5 Industry Experts Weigh In on the 2026 SaaS Management Index

Table of Contents ToggleWhat Is a SaaS License?Why SaaS Licenses MatterTypes...

Back

Back

Search for Keywords...

Blog

Table of Contents

Updated February 5, 2026 with new data.

Companies are buying SaaS (software-as-a-service) like never before. According to Gartner’s projections, global software spend will reach $1.43 trillion in 2026, a 15.2% year-over-year increase.

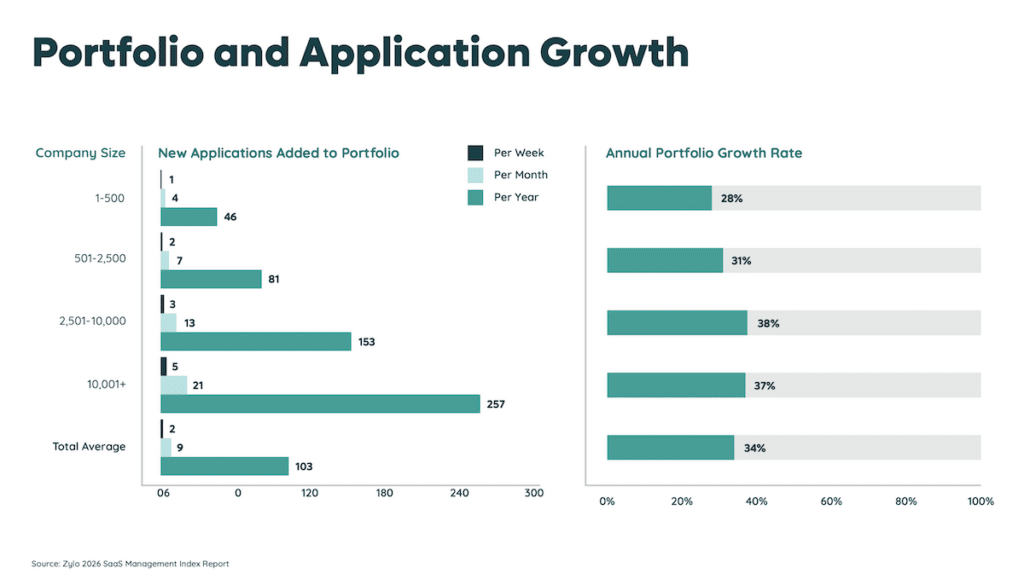

What’s most notable, however, isn’t the growth of the SaaS space—it’s how quickly companies accumulate new applications, subscriptions, and licenses. According to the 2026 SaaS Management Index, on average, organizations have 305 apps in their portfolio and add 9 new apps per month (34% annual growth).

What often gets lost in the shuffle of hundreds of applications: SaaS licenses and the sometimes-confusing “legalese” involved with managing enterprise software. In this blog, we’ll break down what goes into a SaaS license and why understanding licensing agreements matters.

A SaaS license is the formal agreement that defines:

Managing these licenses is critical for controlling SaaS costs and ensuring compliance. Here’s what you need to know:

A SaaS license provides access to a cloud-based application. Unlike traditional software licensing, SaaS licenses are usually based on a subscription model (monthly or annually) and are assigned to individual users or groups within a company.

Each license includes terms and conditions that govern:

SaaS vendors may offer different license tiers based on feature sets, usage volume, or user types (e.g., admin vs. read-only access). This variability means companies must pay close attention to what they’re buying and how it’s used.

Without proper software license management, companies often:

Understanding SaaS licenses matter due to:

Zylo’s 2026 SaaS Management Index shows that employees are responsible for 33.5% of apps and 3.7% of total SaaS spend.

These tools are often purchased without IT’s knowledge or approval, leading to:

When departments operate independently, shadow IT proliferates. Over time, the risks of unmanaged apps compound across the organization.

The average enterprise spends $55.8M annually on SaaS, yet many teams continue to buy duplicate tools or miss opportunities to consolidate vendors.

According to Gartner, organizations without centralized visibility into their SaaS portfolio will overspend by at least 25% through 2028.

This happens when:

Redundant tools increase both costs and complexity, weakening your negotiating position at renewal.

Zylo’s data shows that 59% of expensed apps carry a “Poor” or “Low” risk score, meaning they may lack basic controls like SSO, encryption, or audit logging.

Without application-level oversight:

When apps are added outside of normal review processes, it’s difficult to enforce identity, access, and compliance policies. This increases your exposure to data loss, regulatory noncompliance, and vendor-related risk.

A complete view of your SaaS environment — including app inventory, license assignments, and usage — is critical to reducing these risks.

Zylo’s 2026 Index reports that only 54% of SaaS licenses are used in the average enterprise, resulting in $19.8M in wasted spend annually.

Common causes include:

Unused licenses represent one of the most preventable forms of waste. With accurate usage data and automated reclamation workflows, this value can be recovered quickly.

Your SaaS licensing model determines how you’re charged, how access is managed, and how easily your organization can scale. Each model has its own tradeoffs. Understanding them is key to managing cost, controlling access, and planning renewals effectively.

Here’s a breakdown of the most common SaaS license models:

This is the standard model for most SaaS platforms. You pay a recurring fee (typically monthly or annually) for access to the product.

Subscription pricing can be paired with other models, such as per-user or tiered pricing.

A license is tied to each named user. Examples include Adobe’s Creative Cloud and Microsoft 365. It’s one of the most common models used in business SaaS.

This model can lead to waste if licenses are over-provisioned and not reclaimed after role changes or departures.

Also known as pay-as-you-go or consumption-based pricing. You’re billed based on how much of a resource you consume.

While flexible, this model makes budgeting difficult and often results in unexpected overages if usage isn’t closely monitored.

SaaS vendors offer multiple pricing levels or “tiers” with increasing functionality.

Tiered pricing is flexible but can result in overpaying if your teams don’t fully use the capabilities included in higher tiers.

Flat-rate pricing charges a single fixed fee for unlimited access to the product.

Flat-rate licenses can be efficient, but without usage data, it’s difficult to know if the flat fee truly delivers value.

Freemium pricing offers a limited version of the product at no cost, with optional paid upgrades.

Freemium licenses can bypass traditional procurement, increasing the risk of shadow IT if not tracked.

With per-feature pricing, users pay for access to specific functionalities, often within a base tier or per-user license.

Organizations using this model must monitor adoption and usage to avoid paying for unused capabilities.

Similar to per-feature pricing but more granular, with specific features priced individually as add-ons.

Without oversight, costs can scale quickly as teams activate more capabilities over time.

Choosing between perpetual and SaaS licenses impacts how you pay for software, manage risk, and support long-term growth. Each model comes with tradeoffs in cost, control, and operational overhead. Here’s how they compare across five key dimensions:

Perpetual licenses require a one-time, upfront payment for indefinite use. This is treated as a capital expenditure (CapEx) and can place significant strain on budgets, especially for enterprise deployments.

SaaS licenses follow a recurring subscription model, typically billed monthly or annually. This shifts spending to operational expenses (OpEx) and allows organizations to align cost with actual usage over time.

Perpetual software often requires separate support contracts and manual upgrades, which can be costly and resource-intensive to manage.

SaaS licenses typically include updates, maintenance, and support in the subscription price. New features, security patches, and bug fixes are delivered automatically, reducing IT overhead and improving agility.

Perpetual licenses are difficult to scale. Adding new users or features often involves renegotiating contracts or purchasing new licenses—and implementation can be slow.

SaaS models are built for dynamic scaling. You can add or remove users, adjust license tiers, or shift functionality with minimal friction. This flexibility is especially valuable in fast-changing environments or during periods of growth or contraction.

While perpetual licenses may appear cost-effective long term, they come with hidden costs: infrastructure, IT labor, support contracts, and delayed upgrades.

SaaS licenses distribute costs over time and often reduce total ownership costs through:

The tradeoff is that costs continue as long as you use the software — but you’re always working with the latest version.

Perpetual software often lives outside of centralized visibility, especially when deployed across multiple environments. This makes license tracking and compliance reporting harder.

SaaS platforms can be integrated into centralized SaaS management systems, giving IT and procurement teams:

The governance benefits of SaaS are especially important in organizations managing hundreds of applications.

SaaS vendors offer different types of licenses depending on the buyer and scope of use. Knowing the difference helps reduce risk, optimize cost, and maintain control.

At a glance:

Enterprise licenses are designed for wide-scale deployment across departments or the entire organization. They are typically governed by a custom-negotiated Master Service Agreement (MSA) and offer significant flexibility.

Key characteristics:

This model ensures better visibility and governance, especially when managing business-critical platforms.

Benefits:

End-user licenses are typically purchased and activated at the individual or team level — often without going through IT or Procurement. These licenses are governed by click-through agreements or End-User License Agreements (EULAs), which are accepted by users without negotiation.

Key characteristics:

This creates compliance and security challenges:

These licenses increase the risk of shadow IT and uncontrolled software sprawl. License management tools that surface these agreements and flag unapproved apps are essential to maintaining governance.

SaaS license agreements establish the legal framework governing the use of cloud-based software. These agreements define the rights and responsibilities of both the provider and the customer. Below are key legal considerations organizations should review before agreeing to SaaS terms.

Effective SaaS license negotiations reduce costs, improve terms, and increase flexibility over time. Procurement and IT teams that come prepared with data — not just vendor quotes — are in a much stronger position to influence outcomes.

Here’s how to approach negotiations more strategically:

Entering a SaaS renewal conversation without market benchmarks puts your team at a disadvantage. Vendor-provided pricing is rarely the lowest available.

Using internal and external benchmarks allows you to:

Zylo customers, for example, gain access to real-time market pricing benchmarks, enabling them to negotiate with confidence and reduce license costs by eliminating waste.

Pro tip: Run benchmarks 90+ days ahead of renewal so you can influence terms before you’re locked in

Too many SaaS agreements are one-size-fits-all, built for the vendor’s convenience, not yours. Negotiating smarter means pushing for flexibility, accountability, and business alignment.

Terms to review and tailor:

Customizing license agreements ensures your software contracts reflect actual business needs, not just vendor defaults.

Specialized SaaS negotiator services give internal teams an edge, especially when dealing with top-tier vendors or complex renewals.

These services typically offer:

If your team lacks the time or experience to handle complex software negotiations, a SaaS negotiator can uncover hidden savings and reduce vendor lock-in risk.

Zylo’s Managed Services offering provides this capability in-house, combining real-time benchmarks, usage data, and negotiation execution.

Programmatic SaaS license and agreement management reduces spend, minimizes risk, and increases operational efficiency. Whether you manage 50 tools or 500, success comes down to consistent, systematized workflows.

Start with these four high-impact practices:

SaaS audits create a complete, current view of the apps in your environment and the licenses tied to them. Audits should be conducted quarterly or ahead of renewal cycles to surface waste and risk.

Focus on:

A SaaS Management Platform like Zylo automates this process by pulling data from financial systems, SSO, and app integrations, creating a centralized system of record that IT and Procurement can rely on.

ModMed Drives Operational Excellence & Million-Dollar Savings with Zylo SaaS License Management

Discover how ModMed used Zylo’s powerful license tracking and optimization to save millions of dollars, drive operational excellence, and improve the employee experience.

In most organizations, a significant percentage of SaaS licenses go unused or underused.

Improving utilization requires:

With Zylo, teams can surface usage patterns across their entire SaaS environment, making it easy to rightsize licenses before renewals — or before waste becomes embedded in the budget.

For example, ModMed used automated deprovision workflows to reclaim 2,800 unused licenses, resulting in $1.4 million in cost avoidance.

Redundant tools create duplicate spend, reduce adoption, and introduce governance risk.

Reduce your redundant apps, following these steps:

Zylo enables data-driven rationalization by grouping apps by category, highlighting redundant functionality, and showing which tools are fully adopted — and which aren’t worth the cost.

Every SaaS app is a potential access point. Without centralized identity enforcement, access risk grows quickly, especially in high-churn teams.

SSO helps by:

Zylo surfaces SSO coverage gaps across your stack, helping IT prioritize which applications should be secured first and where risks are most urgent.

SaaS licenses define how your organization accesses, uses, and pays for cloud applications—and they directly impact cost, security, and operational efficiency. Managing them at scale requires more than manual tracking or last-minute renewal reviews.

Zylo provides the visibility, automation, and insights to manage SaaS licenses and agreements with precision—all in a platform built specifically for SaaS Management.

Ready to take control of your SaaS licenses and agreements? Learn more about Zylo’s SaaS License Management solution or book time with our team for a demo.

A SaaS license is an agreement that defines how your organization can access, use, and pay for a cloud-based software application.

Most SaaS licenses are subscription-based, billed monthly or annually and may be tied to the number of users, features, or tiers. In 2025, consumption-based models are becoming more common, creating challenges forecasting usage and spend.

The most common models include per-user, subscription, usage-based, tiered, flat-rate, freemium, and per-feature pricing.

SaaS licenses directly affect IT spend, software utilization, security, and compliance. Mismanaged licenses lead to wasted costs and hidden risks.

Perpetual licenses are a one-time purchase for on-premises software. SaaS licenses are subscription-based, cloud-hosted, and include ongoing updates and support.

Enterprise licenses cover company-wide access and are usually negotiated with Procurement or IT. End-user licenses are assigned to individuals, often governed by click-through agreements or EULAs.

In 2025, Zylo data shows that the average organization uses just 47% of its SaaS licenses. This means, on average, they waste $21M annually on unused licenses.

Regular audits, usage tracking, reclaiming inactive licenses, consolidating redundant apps, and enforcing SSO are proven strategies to reduce SaaS license waste.

Use benchmarks for pricing, tailor terms to match business needs, and plan renewals 90-120 days in advance. Many companies also use SaaS negotiator services for added leverage.

Zylo delivers complete visibility, usage insights, and automation workflows so IT, Procurement, and Finance can optimize licenses, reduce spend, and strengthen governance.

Table of Contents ToggleWhat Is a SaaS License?Why SaaS Licenses MatterTypes...

Table of Contents ToggleWhat Is SaaS Compliance?Why SaaS Compliance MattersKey Types...

Table of Contents ToggleWhat Is a SaaS License?Why SaaS Licenses MatterTypes...

Table of Contents ToggleWhat Is a SaaS License?Why SaaS Licenses MatterTypes...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |