5 Industry Experts Weigh In on the 2026 SaaS Management Index

Table of Contents ToggleWhat Is Usage-Based Pricing, and Why Now?How Usage-Based...

Back

Back

Search for Keywords...

Blog

Table of Contents

Blog updated on February 17, 2026 with new data.

The way we pay for SaaS is shifting—and fast. Vendors are moving away from predictable seat-based models and toward usage-based pricing (UBP), where charges flex based on how much a service is actually used. For many organizations, that shift offers greater flexibility and potential cost efficiency. But it also introduces new blind spots, risks, and budget volatility that can catch even mature SaaS Management programs off guard.

If your team is unprepared to govern UBP, you’re paying more while losing visibility, control, and negotiation power.

In this guide, we’ll break down what usage-based pricing means for IT, software asset management (SAM), and procurement teams, and how to adapt your processes to stay ahead. You’ll learn what’s driving this shift, the hidden risks it introduces, and the specific strategies high-performing teams use to stay informed, aligned, and in control.

Because in a world where every click can carry a cost, precision isn’t a luxury—it’s a requirement.

Usage-based pricing (UBP), also known as consumption pricing, flips the script on traditional SaaS billing. Customers are charged based on actual consumption instead of paying a fixed rate for access, typically based on the number of users. That might mean API calls, documents generated, data processed, user sessions, or other measurable activities.

This pricing model aligns cost more closely with value. You pay for what you use, and only what you use. On the surface, that sounds efficient. But it also introduces variability—spend becomes dynamic and harder to predict, especially at scale.

UBP comes in many forms, depending on the product and vendor, and is especially prevalent with AI tools. Kyle Poyer, author of Growth Unhinged, noted some of the most disruptive AI pricing models so far. For example:

Some vendors use pure usage models, while others offer hybrid pricing, combining a base subscription with metered add-ons, such as AI tools or premium analytics. The 2025 SaaS Benchmarks Report by High Alpha found that, among companies monetizing AI product and features, 11% of SaaS companies rely on usage-based pricing. Another 51% use a hybrid model—a large increase from 2024.

For buyers, this diversity adds complexity. It’s no longer enough to track license counts. Teams must understand how users interact with the product, how usage is measured, and what behaviors drive cost.

This isn’t a passing trend—it’s the result of multiple forces converging:

These shifts make usage-based pricing attractive to vendors and increasingly unavoidable for buyers.

As pricing evolves, so must SaaS Management. UBP requires a more dynamic, data-driven approach—one grounded in real-time visibility, cross-functional alignment, and continuous optimization.

Usage-based pricing offers clear benefits—flexibility, cost alignment, and scalability. But when not actively managed, it introduces hidden risks that can quickly undermine those advantages. What seems like a smarter way to pay can result in runaway costs, confusing invoices, and unpredictable budgets. These issues compound in large or decentralized organizations, where visibility is already strained.

Without the right processes, usage-based pricing can become less about efficiency and more about exposure.

UBP breaks the predictability that finance teams rely on. With no fixed billing cycles or seat limits, even modest usage changes—like activating an AI feature—can blow up forecasts. Budgeting becomes a moving target, especially when you don’t monitor seasonal surges or pilot projects in real time.

Flat-license models are relatively simple to reconcile. Usage-based models, by contrast, require reviewing granular activity, such as API calls or data throughput. Without detailed logs or app-level usage reports, validation becomes manual, time-consuming, and error-prone.

Traditional renewals followed a clear rhythm: assess seat count, evaluate usage, and renegotiate. Usage-based models remove that baseline. With no static entitlements or predictable ceilings, it becomes harder to benchmark value, forecast renewal costs, or align spend with needs.

Shadow IT worsens the problem. Teams can activate usage-based tools with little friction—often bypassing IT or procurement. These purchases accumulate outside formal workflows, making it harder to track, control, or consolidate spend.

SaaS vendors increasingly gate AI functionality behind usage triggers. Users may toggle on helpful features like analytics, automation, and co-pilots without realizing the downstream financial impact. These additions may quietly drive significant spend increases.

Dynamic pricing blurs the connection between spend and value. Without consistent benchmarks or cost centers, assessing whether high-usage departments derive proportional benefit or drive cost without ROI is tricky.

These challenges don’t stay contained. One team might use advanced features heavily while another barely engages—yet both fall under the same contract. Without granular visibility, IT and Procurement are left managing uneven spend with limited insight.

“Measuring ROI is very difficult. If you’re not able to understand what you’re gonna be charged for or when, how do you tie that back to the actual business value?”

— Ben Pippenger, Co-founder at Zylo

To avoid these pitfalls, organizations need more than spreadsheets. They need real-time alerts, centralized usage data, and standardized intake and renewal workflows that link consumption directly to value. UBP may offer flexibility—but without control, that flexibility becomes a liability.

While usage-based pricing introduces complexity, it also offers real advantages—particularly for organizations equipped to monitor and manage SaaS consumption with precision. When governance keeps pace, UBP can lead to more efficient spending, stronger value alignment, and faster innovation.

Done right, it turns software into a responsive asset instead of a static cost center.

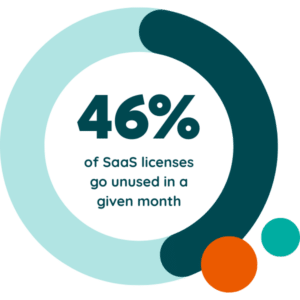

UBP ties spend directly to how much a product is actually used, eliminating waste from inactive seats or underutilized features. It allows teams to match investment to demand, creating a tighter feedback loop between usage, value, and budget planning.

Because there are no rigid license caps, usage-based tools support agile business needs. Teams facing seasonal workloads or fluctuating headcounts can scale consumption without contract friction. This enables faster testing, growth, or wind-down, especially for cross-functional initiatives that evolve quickly.

Many UBP tools offer pay-as-you-go or low-commitment pricing tiers. This allows teams to try new software without large upfront investments or long-term contracts. It’s a safer path to innovation, where adoption can be validated before expanding rollout.

When users know their actions affect cost, it encourages more intentional tool usage. Teams become more aware of which features they activate and how often they use them. That awareness improves software hygiene, reduces waste, and supports stronger business cases at renewal time.

These benefits, however, are only realized when organizations maintain control. Without insight into consumption patterns and cost drivers, the same flexibility that enables innovation can quickly lead to inefficiency or overspending.

When usage is tracked, communicated, and optimized in real time, UBP becomes a lever for growth, not a source of risk.

Software Asset Management (SAM) professionals are navigating a fundamental shift. Traditional licensing models—anchored by predictable seat counts or annual entitlements—offered a level of stability that made reconciliation and optimization manageable. Usage-based pricing upends that model.

Instead of managing a fixed number of licenses, SAM leaders now oversee fluctuating consumption, layered pricing tiers, and decentralized usage. It’s gone beyond access to depth, frequency, and unpredictability.

UBP doesn’t just change how licenses are tracked—it redefines what a license is.

“As more and more SaaS publishers move away from traditional user-based annual subscriptions into a usage-based model, the crossover of the skills between FinOps and ITAM is going to be paramount to making sure that this is a success.”

— Ross Milne, Lead ITAM Consultant at Capgemini Invent UK

Under UBP, licenses may not have set quantities. Pricing can flex dynamically based on activity. Many platforms now offer a base subscription with layered charges for AI features, API usage, or output volume. This hybrid pricing creates fragmented entitlements that are harder to benchmark, audit, or align to budgets.

SAM leaders can’t assume UBP eliminates waste. It may simply shift it from idle licenses to unmonitored features, duplicative tools, or redundant usage across departments.

To stay ahead, SAM must evolve from periodic oversight to continuous management. That includes:

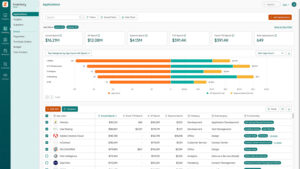

SaaS Management Platforms support this shift by integrating with identity providers, financial systems, and vendor APIs. These platforms create a single source of truth for licensing activity, enabling SAM teams to configure automated alerts, trigger reclamation workflows, and surface value insights at both the app and portfolio levels.

SAM leaders must also be ready to manage hybrid models. Many apps bundle base subscriptions with usage-based components. If AI features or advanced analytics activate without oversight, costs can escalate quietly.

Modern SAM requires a FinOps-aligned approach—focused on daily monitoring, cost-to-value alignment, and stakeholder engagement. This shift goes beyond compliance. It’s about protecting the business from escalating, ungoverned spend.

Usage-based pricing is a stress test for traditional SAM practices—and a moment to rethink how value is measured and managed.

The shift to usage-based pricing is changing how SaaS is billed—and reshaping procurement operations. Historically, procurement teams negotiated from a place of stability. Seat counts and flat-rate contracts provided predictability, enabling cost control and long-term planning.

UBP disrupts that foundation. Pricing now flexes with consumption. Charges vary monthly. Feature tiers add layers of cost. Without usage visibility, procurement walks into renewals blindfolded, lacking the insight needed to justify spend or push back on terms.

According to 2026 data, 81% of SaaS spend is controlled by business units, often via P-cards or expense reimbursements. That decentralization means procurement may not even see major portions of the SaaS portfolio—let alone influence vendor relationships or pricing structures.

When spend is fragmented, Procurement can’t enforce policy, consolidate contracts, or negotiate based on complete data. UBP heightens this risk. Teams can’t benchmark, optimize, or negotiate effectively without knowing how tools are used—or if features overlap across platforms.

To regain influence, Procurement must shift from transactional negotiation to strategic partnership with IT and SAM. That means building a unified view of:

Centralizing this data through a SaaS Management Platform enables smarter vendor conversations. Usage dashboards, cost breakdowns, and historical trends provide leverage to rightsize licenses, challenge overages, and identify redundant spend.

Many organizations lack coordination across Procurement and business units—leaving money on the table during renewals.

Smart Procurement teams bring usage data into the evaluation process—not just at renewal time. Key questions to ask during vendor selection:

Asking these early protects your organization from unpredictable spend and creates space for proactive vendor management.

The fundamentals of Procurement haven’t changed—it’s still about maximizing value. But in a usage-based world, value is tied directly to visibility. And control depends on collaboration.

UBP can deliver meaningful upsides, but only when Procurement has the tools, data, and partnerships to manage it. When procurement, IT, and SAM share insight and strategy, they gain the clarity needed to approach renewals with confidence and drive a SaaS program that’s both agile and cost-effective.

Usage-based pricing is becoming the SaaS standard, and there’s no sign it’s going away. But its flexibility often comes at the cost of predictability. The challenge for IT, SAM, and procurement teams isn’t avoiding UBP—it’s managing it proactively and precisely.

Here are six integrated strategies to help your organization stay in control.

Visibility is foundational. Yet many organizations rely on fragmented data sources—finance systems, SSO logs, browser extensions—to monitor usage. That patchwork view isn’t sustainable under usage-based pricing.

Deploy a SaaS Management Platform that integrates with vendor APIs, authentication providers, and expense systems. This creates a centralized system of record that shows:

With UBP, real-time discovery becomes essential for policy enforcement, optimization, and renewal planning.

SaaS costs shouldn’t be a surprise. In UBP models, spikes in usage lead directly to spikes in billing—often before anyone notices.

Configure alerts that flag anomalies like:

Set benchmarks by app, team, or historical patterns. Early alerts give you time to investigate, coach users, or adjust access before the invoice arrives.

Business units often toggle on premium features—AI co-pilots, analytics, automation—without realizing the downstream cost. Without education, small actions can drive large overages.

Regularly share usage and spend reports by team and feature. Build cost awareness into onboarding, intake processes, and stakeholder reviews. When app owners understand the impact of their decisions, they’re better equipped to manage consumption responsibly.

Rogue usage is expensive under UBP. A department activating an unapproved tool could generate significant spend before anyone knows it’s live.

Establish an intake process for software requests. Use a pre-approved app catalog and route requests through IT, Security, and Procurement. Integrated governance isn’t about slowing innovation—it’s about preventing silent risk.

Internal metrics—like cost per active user or feature adoption—offer a baseline. But external benchmarks also create negotiation leverage.

The right SaaS Management Platform provides anonymized peer data to show pricing norms, usage thresholds, and common contract terms. Bring this into renewal conversations to support rightsizing licenses, identify pricing anomalies, and align stakeholder expectations.

FinOps isn’t just for cloud spend. Its core principles—real-time data, cross-functional collaboration, shared accountability—apply directly to usage-based SaaS.

Even without a dedicated FinOps team, you can borrow the model:

“You’ve got to have a FinOps mindset from the moment you start using consumption-based models.”

— Siroui Mushegian, CIO at Barracuda Networks

This mindset shift—from contract oversight to ongoing cost engagement—helps every stakeholder make faster, smarter decisions.

Usage-based pricing is accelerating and evolving. As vendors seek to align pricing more directly with customer activity, adaptive models are becoming the new normal. This shift brings more nuance, variables, and risk for teams without visibility.

Expect to see:

These models are hard to predict and even harder to manage. Without full transparency into who’s using what, when, and at what cost, organizations will struggle to contain spend, measure ROI, or negotiate effectively.

The takeaway is clear: if you don’t have usage visibility, you don’t have pricing control.

When IT, SAM, and procurement teams operate from a shared system of truth, they can move from reactive license tracking to strategic SaaS management. That shift isn’t optional anymore—it’s essential.

Usage-based pricing can support flexibility, scalability, and innovation. But only for teams equipped to manage it with real-time insight, clear accountability, and cross-functional coordination.

Stay ahead of the shift. Sign up for the Zylo newsletter to get tactical SaaS Management insights in your inbox. And download the 2025 SaaS Management Index Report for benchmark data and more peer strategies.

Table of Contents ToggleWhat Is Usage-Based Pricing, and Why Now?How Usage-Based...

Table of Contents ToggleWhat Is Usage-Based Pricing, and Why Now?How Usage-Based...

Table of Contents ToggleWhat Is Usage-Based Pricing, and Why Now?How Usage-Based...

Table of Contents ToggleWhat Is Usage-Based Pricing, and Why Now?How Usage-Based...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |