinOps categories are developing as cloud usage and architectures evolve. These include:

These solutions address gaps created by rapid cloud growth and the increasingly distributed nature of tech environments. Typically, they complement core FinOps platforms and extend capabilities into areas where traditional tools offer limited depth.

Selecting the right tool mix depends on your cloud footprint, FinOps maturity, internal skills, and long-term goals. Organizations with complex environments may rely on a full-stack platform for governance while adding point solutions for deeper optimization. Smaller teams may start with native tools and expand as their needs grow.

The most potent mix evolves with your environment. Prioritize tools that:

A stack built around these principles helps you scale cloud usage with confidence while keeping spend aligned with business value.

Some of the most widely adopted FinOps and cloud cost management tools teams rely on for visibility, optimization, and governance include:

FinOps tools vary widely in depth, automation, and integration quality. This list reflects commonly adopted platforms across engineering, finance, and procurement teams. Each supports different levels of maturity, from basic visibility to advanced optimization at scale.

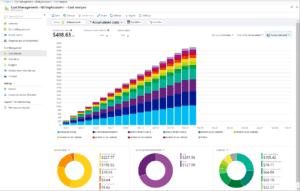

CloudHealth is a multi-cloud management platform offering visibility, governance, and optimization. It stands out for its strong policy-driven governance framework, which helps large organizations standardize cloud operations across many teams.

AWS Cost Explorer provides native AWS reporting, budgeting tools, and recommendations. Teams value it for its direct integration with AWS billing data, making it a reliable entry point for early FinOps practices.

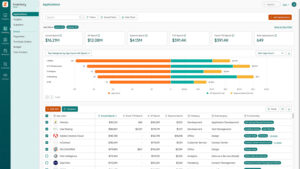

Zylo is a SaaS Management platform that helps enterprises reduce software costs via application usage, renewal management, and license optimization. What sets it apart is its focus on SaaS—a capability cloud-only tools cannot address. With the FinOps Foundation now recognizing SaaS as an official scope area, Zylo has become essential for managing the fastest-growing portion of enterprise technology spend.

Azure Cost Management delivers native reporting, budgeting, and optimization tools for Azure workloads. Its appeal lies in its tight integration with Azure services, though it lacks deeper multi-cloud and SaaS visibility as organizations scale.

GCP Cost Management provides cost breakdowns, forecasts, and recommendations for Google Cloud environments. It is most effective for teams centralized on GCP, offering native insights that are harder to reproduce across multi-cloud or SaaS ecosystems.

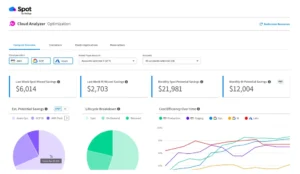

Spot by NetApp automates optimization through rightsizing, workload placement, and spot-instance orchestration. It distinguishes itself through active, hands-off efficiency improvements that continuously adjust infrastructure to reduce spend.

Apptio Cloudability—now called IBM Cloudability—offers enterprise-grade reporting, allocation frameworks, forecasting, and governance workflows. Organizations choose it for its strong financial controls and ability to support detailed cost modeling across teams.

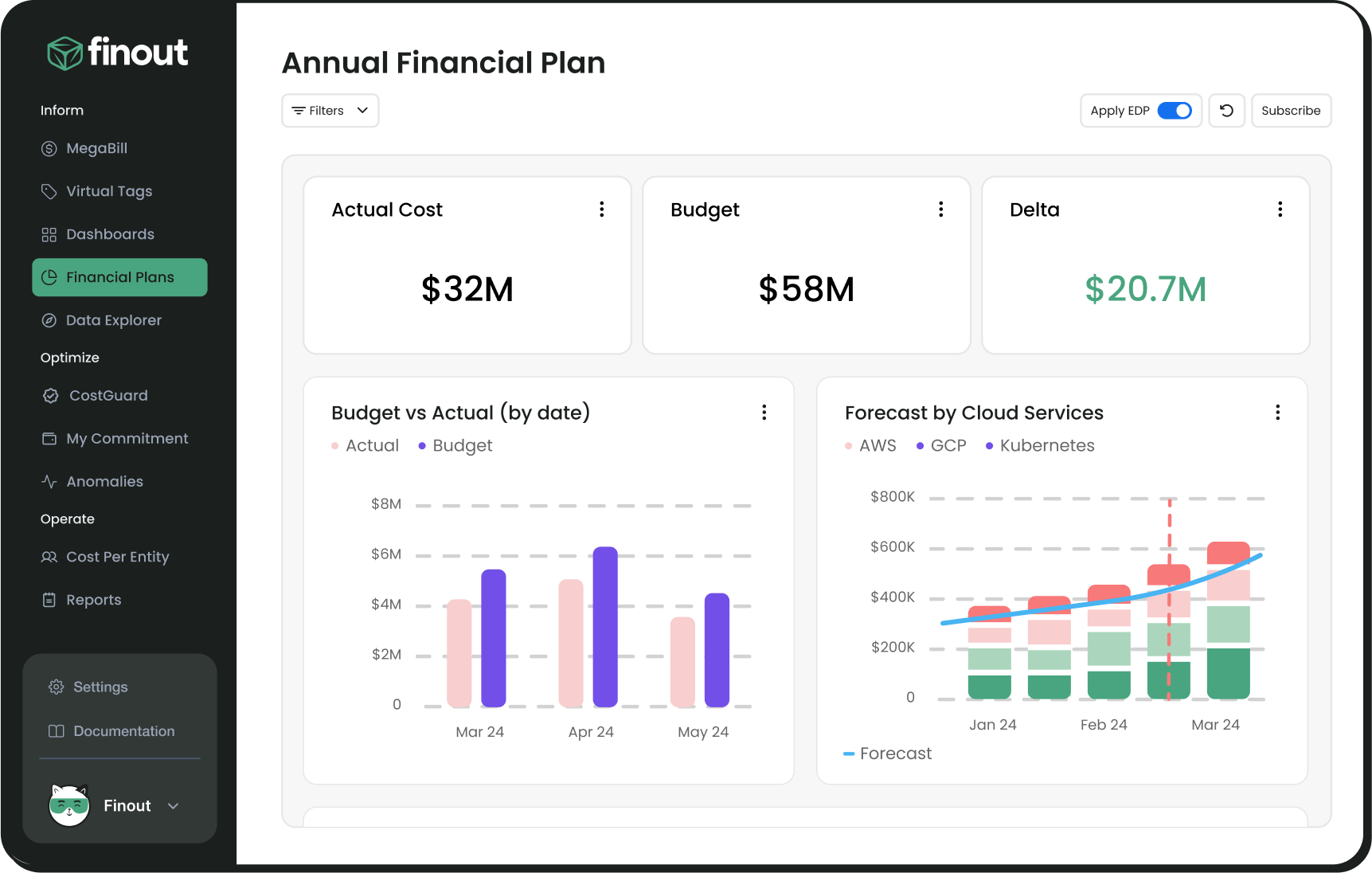

Finout is a cost observability platform that breaks down spend by microservice, team, or product. Its unique strength is in delivering unit-economic insights that help engineering leaders understand how specific workloads drive costs.

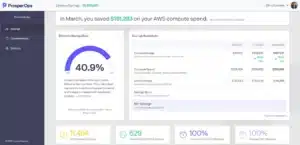

ProsperOps automates AWS Savings Plan and Reserved Instance management. Users appreciate its continuous optimization engine, which improves coverage and reduces commitment risk without manual intervention.

Selecting the right FinOps solution requires evaluating how well a tool fits your environment, supports your teams, and adapts as your cloud and SaaS footprint grows. The strongest platforms balance usability with governance and provide the clarity needed to make confident cost decisions. Look for:

Your FinOps solution should adjust as your cloud and SaaS usage expands. Look for tools that scale across multiple teams and handle different architectures without forcing process changes.

FinOps works only when everyone can participate. Choose tools that are simple enough for non-technical teams yet detailed enough for engineering and finance. Straightforward navigation and shared dashboards help align decisions.

Solutions should reinforce your existing controls. Priorities include:

These safeguards protect your financial data and maintain trust across teams.

Vendors differ in how they price their tools. Consider subscription costs alongside the internal effort required to maintain integrations or workflows. A solution with lower overhead may offer better long-term value.

FinOps spans multiple disciplines. Your platform should support:

Shared access reduces friction during planning and reviews.

Cloud and SaaS pricing continue to shift toward consumption pricing models. Choose tools that can interpret:

These capabilities help you plan effectively as cost structures evolve.

Your FinOps stack should connect smoothly to cloud platforms, financial systems, and engineering tools. Strong integrations reduce manual effort and ensure all teams work from the same data.

FinOps software delivers the most value when it supports repeatable practices, shared accountability, and clear financial visibility. The following best practices help teams turn software features into measurable outcomes:

Adoption begins with shared expectations. Encourage engineers, finance, and procurement to participate in reviews and understand how their decisions affect spend. When teams see the same data, they collaborate more effectively.

Reliable processes help you plan with confidence. Use your FinOps platform to validate forecasts, track variances, and adjust budgets as usage patterns evolve. Consistency reduces surprises and strengthens financial predictability.

Accurate data is the foundation of meaningful insight. Improve visibility by keeping tags current, validating allocation rules, and reviewing metadata regularly. Strong hygiene prevents reporting gaps and avoids rework.

Cost trends change quickly. Schedule recurring reviews to analyze anomalies, validate savings, and address unexpected drivers. Continuous monitoring prevents minor deviations from becoming budget risks.

Shared KPIs help teams prioritize the same outcomes. Track common metrics like unit costs, allocation accuracy, and optimization savings. When KPIs align, conversations become faster and more objective.

Benchmarking highlights whether services, teams, or applications are trending above expected cost levels. Compare performance to historical data or peer environments to find areas for deeper optimization.

Proactive alerts prevent missed deadlines and rushed negotiations. Set automated reminders for contract renewals, license expirations, and pricing changes so procurement and finance can prepare with accurate data.

As environments blend cloud services with large SaaS portfolios, integrated visibility becomes essential. Combine your cloud and SaaS data sources to improve forecasting, understand total spend, and reduce hidden costs.

FinOps software delivers value only when teams can adopt it effectively. Organizations that address the following challenges build a stronger, more sustainable FinOps practice.

Teams may hesitate to adjust workflows or incorporate financial accountability into daily decisions. Implement clear communication, shared goals, and consistent leadership support to make adoption smoother and help teams see the benefits of cost awareness.

“We still want to empower employees to do whatever it is they need to do, but we’re just putting a couple of little speed bumps so that we’re following the Home Depot process on software acquisitions.”

— Ridge Fussell, Sr. Manager of FinOps at The Home Depot

FinOps platforms work best when they connect to your engineering, finance, and procurement tools. Close gaps in integrations to speed up implementation or eliminate duplicate work. Prioritize solutions that offer strong APIs and prebuilt connectors.

FinOps insights depend on accurate and well-governed data. Clearly define best practices for tagging, ensuring consistent metadata, or assigning ownership. In addition, address privacy and access controls to ensure sensitive financial and usage data stays protected.

As cloud and SaaS usage expand, governance becomes harder to maintain. Mature FinOps practices include automated policies, routine audits, and continuous monitoring to keep environments aligned with organizational standards.

FinOps software is evolving quickly as organizations manage larger, more distributed environments and new pricing models. The next generation of tools will emphasize automation, intelligence, and sustainability while giving teams clearer control over rapidly shifting cost drivers. In 2026, we will see:

AI and machine learning are beginning to automate tasks that previously required manual analysis. These models can predict spend, identify anomalies, and recommend architectural adjustments with greater accuracy. As pricing models become more usage-based, AI will play a larger role in guiding real-time decisions.

Future FinOps platforms will move beyond recommendations into automated execution. Organizations will rely on tools that enforce policies, clean up unused resources, and trigger optimization changes with minimal human intervention. This reduces operational overhead and improves consistency across environments.

Sustainability is becoming a formal part of cloud strategy. FinOps tools will increasingly track energy usage, carbon impact, and efficiency metrics. By connecting cost and sustainability data, teams can make decisions that support financial and environmental goals simultaneously.

As workloads span cloud infrastructure, SaaS applications, and AI platforms, FinOps tools must provide unified insight. Teams will rely on solutions that consolidate data across all three categories to understand total spend, align budgets, and optimize resources holistically.

According to the 2025 State of FinOps, respondents who manage AI spend significantly increased from 2024, reflecting the scale of investment in AI. For 2026, the report predicts that it will continue to grow, with 96% of organizations planning for AI investments.

As cloud and SaaS adoption accelerate, FinOps software provides the structure required to stay agile without losing financial control. The right tool will help you:

If you’re a FinOps leader who’s been asked to tackle SaaS, get the visibility you need with Zylo. Meet with our team to learn how Zylo can support your FinOps practices and business goals this year.

See why Zylo is recognized as the only “Customers’ Choice” in the 2025 Gartner Peer Insights “Voice of the Customer” Report for SaaS Management.

FinOps software helps organizations manage cloud and SaaS spending by centralizing cost data and improving visibility. They support budgeting, forecasting, optimization, and collaboration between engineering, finance, and procurement teams.

FinOps software gives teams real-time insight into usage and cost trends. It also reduces manual reporting work and helps organizations identify and eliminate waste, improve forecasting accuracy, and align spending with business value.

Most platforms connect directly to cloud environments and financial systems. Strong integrations let you combine usage data, allocation rules, and budget structures without duplicating workflows.

Look for tools that offer clear visibility, reliable governance controls, and flexible workflows. Strong solutions usually support:

Commonly used tools include CloudHealth, AWS Cost Explorer, Zylo, Azure Cost Management, GCP Cost Management, Spot by NetApp, Apptio Cloudability, Finout, and ProsperOps. Each supports different maturity levels and cost management needs.

AWS Cost Explorer is the primary FinOps tool for AWS environments. It provides native visibility, budgeting tools, and recommendations for optimizing AWS workloads.

No. FinTech focuses on financial technology products such as payment systems and banking software. FinOps is a cloud financial management discipline that aligns engineering, finance, and procurement around cost accountability.

Table of Contents ToggleWhat FinOps Means in the Modern Cloud EnvironmentWhy...

Table of Contents ToggleWhat Is SaaS Compliance?Why SaaS Compliance MattersKey Types...

Table of Contents ToggleWhat FinOps Means in the Modern Cloud EnvironmentWhy...

Table of Contents ToggleWhat FinOps Means in the Modern Cloud EnvironmentWhy...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |