The IT & SAM Leader’s Guide to Smarter Zoom License Management

Table of Contents ToggleWhy Does SaaS Cost Management Matter?Sources of Growing...

Back

Back

Search for Keywords...

Blog

Table of Contents

SaaS cost management—also called SaaS spend management—is the practice of managing software-as-a-service (SaaS) applications with a focus on reducing and optimizing costs.

This practice includes the processes of identifying all costs associated with SaaS applications, right-sizing licenses and entitlements for optimal value, reducing unplanned expenses due to automatic subscription renewal, and leveraging corporate buying power.

Cloud-based deployment is now the software deployment method of choice as more organizations recognize the tangible benefits of software without servers and the convenience of subscription licenses.

Overall, SaaS, as an industry, has grown at a breathtaking pace in recent years, accumulating double-digit growth for several years. Gartner predicts global SaaS spend will grow up to $299B in 2025 – up from $247B in 2024. The analyst also notes in its 2022 Market Guide for SaaS Management Platforms that SaaS spend continues to grow by 15-20% annually.

This unprecedented and rapid growth in a new category of software left business leaders unprepared for a corollary growth in costs, which can often be obscured by unmanaged employee acquisition of software applications and their expenses, so-called shadow IT.

This unprecedented and rapid growth in a new category of software left business leaders unprepared for a corollary growth in costs, which can often be obscured by unmanaged employee acquisition of software applications and their expenses, so-called shadow IT.

On average, about one in fifteen (6.6%) employees will purchase a SaaS application using a credit card or expense reimbursement. Discovering, mitigating, and optimizing these transactions – as well as all other purchases of subscription software – is an essential aspect of SaaS cost management.

Where does the need for SaaS cost management originate? Spending on IT overall typically grows every year, and Gartner notes specifically that IT spending growth is being driven by the rest of the world catching up on cloud spending.

Overall, spending on enterprise software has steadily increased, notably within cloud software and related services – and within the cloud market, SaaS commands the most spending. While subscription software may be dominating the market on a macro level, it’s presence has steadily increased at individual businesses and organization for several reasons:

Cloud-based subscription software deployment is the new default choice. Subscription software has been around for more than two decades, successfully displacing on-premises based software deployments. Well established software publishers such as Microsoft, Oracle, SAP, and Adobe have all moved their products into cloud-first or cloud-only deployments.

While this has led to an increase in SaaS spending, it also represents a need to update software asset management practices to account for the unique attributes of SaaS within enterprise organizations and other businesses.

Decades ago, software for enterprise-sized organizations could be considered a one-size-fits-all affair. As cloud-based software has removed obstacles to software access and deployment, applications have become increasingly specialized to business unit functions.

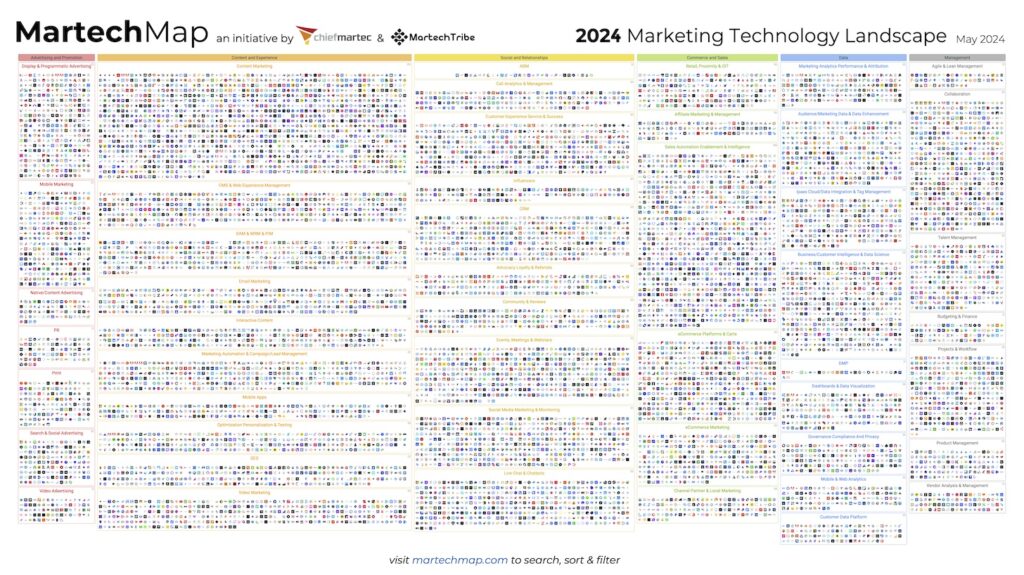

Business units such as Marketing, Human Resources, Finance, Legal, and others now have access to tools explicitly made and only for their business functions. For example, in under a decade, the number of digital applications for marketing teams has risen from around 150 to nearly 13,000, which represents a more than 8,500% increase since 2011.

Marketing SaaS applications represent a prime example of the explosive growth – and growing costs – of specialized tools and services. The market for marketing-specific tools grew from 150 applications in 2011 to nearly 10,000 in 2022. Credit: chiefmartec.com

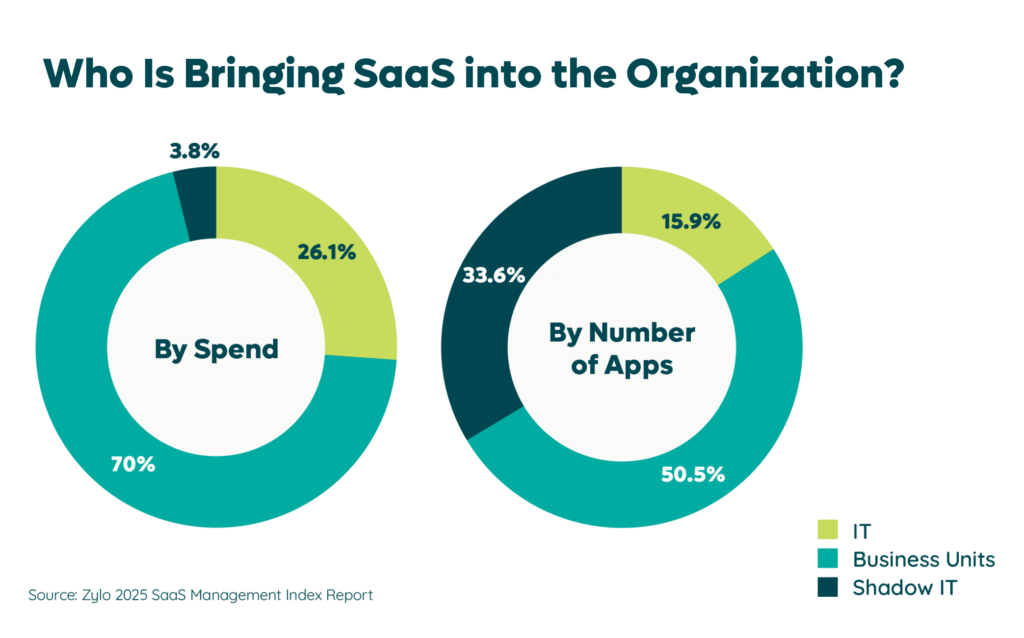

Employees are now software decision-makers. Today, they are responsible for more than one-third of the applications within the business. The success of SaaS conclusively demonstrates the concept of product-led growth, where software applications are designed to maximize their appeal and utility for the end-user first, and then spread more or less organically.

This end-user focus shifts the decision-making from traditional software development and sales even further than business unit purchases to employees themselves.

From a practical standpoint, the same attributes that make SaaS a more accessible, easier to use, and easier to deploy can lead to runaway costs and unmanaged spending – making SaaS cost management an imperative for organizations.

Because SaaS applications are so easy to acquire and deploy, they frequently escape detection. Without a way to discover these purchases – and rectify things like cost attribution or ownership – SaaS quickly accumulates as a hidden cost within organizations.

Gartner studies have estimated as much as 30 to 40% of technology spending results in shadow IT. And even when these transactions do appear in financial systems, they’re frequently mislabeled or miscategorized.

Zylo data has found that as many as 51% of transactions involving SaaS applications are not tagged as “software” in expense systems.

IDC predicts 70% of US tech spending now occurs from business-unit budgets. As business unit spending on technology and software continues to overpower IT-sourced spending, costs associated with shadow IT can be expected to grow.

Here are a few reasons why the unique characteristics of SaaS contribute to increased costs:

With freemium options and low monthly recurring charges, SaaS applications are frequently acquired by employees without consideration of a centralized procurement or sourcing strategy.

A single employee subscribing to a $9.99 per month SaaS application likely won’t create significant impacts to the bottom line, but at scale, hundreds or thousands of employees in an enterprise each paying $9.99 per month can quickly create cost overruns.

Using the same example from above, the same scenario creates increased costs in the form of unleveraged buying power. Let’s say the business needs to purchase 100 user licenses for a project collaboration application.

By purchasing end-user licenses in bulk, the business can receive a reduced rate. However, if an end-user purchased the same license, she or he would likely pay market rates.

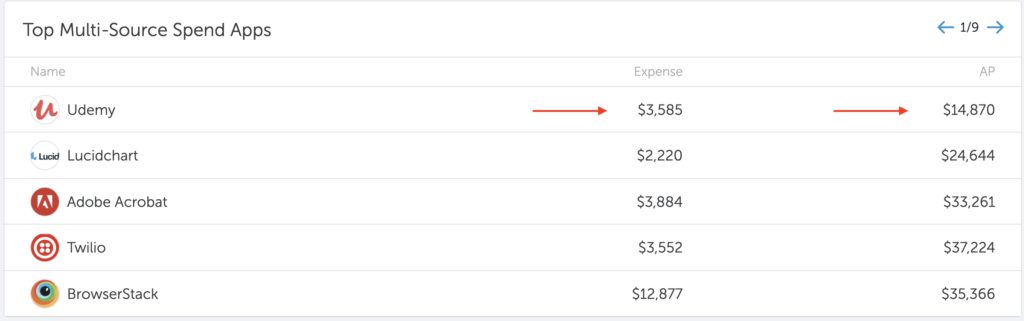

In the same scenario as above, the business buys 100 seats to a project collaboration application via Accounts Payable or by a direct supplier purchase. However, an employee now purchases the same application using credit card reimbursement. Now, the business has two instances of the same application in separate financial lines.

When SaaS applications are purchased via both Expense and AP channels, the result is unneeded cost.

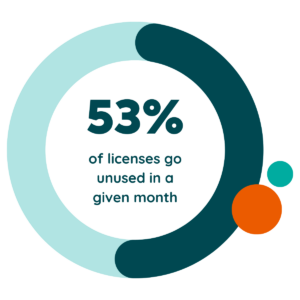

Regardless of acquisition source, when application licenses or additionally purchased features aren’t used to their full potential, that spend is wasted. Zylo data shows that about 53% of all SaaS application licenses go under-utilized in a typical 30-day period. In sum, that’s $18M in wasted spend annually, on average.

Automatic renewals are a key feature in subscription software. Ostensibly, they ensure uninterrupted access to an application’s services.

But, because most applications require notification periods of 30, 60, or 90 days to signal the intent of non-renewal, automatic renewals can come as a surprise. Underutilized or unnecessary applications that undergo automatic renewal can create significant cost burdens.

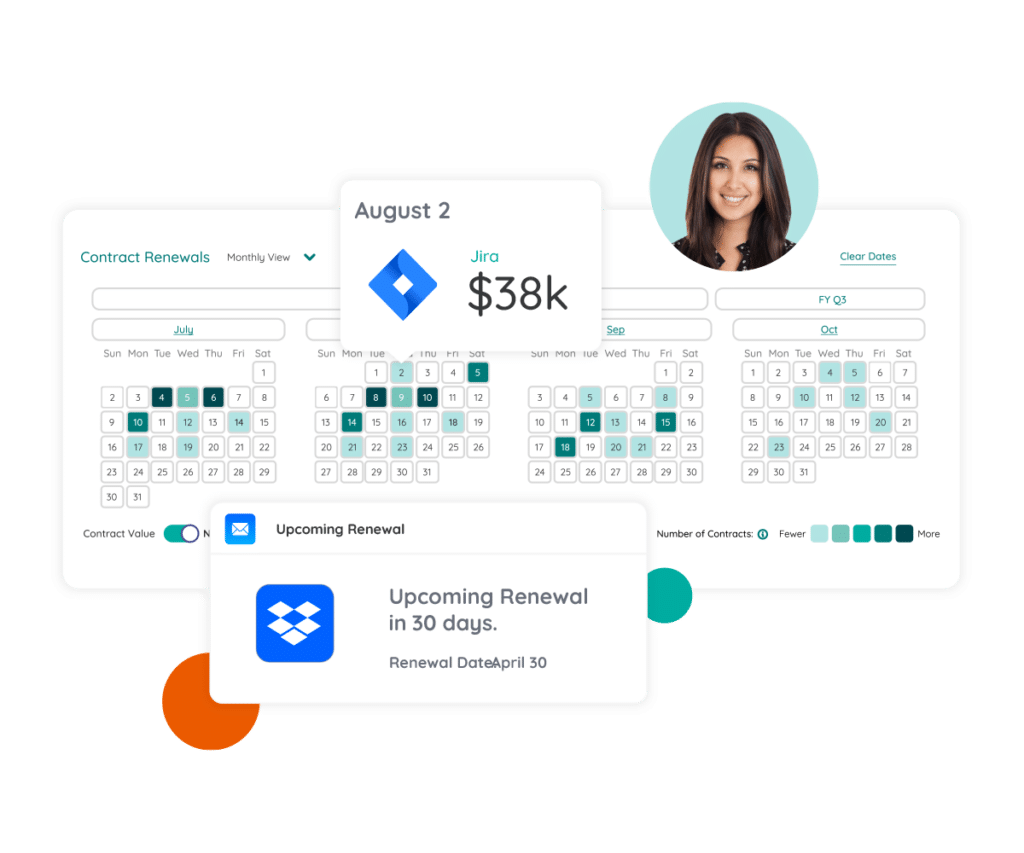

Without a comprehensive calendar-based view of all SaaS renewals occurring or soon to occur, surprise renewals can incur significant costs.

In the next section, we’ll examine how to identify and mitigate some of the most common sources of unmanaged SaaS costs.

Reducing SaaS costs can save organizations in both the short and long term. Savings are typically generated by identifying current sources of unnecessary expenses, right-sizing licenses and entitlements to meet current user needs, and building a robust rationalization process that can be applied to each application within the organization. So, it goes without saying that it’s important to have an approach to SaaS cost management for your organization.

Identifying the current inventory represents the first step towards realizing hard cost savings on SaaS tools and services. Why? You cannot manage what you can’t identify.

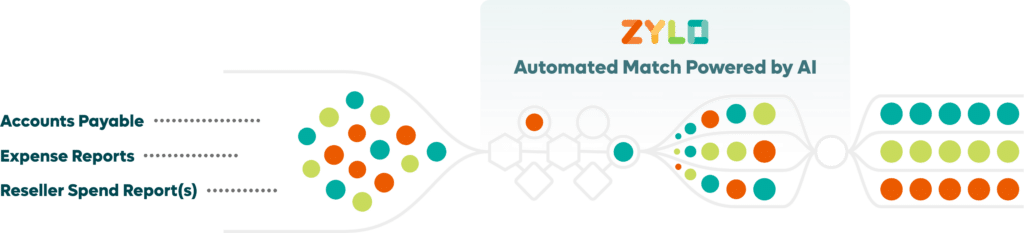

While several types of discovery processes can help identify SaaS applications maintained by an organization, for cost management, the ideal discovery process involves a thorough analysis of all financial transactions.

This analysis should include both direct supplier spend found in Accounts Payable or purchase orders, as well as all transactions created in expense categories, including individual corporate credit cards, procurement cards, and employee expense reports.

RELATED: How Zylo’s AI-Powered Discovery Identifies SaaS Transactions

The discovery and categorization of every SaaS application that can be found within the four walls of a business should provide a current snapshot of current software costs and investments.

Zylo recommends examining about 12 months’ worth of transactions to gain an accurate picture of current spending and potential commitments created by renewals. This is a crucial reason that any discovery method that does not utilize data sourced from both Accounts Payable and expense systems may provide an incomplete picture.

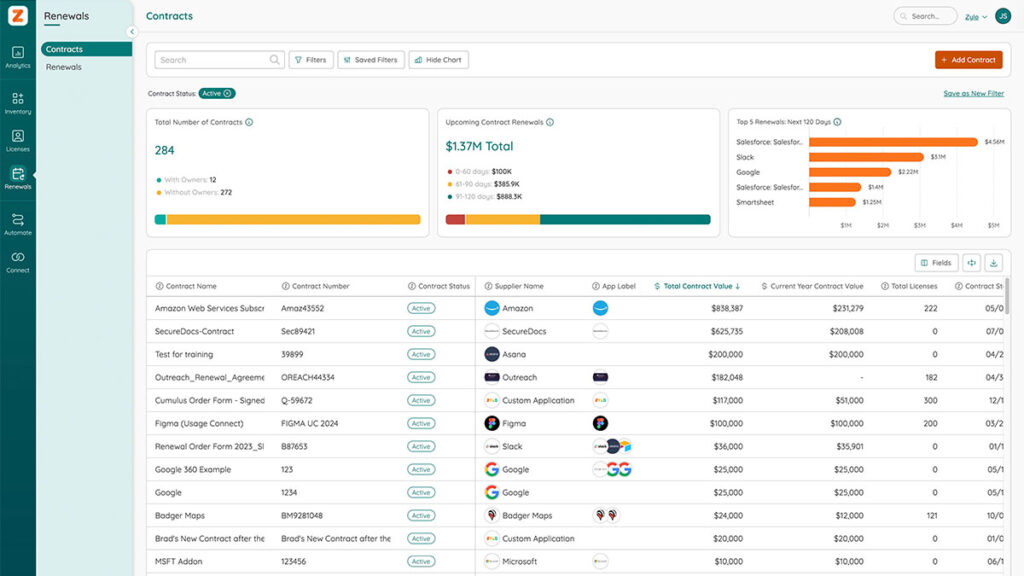

For each application, every detail related to cost should be accounted for to manage overall costs and spending. Much of this information can be found in the application’s original agreement or contract, as well as purchase orders, invoices, or other billing documentation.

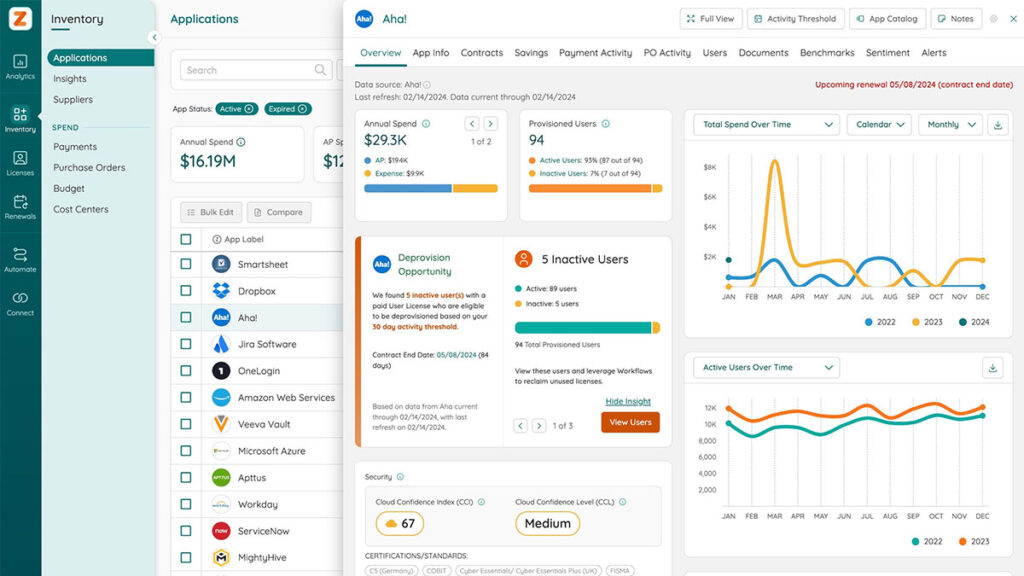

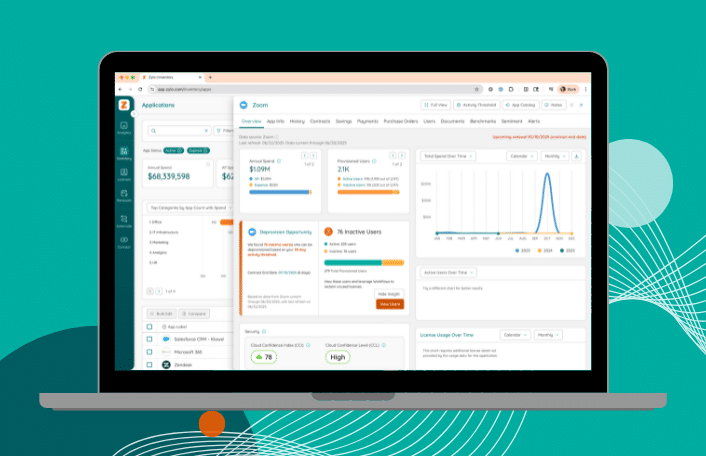

Curating this information serves as a system of record for all SaaS-related applications, how they’re used, and exactly how, what, and when they drive costs within the organization. A SaaS management platform like Zylo can automate much of these discovery, categorization, and database -building processes – ultimately helping you reign in spend.

In the absence of a SaaS management platform, this information can be manually curated into a spreadsheet. However, they tend to be cumbersome to maintain and often incomplete and inaccurate.

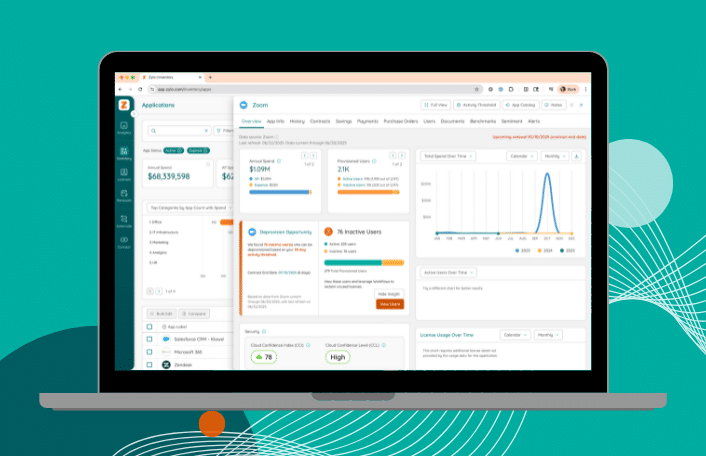

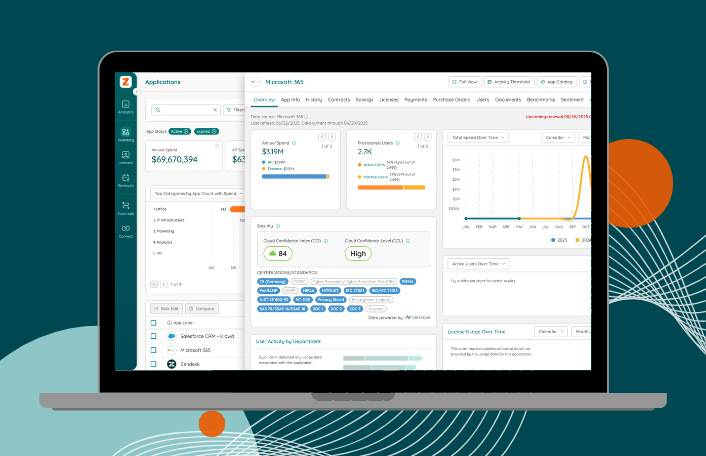

The Zylo SaaS management platform automates the discovery and curation of all SaaS applications, spending, and license information.

With all SaaS application spending and cost information identified, and each application’s relevant data and attributes recorded, it’s possible to begin holistic cost reduction activities.

If the SaaS application discovery process effectively answers, “What applications does the business actually have? The next logical question to be answered is, what applications should the company continue to retain?

Review the full inventory and look for the SaaS tools that have a significant number of functional overlaps with other tools.

Common tool categories for functional overlap include collaboration tools such as workplace messaging platforms such as Teams and Slack.

Other typical applications for significant function overlaps include file storage and sharing – including tools like Box, Dropbox, and Sharefile – and project management tools such as Asana, Monday, Trello, or Basecamp.

When coupled with an accurate SaaS inventory, a SaaS system of record (or spreadsheet at a minimum), can identify functional overlaps to eliminate to reduce costs.

Consolidate the number of tools with functional overlaps where possible. If the business has already determined specific tools to fulfill particular tasks, examine the SaaS inventory to find non-approved tools in use.

If standards have not yet been determined for applications, this process is driven by developing an understanding of the preferences and requirements within the business, its teams, and its employees for SaaS applications going forward. Closely examining utilization metrics is another recommended activity to help determine which applications should make the cut.

Consolidation saves costs because when teams or users can switch to a single project management tool deployed across the organization, the business can offboard other similar applications. It can also negotiate a better rate for the single now widely used tool.

Consolidation produces cost savings by standardizing tools and going “all in” on a single application, rather than maintaining multiple applications for the same purpose.

Application standardization also saves time, as having fewer applications reduces the support workload for IT. It also ensures that communication and collaboration between business units become standardized. A single file share application deployed across the business, for example, helps ensure greater uniformity across the company.

Surveying application users about the reasons behind their application choices can help build sourcing requirements for new tools and choosing which applications should remain after consolidation.

When a standardized application is selected, publish the list of approved tools to the broader organization. Provide training on best practices for software acquisition going forward if adopting new policies to prevent future shadow IT.

Many companies see significant reductions in unsanctioned software acquisition by implementing software review boards, prohibiting employee-led software purchases, or setting spending limits on expense reimbursements.

Adobe Drives Innovation and Massive Savings with Zylo

In the past 4 years, Adobe has rapidly scaled from $9B to $18B. This growth has made an already complex environment even more complex. Learn how they leveraged Zylo to get complete visibility into their SaaS portfolio, unlock millions in cost savings and avoidance and improve the employee experience.

Another critical attribute to compare when prioritizing reducing application functional overlap is renewal dates. Prioritize the “keep or delete” process for applications with near-term renewal dates. Focusing on these applications first helps ensure an automatic renewal doesn’t lock the business in place with an unwanted application or its costs.

Any upcoming renewals also represent an opportunity to negotiate pricing and terms or seek new discounts.

Setting notifications around renewal dates also bears importance on the process terminating any application, as notice must typically be provided 30, 60, or 90 days in advance of the intended non-renewal.

It’s especially important to understand the terms around notification periods; some renewal clauses include terms about not only when the vendor must be notified but also how (e.g., notice must be in writing).

Eliminate applications that are not essential or mission-critical to the business. Eliminate applications that do not pass the rationalization process. Provide notice to the vendor when necessary in the appropriate method.

Ensure that any counteract provisions concerning business data are reviewed before termination to ensure any company-owned or customer-specific data is returned to the business or deleted appropriately.

Prevent eliminated applications from re-entering the environment as shadow IT by rerunning the discovery process regularly. Continual monitoring and discovery are possible when using Zylo’s SaaS management platform. It can also be prudent to set alerts in expense management systems to flag any new software purchases.

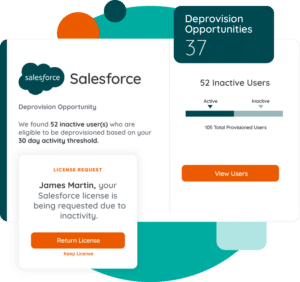

Another SaaS cost management practice that reduces spend is to eliminate applications no longer needed due to employees leaving the business. This process relies on a robust discovery process with the ability to identify application ownership at the employee level.

Using a list provided by Human Resources, check your application inventory against the list of employees who have left the company. Review the matches with the former employee’s manager to determine if the application remains in use by the broader team, or if it’s a mission-critical, “keep the lights on” tool.

Determining if the former employee or employees’ application was acquired via a credit card or expense reimbursement can also play into adjusting future purchase policies to prevent orphaned applications from cropping up.

When terminating former employees’ applications, like all other applications, provide non-renewal notification to the vendor. It’s also a good idea to prevent any recurring credit card purchases that may be associated with any former employees.

In a typical SaaS application inventory, about 53% of SaaS licenses are underutilized, so it’s important to build processes to reclaim lost value due to unneeded or under-used licenses.

Unneeded licenses can happen for a variety of reasons, from employees being provisioned with licenses but never used to employees no longer requiring access to applications to employees departing the organization. That’s why it’s vital to periodically manage SaaS licenses and right-size the count against actual need.

Unneeded licenses can happen for a variety of reasons, from employees being provisioned with licenses but never used to employees no longer requiring access to applications to employees departing the organization. That’s why it’s vital to periodically manage SaaS licenses and right-size the count against actual need.

Under-utilization of licenses requires understanding the use case for each application and defining a standard utilization rate. For example, if a user signs in and utilizes an application at least once every 30 days, they could be considered an active user. However, application use cases vary widely, so tailoring standard utilization rates to account for typical user behavior is recommended.

Through direct integrations with critical applications and single sign-on (SSO) tools such as Okta, the Zylo SaaS management platform makes it possible to manage multiple SaaS applications and licenses from a single central dashboard.

The dashboard offers insights into license usage by showing each application’s provisioned users, granular license utilization data, and entitlements such as premium or advanced licenses. It is possible to maintain SaaS license inventory using a spreadsheet and manage applications individually, albeit more time-consuming.

Whether using a SaaS cost management system or a spreadsheet, note the applications that are managed and supported in a centralized manner. For example, an office tool suite like Microsoft Office 365 or Google Suite is managed by a central administrator who’s responsible for provisioning new users such as new employees.

Whether using a SaaS cost management system or a spreadsheet, note the applications that are managed and supported in a centralized manner. For example, an office tool suite like Microsoft Office 365 or Google Suite is managed by a central administrator who’s responsible for provisioning new users such as new employees.

To match the number of provisioned licenses to actual users in centrally managed applications, compare the current license inventory against the current directory of employees. If discrepancies exist due to employee transitions or departures, pull back licenses no longer needed. Redeploy these licenses to users who may need them or plan to adjust license quantity to match user count accordingly at the next renewal negotiation for that application.

Another way to approach license right-sizing is by examining data provided by integrating a SaaS management platform like Zylo with an SSO system. This integration can be especially beneficial when examining license utilization for tools that are not managed by a central team such as IT. By integrating with SSO, a SaaS management platform can holistically display all SaaS licenses managed by SSO and their utilization data.

It’s also possible to create de facto deprovisioning for inactive licenses or departed employees by blocking user access to licenses via the SSO platform. This process makes it possible to practice license management for applications not under direct IT management.

With license inventory for applications now accurately compared against actual users and utilization, it’s also essential to examine each application’s renewal date, license quantity, consumption metrics, and entitlement plan.

Where it’s possible to reduce license quantity and costs immediately, do so. If license quantity is tied to an agreement, plan on eliminating licenses or features at the next possible renewal. However, it’s possible to reach out to SaaS vendors to negotiate and renew applications early and right-size license quantity.

The Ultimate Guide for Wildly Effective SaaS Renewals

Learn MoreBeyond optimizing costs within your organization by rationalizing the application portfolio or reducing license costs, negotiating and modifying existing terms with SaaS vendors can reduce overall vendor spend or help improve the cash flow position for the business.

Gartner published a guide, How to Cut Software and SaaS Costs (ID G00724244), outlining best practices for managing vendor negotiations in times of crisis that require immediately reducing costs, which will be summarized here.

Before reaching out to any SaaS vendor to negotiate, it’s essential to gain a comprehensive understanding of each application’s profile within the inventory – especially for the most costly tools – to prioritize concessions that will be requested from each vendor in advance of reaching out. This research includes understanding the billing terms, renewal dates, utilization rates, license quantity, total contract value, feature sets, and payment schedule.

If the business requires drastic cost-cutting for SaaS applications, reach out to SaaS vendors and request more favorable terms for payments. Improving cash flow health for the short term may provide the breathing room needed to sustain a crisis.

This breathing room may include requesting a suspension or postponement of payment obligations for a six- to 12-month period until the economic situation resolves.

Another option is to request that annual payment terms change over to quarterly or monthly payments in arrears to mitigate and delay impacts to cash flow.

For big-ticket investments essential to business operations, consider options such as vendor financing or bank-backed financing for short-term periods.

Finally, take a look at upcoming contract renewal or expiration dates. Consider extending contracts on a month-to-month basis to avoid long commitments and upfront payments until the economic outlook improves.

If the business has identified lower-than-expected utilization of SaaS application licenses or features, but renewal dates are in the distant future (and therefore prevent more traditional contract negotiations), it’s still possible to reduce overall vendor spend.

In some cases, SaaS vendors may be willing to provide flexibility on payments in favor of maintaining a long-term relationship with its paying customers. For example, this could include a shift to flexible pricing metrics based on revenue, employee headcount, consumption rates, or utilization. If these flexible pricing metrics already exist, consider recalibrating the terms of the metics to reduce overall cash exposure.

Finally, review all SaaS agreements and contracts to eliminate unnecessary SKUs, entitlements, features, or other upgrades. Professional services, such as support and maintenance, may also be temporarily suspended to reduce costs.

4 Need-to-Know SaaS Stats for Procurement Leaders

Learn MoreMany SaaS vendors make public statements in times of crisis, including economic downturns, about how the business will adjust its approach. If pushing for reduced costs from these vendors, consider researching press releases and other statements that outline the vendors’ positioning.

It can also be helpful to research how each vendor’s business model recognizes revenue and prioritizes metrics. A vendor with a long-standing and publicly heralded focus on customer retention, for example, may be willing to negotiate on reducing short-term costs for clients.

Take the time to research vendor offerings, as well. It may be more cost-effective to consolidate the functionality provided by several smaller, discrete tools into functionality provided under the umbrella of a larger preferred vendor at a lower price.

Defining the context and purpose for cost-reduction discussions with vendors may create a more partnership-driven and amenable approach to negotiations.

If your organization’s executives have mandated a cost-cutting program, share that with any SaaS vendor involved in cost reduction. This notification outlines the company’s formal position and shows that cost-reduction activities are taking place across the vendor portfolio and that all vendors are under review.

Establishing that contract restructuring and requests for pricing flexibility are an executive mandate adds legitimacy to requests. It may also be useful to escalate the conversation to the highest management levels possible as senior managers or executives typically have more discretion and leeway to grant concessions.

Be willing to concede on terms that may be more favorable to the vendor, such as the willingness to extend a contract’s term in exchange for short-term flexibility around payments or price reductions.

In times of crisis, many business relationships can be strengthened by a mutual understanding of what defines long-term success. Most vendors understand that a business relationship can extend beyond mere financial commitments.

For instance, when they take place, structure the dialog about cost reductions or payment flexibility payments within the context of building a long-term relationship with the supplier. SaaS vendor customers can also offer to support the vendor in other ways.

For instance, volunteer to take part in a customer success story in vendor marketing materials to create a tangible vendor outcome instead of payment. Customers can also offer to leverage network relationships to benefit the vendor, including offering to appear on behalf of the vendor at speaking sessions, professional conferences, or trade shows.

Lastly, demonstrating your organization’s lifetime value as a customer, whether by leaning on investment to date or future investment, may aid your ability to negotiate more flexible terms.

Table of Contents ToggleWhy Does SaaS Cost Management Matter?Sources of Growing...

Table of Contents ToggleHow FinOps Teams Commonly Understand SaaS—and What’s MissingSaaS...

Table of Contents ToggleWhat Is an E-Commerce Tech Stack?Why Your E-commerce...

Table of Contents ToggleWhy Does SaaS Cost Management Matter?Sources of Growing...

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |